In the ever-evolving financial landscape, where opportunities abound and volatility reigns supreme, the debate between binary options and forex trading has long been a topic of interest. Both instruments offer unique advantages and challenges, presenting traders with a range of choices depending on their risk tolerance and investment goals. In this comprehensive guide, we delve into the intricacies of binary options and forex trading, unraveling their similarities, dissimilarities, and charting a path toward informed decision-making.

Image: pipbear.com

Binary Options-A Dive into the Basics

Binary options, as the name suggests, revolve around a “yes” or “no” proposition. Traders essentially wager on the movement of an underlying asset (stock, currency, commodity) within a predefined period. If their prediction aligns with the actual market outcome, they earn a predetermined profit. The simplicity and potential for high returns have made binary options alluring to many traders, particularly those seeking quick profits with limited capital.

Advantages of Binary Options

- Simplified Structure: Binary options offer a straightforward concept, eliminating the complexities often associated with traditional investment instruments.

- Fixed Payouts: Traders know the potential returns upfront, reducing uncertainty and making risk management more manageable.

- Low Capital Barrier: Binary options are accessible to a broad range of investors due to their low minimum investment requirements.

Disadvantages of Binary Options

- All-or-Nothing Proposition: The rigidity of binary options means that traders either make a profit or lose their entire investment, leaving no room for partial gains or losses.

- Potential for Manipulation: Concerns have arisen about the possibility of market manipulation, impacting the reliability of price movements.

- Regulatory Challenges: Binary options trading is subject to differing regulatory frameworks across jurisdictions, which can impact its availability and transparency.

Forex Trading-Navigating the Global Currency Market

In contrast to binary options, forex trading involves the exchange of currencies in the world’s largest financial market. Traders speculate on the fluctuations in currency pairs, seeking to profit from shifts in value. Unlike binary options, forex trading offers greater flexibility, as positions can be opened and closed on a continuous basis, allowing for both long-term and short-term trading strategies.

Advantages of Forex Trading

- Market Depth and Liquidity: The forex market is renowned for its vast liquidity, which enables traders to execute orders swiftly and efficiently.

- Leverage Benefits: Brokers offer leverage, amplifying the potential returns on investment, although it also magnifies potential losses.

- Varied Strategies: Forex trading offers a wide range of trading strategies, from scalping to swing trading, catering to diverse trading preferences and risk appetites.

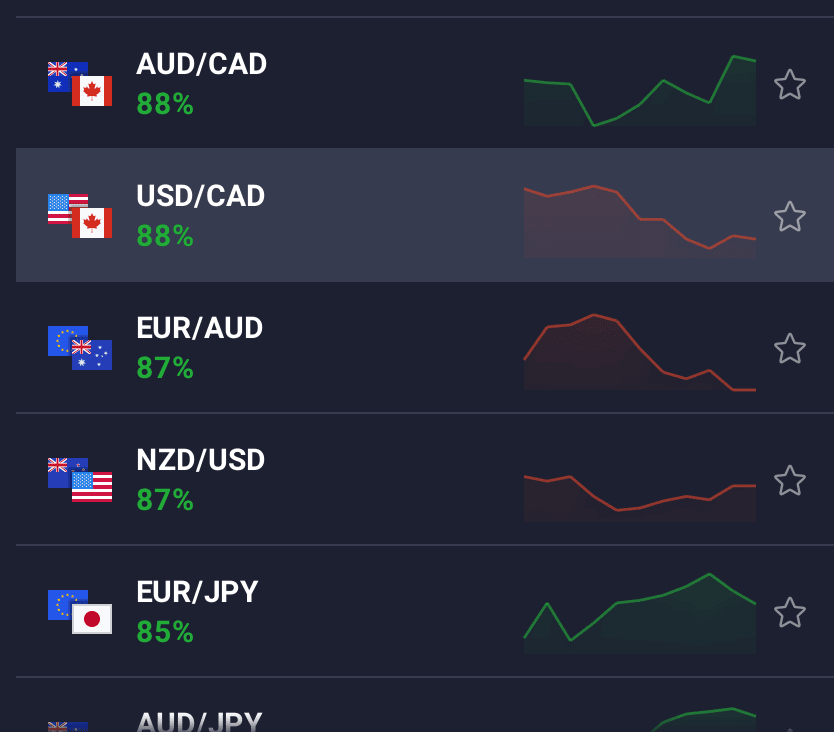

Image: blog.iqoption.com

Disadvantages of Forex Trading

- Higher Learning Curve: Forex trading involves complex concepts, and beginners may face a learning curve before becoming proficient.

- 24/5 Market: The nonstop nature of the forex market can be demanding, requiring traders to monitor the market closely.

- Currency Risk: Forex trading exposes traders to currency risks, as changes in exchange rates can impact profit margins.

Binary Options vs. Forex Trading-Choosing the Right Path

The decision between binary options and forex trading hinges on individual circumstances and financial goals. Binary options may suit risk-averse traders seeking immediate profits, while forex trading is more appropriate for experienced traders comfortable with higher risks and complexities.

Expert Tips for Success

- Understand Your Risk Tolerance: Assess your financial situation and determine the level of risk you are willing to undertake.

- Educate Yourself: Both binary options and forex trading require a thorough understanding of market dynamics and trading strategies. Devote time to research and gain knowledge.

- Choose a Reputable Broker: The integrity and reliability of your broker are crucial. Research various brokers to identify the one that aligns with your needs and preferences.

Frequently Asked Questions

- What is the minimum investment for binary options?

Depending on the platform, the minimum investment can vary from a few dollars to a few hundred dollars. - Can I make a profit consistently with binary options?

While binary options offer the potential for high returns, predicting market outcomes accurately is challenging, and consistent profitability is not guaranteed. - Is forex trading suitable for beginners?

Forex trading requires a deeper understanding of financial markets and careful risk management, making it less suitable for novice traders.

Binary Options Versus Forex Trading

Conclusion

The realm of binary options and forex trading unfolds vast opportunities and challenges. Navigating these markets requires a comprehensive grasp of their unique characteristics and a judicious assessment of personal goals. By delving into the intricacies of both instruments, traders can equip themselves with the knowledge and strategies to navigate the volatile financial waters. Remember that understanding your risk tolerance and seeking continuous education are key ingredients for successful trading in any market. Are you ready to embark on the captivating journey of binary options and forex trading?