The foreign exchange (forex) market is a vast and dynamic arena where traders strive to make profitable moves. Amidst the volatility and risks, break-even strategies emerge as a beacon of stability, allowing traders to navigate the murky waters with confidence. Join us as we delve into the realm of break-even forex strategies, unveiling their secrets and empowering you with real-world examples to harness their potential.

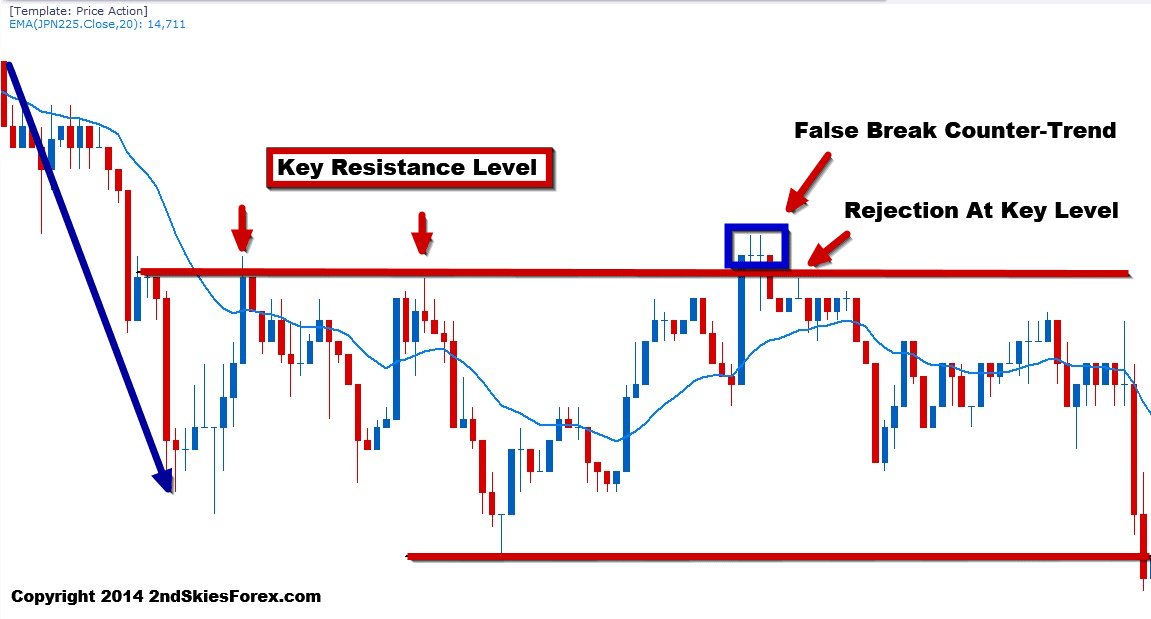

Image: 2ndskiesforex.com

What is a Break-Even Forex Strategy?

At the heart of a break-even forex strategy lies a simple yet profound goal: to minimize losses and maximize the chances of breaking even or even turning a small profit. This approach prioritizes risk management, recognizing that not every trade will yield a windfall but that preserving capital is paramount for long-term success.

Key Components of Break-Even Strategies

-

Risk Management: Break-even strategies emphasize setting realistic profit targets and implementing strict stop-loss orders to limit potential losses.

-

Trade Entry and Exit Points: Traders employ technical analysis, such as chart patterns and indicators, to identify optimal entry and exit points, aiming to capture profitable price movements.

-

Martingale Approach: Some strategies utilize the Martingale approach, where losing trades are doubled down on in subsequent trades to recover losses. However, this approach carries significantly increased risk and should be used cautiously.

Real-World Break-Even Forex Strategy Examples

1. Moving Average Crossover Strategy:

This strategy relies on crossing moving averages of different lengths (e.g., 50-day and 200-day averages). When the shorter average crosses above the longer average, it signals a bullish trend and a potential entry point.

2. Bollinger Bands Breakout Strategy:

Bollinger Bands create a price channel using standard deviations. When the price breaks out of the upper or lower band, it indicates a potential trend reversal and a possible entry point.

3. Support and Resistance Strategy:

Traders identify support (a price level where the price tends to bounce back up) and resistance (a price level where the price tends to bounce back down) and enter trades that align with these levels.

4. Fibonacci Retracement Strategy:

Fibonacci retracement levels are horizontal lines drawn at key Fibonacci ratios (e.g., 23.6%, 38.2%, 50%) based on past price movements. Traders use these levels to identify potential retracement points for entering or exiting trades.

5. Price Action Strategy:

This strategy focuses on identifying price action patterns, such as candlesticks and chart patterns, to determine entry and exit points without relying on indicators.

Image: majalahforexmalaysia.com

Benefits of Break-Even Forex Strategies

-

Preservation of Capital: Break-even strategies prioritize risk management, minimizing the risk of significant losses.

-

Confidence Building: Traders gain confidence by knowing they’re not at high risk of losing large amounts of money.

-

Scalping Opportunities: These strategies can be useful for scalpers who seek relatively small profits from quick price movements.

Limitations of Break-Even Forex Strategies

-

Limited Profit Potential: Break-even strategies tend to have lower profit potential compared to riskier strategies.

-

Requires Discipline: Execution of these strategies requires strict adherence to risk management protocols, which can be challenging in times of market volatility.

-

Not Suitable for All Markets: Certain market conditions may not be favorable for break-even strategies.

Break Even Forex Strategy Examples

Conclusion

Break-even forex strategies offer a balanced approach to trading, prioritizing risk management and capital preservation. Understanding these strategies and applying them effectively can provide traders with a solid foundation for navigating the complex forex markets. Remember that trading involves risk, and it’s essential to conduct thorough research and practice risk management techniques to increase your chances of success. Embrace the insights and examples presented here, and embark on your forex trading journey with newfound confidence and a deep understanding of break-even strategies.