In the dynamic realm of foreign exchange (forex), the bill of exchange (BoE) stands as a crucial instrument that oils the wheels of international trade and facilitates financial transactions across borders. It’s a document that carries both legal and monetary significance, acting as a promise to pay a specified sum of money on a defined date.

Image: mg.co.za

Whether you’re a seasoned forex trader or just starting to explore this vast financial landscape, understanding the bill of exchange concept is paramount. Embark on this insightful journey as we delve into its intricacies and unlock its transformative potential in the global exchange market.

Bill of Exchange: The Essence

At its core, a bill of exchange is a written order issued by one party (the drawer) to another (the drawee), instructing them to pay a sum of money at a specified time to a third party (the payee). It serves as a financial agreement and a legal instrument that dictates the terms of payment. Originating from centuries-old commercial practices, the BoE has evolved into an indispensable tool in today’s interconnected financial ecosystem.

The Players in the BoE Game

- Drawer: The entity that initiates the BoE, initiating the request for payment.

- Drawee: The party receiving the BoE instruction to pay the specified amount.

- Payee: The designated recipient of the funds, as per the BoE terms.

Two Key Variants of Bills of Exchange

BoEs come in two primary types:

- Trade Bill: Specifically used in international trade, where it serves as a form of payment for goods or services.

- Banker’s Acceptance: A BoE issued by a bank, guaranteeing payment to the payee, enhancing its credibility and security.

Image: nepalicalendar.rat32.com

The Bill of Exchange Journey

The lifecycle of a BoE comprises several stages:

- Creation: The drawer issues the BoE, including all essential details like payment amount, date, and the parties involved.

- Acceptance: The drawee acknowledges and accepts the payment obligation by signing the BoE, signifying their commitment to honor it.

- Negotiation: The BoE can be bought and sold before its maturity date, introducing additional parties into the transaction.

- Payment: On the specified maturity date, the drawee fulfills the payment obligation to the payee, concluding the BoE’s journey.

Bill Of Exchange Concept In Forex

Benefits of Using Bills of Exchange in Forex

In the world of foreign exchange, BoEs offer a plethora of benefits:

- Convenience: Facilitating seamless cross-border payments without the constraints of physical currency exchange.

- Trust and Security: BoEs provide a secure and verifiable means of payment, minimizing the risk of fraud or non-payment.

- Financial Flexibility: BoEs offer flexibility in payment terms, allowing for tailored arrangements that suit different business needs.

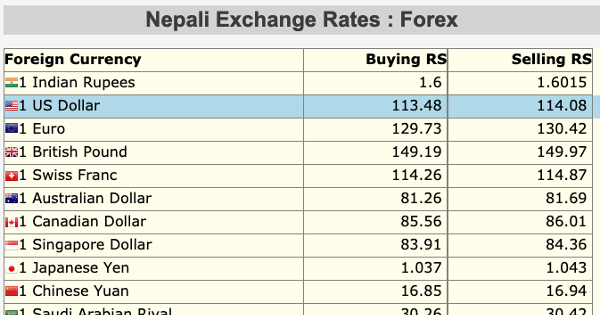

- Favorable Exchange Rates: By leveraging BoEs, you can tap into more favorable exchange rates, optimizing your forex transactions.

In essence, bills of exchange are financial instruments that embody trust, security, and convenience in the captivating world of forex. Embrace their potential to unlock seamless cross-border transactions and elevate your forex trading strategies.