Introduction

In the competitive world of financial markets, traders and investors are constantly seeking innovative tools and solutions to enhance their performance. SBI, a leading financial institution in India, has made significant strides in this arena by introducing state-of-the-art bot forex technology and establishing a robust Treasury Single Department (TSD). This synergistic combination offers unprecedented benefits and advantages, empowering traders to navigate the complex world of foreign exchange with greater efficiency and success.

Image: sbiforexrate.in

The integration of bot forex technology within SBI’s trading platform marks a significant milestone in automated financial trading. These intelligent bots, designed with sophisticated algorithms and machine learning capabilities, leverage historical data and real-time market analysis to make informed trading decisions on behalf of the user. This automation eliminates the emotional biases and human errors that often plague manual trading, resulting in enhanced accuracy, efficiency, and profitability.

Benefits of SBI’s Bot Forex Technology

- Automated decision-making: Bots execute trades based on predefined instructions and parameters, providing consistent and unbiased trading behavior.

- Real-time monitoring: Bots constantly monitor market conditions, identifying trading opportunities around the clock.

- Improved efficiency: Automation frees up traders from manual tasks, allowing them to focus on strategy development and risk management.

- Reduced emotional trading: By removing human emotions from the trading process, bots minimize impulsive and irrational decisions that can lead to losses.

- Backtesting and optimization: Bots enable traders to test and optimize strategies on historical data, refine parameters, and identify optimal trading conditions.

Treasury Single Department: The Backbone of SBI’s Forex Operations

The Treasury Single Department (TSD) plays a pivotal role in managing SBI’s forex operations and facilitating seamless settlements. This centralized department provides the following critical services:

- Centralized cash management: The TSD consolidates and manages all of SBI’s forex cash resources, ensuring efficient cash flow and optimal utilization of funds.

- Risk management: The TSD employs sophisticated risk management strategies to mitigate forex market risks and protect SBI’s financial integrity.

- Compliance: The TSD ensures compliance with all applicable regulations and central bank guidelines, preserving the bank’s reputation and trust.

- Liquidity management: The TSD maintains adequate liquidity levels to meet the demands of customers and counterparties, minimizing the impact of market disruptions.

- Interbank transactions: The TSD facilitates smooth execution of interbank forex transactions, ensuring efficient settlement and counterparty risk management.

Synergistic Benefits of Bot Forex and TSD

The combination of bot forex technology and a robust Treasury Single Department creates a powerful synergy that delivers exceptional benefits to traders:

- Enhanced risk management: The TSD’s risk management expertise complements the bot’s automated decision-making, ensuring comprehensive risk mitigation and protection of trading capital.

- Optimized liquidity: The TSD’s liquidity management capabilities ensure seamless settlement of bot Forex trades, eliminating delays or disruptions.

- Compliance assurance: The TSD’s compliance expertise ensures that bot forex operations adheres to all regulations and guidelines, providing peace of mind to traders.

- Comprehensive reporting: The TSD provides detailed reporting of bot forex activities, enabling traders to track performance, analyze results, and make informed adjustments to their strategies.

- Round-the-clock support: SBI’s dedicated support team provides traders with 24/7 assistance, ensuring timely resolution of any issues and maximizing trading potential.

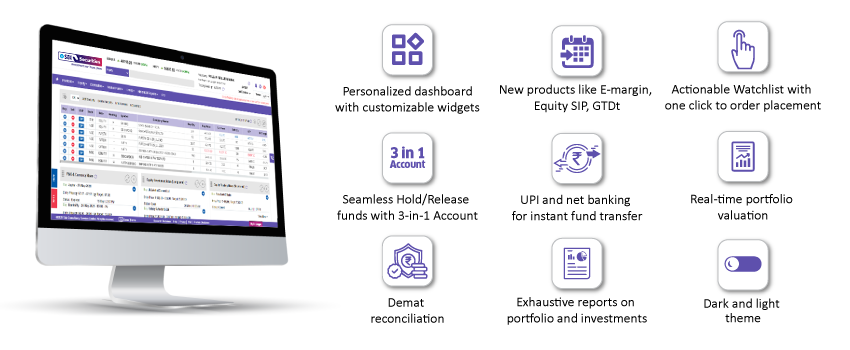

Image: www.sbisecurities.in

Bot Forex And Treasury Single Department In Sbi

https://youtube.com/watch?v=nfiOxL78rTI

Conclusion

In conclusion, SBI’s bot forex technology and Treasury Single Department represent a groundbreaking advancement in financial trading. The integration of intelligent bots with a robust centralized treasury system empowers traders with unparalleled automation, risk management, and liquidity optimization. By leveraging the synergistic benefits of these two innovative offerings, traders can enhance their performance, minimize risks, and achieve greater success in the dynamic world of foreign exchange trading.