A Transformative Confluence

State Bank of India (SBI), India’s largest financial institution, has made a strategic move by integrating its bot forex and treasury operations into a single, formidable unit. This merger marks a pivotal moment in the Indian financial landscape, unlocking a synergy that promises to revolutionize forex and treasury services in the country.

Image: www.youtube.com

Expanding Service Horizons

The consolidation of SBI’s bot forex and treasury functions creates a comprehensive financial powerhouse, offering an unparalleled suite of services. The merged unit will provide specialized foreign exchange trading, treasury management, and advisory services to businesses and individuals alike.

Enhancing Operational Efficiency

By streamlining its operations, SBI aims to enhance the efficiency and effectiveness of its forex and treasury services. The integration eliminates duplication of resources, allowing for seamless coordination and faster decision-making. The consolidated unit will operate on a modern technological platform, enabling real-time monitoring and optimized risk management.

Leveraging Technology Advancements

SBI’s merger capitalizes on the advancements in technology to provide cutting-edge forex and treasury solutions. The integrated platform incorporates automated workflows, advanced analytics, and data-driven decision-making tools. These technologies empower businesses with real-time insights, enabling them to make informed financial decisions and manage risk effectively.

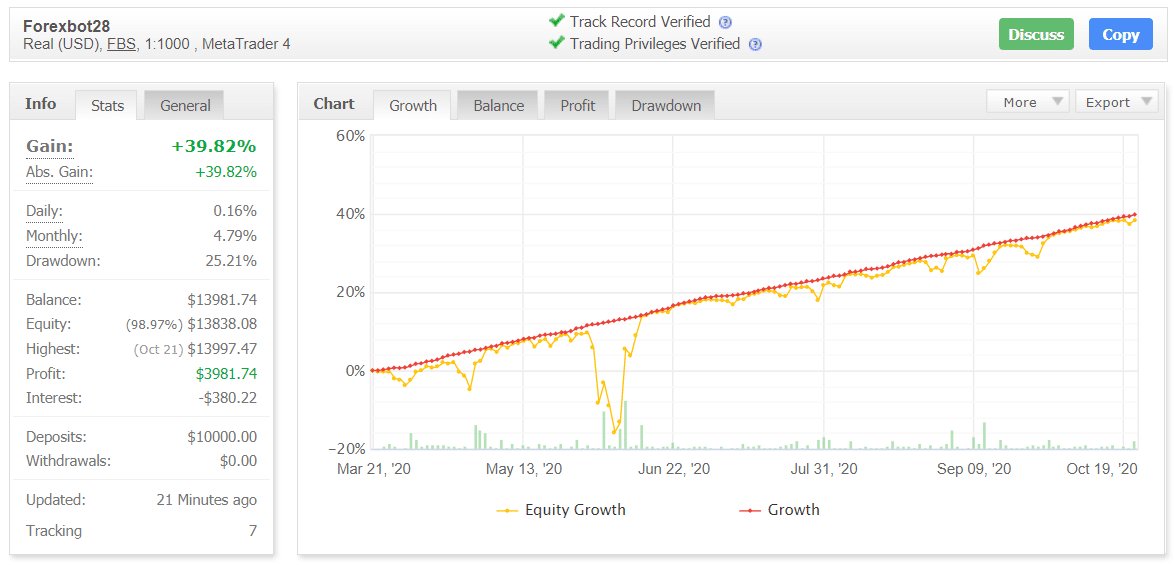

Image: forexrobotexpert.com

Expert Guidance and Analysis

The merged unit’s team of experienced professionals possesses deep expertise in both forex trading and treasury management. Clients can expect personalized advisory services, tailored to their specific financial objectives. Regular market updates, research reports, and insights will keep customers abreast of the latest market trends, enabling them to make informed decisions.

Tips and Expert Advice

To navigate the complexities of foreign exchange and treasury management, consider the following tips:

- Stay informed: Monitor market trends and updates to stay ahead of currency fluctuations and economic changes.

- Set a budget: Determine a clear financial plan and stick to it to avoid overexposure and protect your assets.

- Manage risk: Use hedging strategies to minimize potential losses and protect your financial position.

- Seek professional advice: Consult experienced professionals to guide your financial decisions and optimize your financial strategies.

Frequently Asked Questions

Q: What is the significance of this merger for SBI?

A: The merger consolidates SBI’s forex and treasury operations, unlocking a synergy that enhances efficiency, expands service offerings, and leverages technology to provide unparalleled services.

Q: Who will benefit from this merger?

A: Businesses and individuals seeking specialized forex and treasury services will greatly benefit from the expanded offerings, expertise, and efficiency of the merged unit.

Q: What are the advantages of using a consolidated forex and treasury service provider?

A: A consolidated provider allows for seamless coordination, optimized risk management, real-time insights, and personalized advisory services, ensuring a comprehensive and tailored approach.

Bot Forex And Treasury Merged In Sbi

Conclusion

The merger of SBI’s bot forex and treasury operations into a single unit marks a significant step forward for the Indian financial industry. This transformative move paves the way for enhanced service offerings, greater operational efficiency, and the adoption of technological advancements. As businesses and individuals seek expert guidance amidst the complex financial landscape, SBI’s consolidated unit stands ready to provide tailored solutions and support their financial endeavors.

Are you seeking exceptional forex and treasury services that can empower your financial strategies? Reach out to SBI’s integrated unit to unlock a world of possibilities and navigate the complexities of the financial markets with confidence.