Day trading forex can be an exciting and potentially lucrative endeavor, but it’s crucial to implement effective risk management strategies to mitigate potential losses. One of the most fundamental aspects of managing risk is determining the optimal stop loss for each trade. This comprehensive guide will explore the best stop loss strategies for day trading forex, empowering you to enhance your trading performance.

Image: blog.bullbear.io

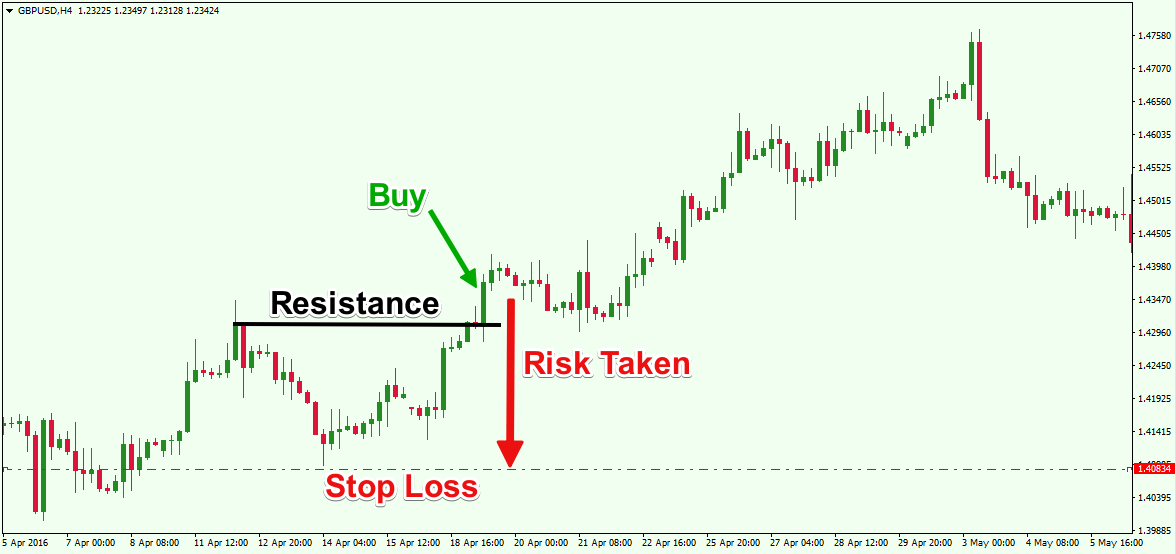

Before delving into the specifics, let’s define a stop loss. A stop loss is a pre-determined price level at which you automatically exit a trade when it reaches that level. It serves as a protective measure, helping to limit your potential losses if the market moves against you.

Determining an Optimal Stop Loss

Selecting an optimal stop loss involves balancing several factors, including:

1. Risk Tolerance: Determine your acceptable risk level for each trade. This will vary depending on your trading strategy, account size, and personal preferences.

2. Historical Volatility: Analyze historical price fluctuations for the currency pair you’re trading. Higher volatility requires a wider stop loss to avoid premature exits due to short-term price fluctuations.

3. Market Psychology: Understand the market’s tendencies, such as support and resistance levels. Placing stop losses just outside these levels can provide additional protection.

4. Trade Duration: Consider the intended duration of your trades. Longer-term trades generally require wider stop losses due to increased potential price fluctuations.

Technical Indicators for Setting Stops

Various technical indicators can assist in determining optimal stop loss levels:

- ATR (Average True Range): Helps measure average price volatility. Multiplying the ATR by a factor (e.g., 2, 3) provides a wider stop loss range.

- Bollinger Bands: Outside bands can act as potential stop loss levels when the price exceeds them.

- Fibonacci Levels: Retracement and extension levels can provide insight into potential price targets and stop loss placements.

- Moving Averages: Stop losses can be set below (for short trades) or above (for long trades) moving averages to protect against adverse price action.

Tips and Expert Advice

Consider the following advice to enhance your stop loss strategy:

- Use a Percentage-Based Stop Loss: Calculate your stop loss as a percentage of your entry price or account balance.

- Set Trailing Stops: Adjust your stop loss dynamically as the trade moves in your favor, ensuring protection while capturing more profit.

- Avoid Emotional Decisions: When the market moves against you, don’t hastily move your stop loss closer. Stick to your pre-determined plan.

- Consider Partial Stops: Allow a portion of your position to close at a stop loss while maintaining the remainder open for potential profit continuation.

Image: www.thewolfofallstreets.io

FAQ

Q: What happens if I don’t use a stop loss?

A: Trading without a stop loss significantly increases the risk of incurring substantial losses if the market moves adversely.

Q: How tight should my stop loss be?

A: The stop loss should provide adequate protection while allowing for reasonable price fluctuations. Tight stops can lead to premature exits, while wide stops may increase potential losses.

Best Stop Loss For Day Trading Forex

Conclusion

Determining the best stop loss for day trading forex requires a multifaceted approach that considers various factors and utilizes technical indicators. By implementing these strategies, you can enhance your risk management, improve your trading performance, and navigate the forex market with greater confidence. Remember to regularly review and adjust your stop loss approach based on market conditions and your evolving risk tolerance.

Are you ready to elevate your Forex day trading skills? Share your thoughts and experiences in the comments below!