In the fast-paced world of forex trading, every tick of the clock holds the potential for immense profit or loss. As a day trader, maneuvering the market’s ever-shifting currents requires precision, skill, and unwavering observation. And that’s where technical indicators step into the spotlight – your indispensable tools for deciphering the market’s whispers and maximizing your odds of success.

Image: forexpops.com

Unveiling the Power of Technical Indicators

Technical indicators are mathematical formulas applied to past price data to help traders identify trends, predict price movements, and recognize overbought or oversold conditions. They provide an objective and data-driven approach to trading, eliminating the noise and emotional biases that can cloud decision-making.

Diving into the Best Technical Indicators

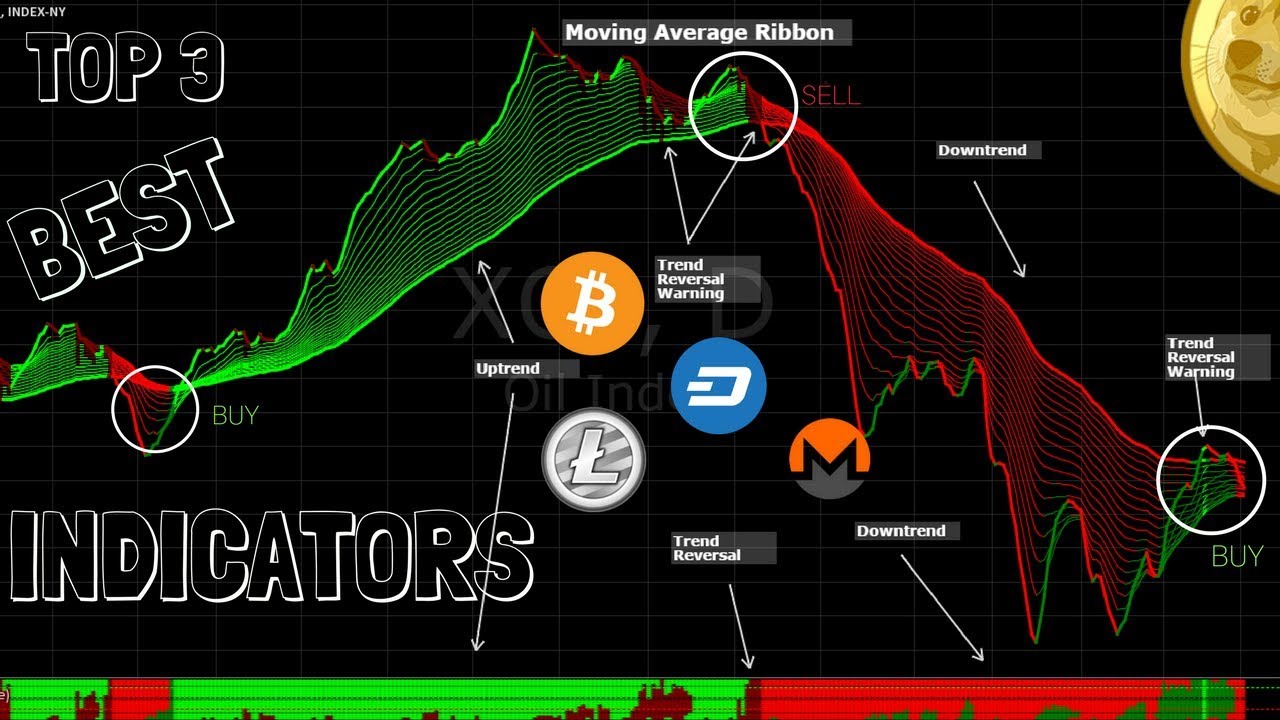

Myriad technical indicators exist, each catering to specific trading strategies and market conditions. For day traders seeking to dominate the 2018 forex landscape, these indicators stand out as the most effective weapons in their arsenal:

- Moving Averages: Smoothing out price fluctuations, moving averages reveal underlying trends and identify potential support and resistance levels.

- Bollinger Bands: Enveloping price action within upper and lower bands, Bollinger Bands gauge market volatility and indicate potential breakout points.

- Relative Strength Index (RSI): Measuring the magnitude of price changes, the RSI identifies overbought (high values) and oversold (low values) conditions.

- Stochastic Oscillator: Assessing market momentum, the Stochastic Oscillator helps traders determine when an asset is nearing its overbought or oversold extremes.

- MACD (Moving Average Convergence Divergence): Combining multiple moving averages, the MACD pinpoints trend reversals and provides signals for potential trading opportunities.

Beyond Theory: Realizing Indicator Mastery

Mastering technical indicators extends beyond mere understanding their formulas. True proficiency lies in skillful application, a dance between intuition and objective analysis. Here are a few tips to elevate your game:

- Backtesting: rigorously test indicators on historical data to assess their efficacy and identify optimal settings.

- Multiple Indicators: leveraging multiple indicators simultaneously enhances your analysis, but avoid overloading your charts.

- Avoid Overdependence: Indicators are valuable tools, but excessive reliance can lead to tunnel vision and missed opportunities.

- Seek Expert Guidance: consult experienced traders, attend webinars, or engage in trading communities to sharpen your skills.

Embrace the Day Trading Revolution

Armed with the best technical indicators of 2018, day traders gain an unparalleled advantage in the fiercely competitive forex market. By meticulously interpreting market data and executing precise trades, they unlock the path to consistent profitability and financial freedom.

Join the ranks of successful day traders today. Master the art of technical indicator analysis and conquer the ever-evolving forex landscape. The year 2018 belongs to those who dare to seize the moment and harness the power of knowledge. Invest in yourself, become a master, and let the market bow to your will.

Image: tradingforexguide.com

Best Technical Indicators Day Trading Forex 2018