An Insight into the Financial Lifeline of Currency Trading

Imagine you’re at an auction house, surrounded by avid collectors vying for the prized painting on display. As the gavel drops, two figures emerge: the bid rate, representing the highest price buyers are willing to pay, and the ask rate, the lowest price sellers demand. The constant interplay between these rates forms the heartbeat of the foreign exchange (forex) market.

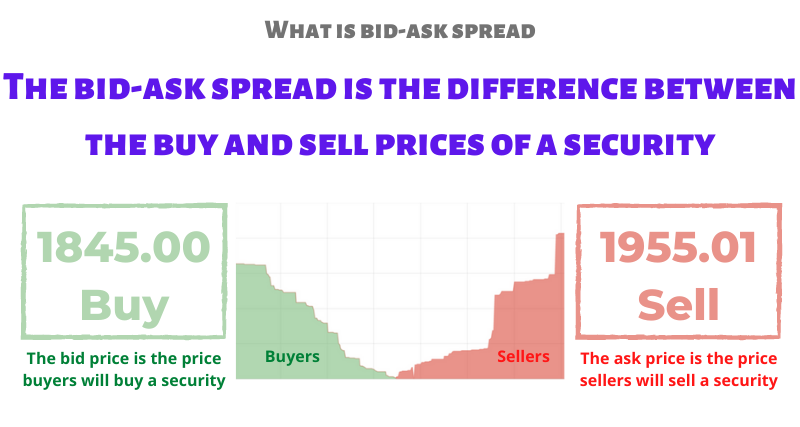

Image: thetradingstrategist.info

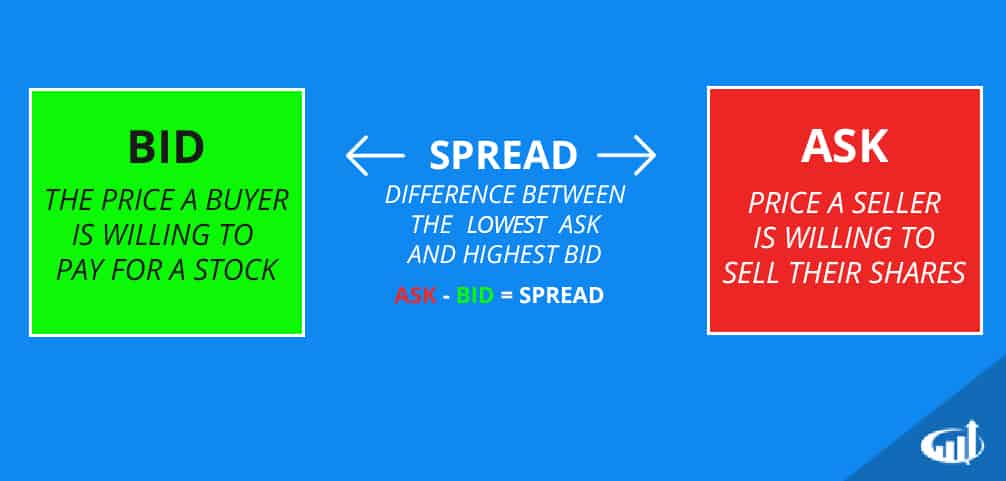

In the realm of global finance, currencies dance to the rhythm of these rates. The bid rate reflects the best price at which traders are ready to purchase a particular currency, while the ask rate denotes the lowest price at which they can sell it. The difference between these two is called the spread, which serves as a profit margin for market makers.

Bid Rate: The Buyer’s Baseline

When you intend to buy a currency, the bid rate becomes your guide. It determines the maximum amount you’re willing to part with to acquire the desired currency. A higher bid rate indicates increased demand for a particular currency, signaling optimism and confidence among buyers. Understanding the factors influencing this demand, such as economic stability, interest rate differentials, and political climate, is vital for making informed trading decisions.

Ask Rate: The Seller’s Bottom Line

On the opposite end of the spectrum lies the ask rate. It represents the lowest price at which a seller is prepared to let go of a currency. A higher ask rate indicates a lower willingness to sell, often due to expectations of a future rise in its value. Identifying the drivers behind these expectations, such as positive economic outlooks, currency speculation, and supply-demand dynamics, is crucial for successful forex trading.

Understanding Market Quotes

In the forex market, currency pairs are always quoted in terms of bid and ask rates. For instance, the EUR/USD currency pair denotes the exchange rate between the Euro (EUR) and the US Dollar (USD). The bid rate represents the number of USD you would receive for one EUR, while the ask rate denotes the number of USD you need to pay to purchase one EUR.

Image: admin.itprice.com

Impact of Bid-Ask Spread on Forex Trading

The bid-ask spread, the difference between the ask and bid rates, plays a significant role in forex trading. A wider spread indicates higher transaction costs, potentially reducing profitability. Additionally, market volatility and liquidity can affect the spread, making it crucial to consider these factors when entering or exiting a trade.

Bid Rate And Ask Rate In Forex Market

Conclusion

The bid rate and ask rate are indispensable pillars of the forex market, shaping currency valuations and impacting trading strategies. Understanding these rates and the factors influencing them empowers traders to navigate the dynamic landscape of global currency exchange and maximize their trading outcomes.

Are you ready to delve deeper into the intricacies of bid rates and ask rates and unlock the potential of forex trading?