Unleash the Power of Forex Indicators to Boost Your Trading Strategy

Navigating the volatile forex market can be a daunting task, particularly for novice traders. Forex trading indicators provide invaluable assistance in this endeavor, empowering traders to make informed decisions and maximize their profit potential. In this comprehensive guide, we embark on a journey to explore the realm of forex indicators, unearthing their true potential and revealing the secrets to selecting the best tools for your trading strategy.

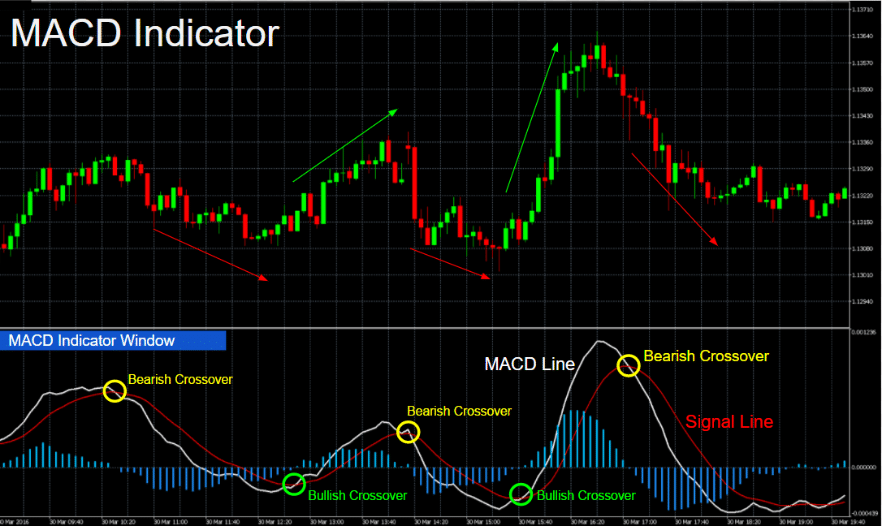

Image: forexezy.com

Forex Indicators: An Introduction

Forex indicators are technical analysis tools designed to identify trading opportunities and assess market trends. These indicators utilize historical price data to generate signals and patterns, providing traders with a deeper understanding of market behavior. Understanding the nuances of forex indicators is paramount for traders seeking to enhance their trading strategies and achieve sustained profitability.

Deciphering the Types of Forex Indicators

The multifaceted world of forex indicators encompasses a diverse range of tools, each serving a specific purpose.

- Trend Indicators: These indicators assist traders in identifying the prevailing market trend, providing insights into the overall market direction.

- Momentum Indicators: Momentum indicators gauge the strength of a trend, indicating whether it is gaining or waning.

- Volume Indicators: Volume indicators measure the trading volume, providing insights into market sentiment and potential trend reversals.

- Volatility Indicators: Volatility indicators assess the market’s volatility, helping traders identify potential breakouts and market fluctuations.

- Correlation Indicators: Correlation indicators measure the relationship between different currency pairs, revealing potential hedging opportunities.

Essential Considerations for Indicator Selection

Selecting the optimal forex indicators for your trading strategy hinges on several key factors.

- Trading Strategy: The indicators you choose should complement your trading strategy and trading time frame.

- Market Volatility: Consider the volatility of the market you trade in and select indicators that perform well in those conditions.

- Technical Analysis Skills: Choose indicators that align with your technical analysis skills and knowledge level.

- Combine Indicators: Combining multiple indicators can provide a more comprehensive market view and enhance signal accuracy.

Image: www.dolphintrader.com

Tips and Expert Advice for Forex Indicator Success

Maximizing the effectiveness of forex indicators in your trading strategy requires adherence to certain best practices.

- Avoid Indicator Overload: Using too many indicators can lead to confusion and false signals. Stick to a few well-tested indicators.

- Confirm Signals: Do not rely solely on indicator signals. Incorporate other forms of analysis, such as price action and chart patterns, for confirmation.

- Historical Testing: Test indicators on historical data to assess their profitability and reliability before using them in live trading.

- Avoid Overfitting: Indicators should not be customized excessively to fit a specific market condition. Overfitting can lead to poor performance in changing market conditions.

Frequently Asked Questions About Forex Indicators

To enhance your understanding of forex indicators, here are answers to some commonly asked questions.

- Q: What is the most profitable forex indicator?

A: There is no single most profitable forex indicator. The profitability of an indicator depends on the trading strategy and market conditions. - Q: Can I use forex indicators on any trading platform?

A: Most major trading platforms provide a range of forex indicators that traders can use. - Q: Is it possible to create custom forex indicators?

A: Yes, traders with programming skills can create custom forex indicators tailored to their specific requirements.

Buy Best Indicator For Forex

Conclusion

Forex indicators are indispensable tools for traders navigating the complex world of forex trading. By carefully selecting indicators that align with your trading strategy and employing them judiciously, you can unlock their true potential and make informed trading decisions. This guide has provided you with a comprehensive understanding of forex indicators, empowering you to harness their power and elevate your trading performance.

Are you eager to discover more about forex trading indicators and their practical applications? Join our online community of traders today, where you can connect with experts, share knowledge, and stay abreast of the latest market trends. Unlock the secrets to successful forex trading with the guidance of our experienced traders.