Introduction

In the fast-paced world of forex scalping, identifying the optimal moving average that aligns with your trading strategy is paramount. Forex scalping, a trading technique involving frequent executions over short durations, demands a dependable indicator like moving averages to navigate market fluctuations and enhance decision-making. Join us as we delve into the realm of moving averages, exploring their types and nuances, to uncover the most effective moving average for your scalping endeavors.

Moving Averages: A Foundation for Scalping Success

Moving averages, the cornerstone of technical analysis, offer a simplified representation of price trends by smoothing out market noise. These indicators provide traders with a clear understanding of price direction, identifying support and resistance levels, and pinpointing potential trading opportunities.

Types of Moving Averages

A plethora of moving averages exists, each tailored to specific trading styles and time frames. Among the most commonly employed are the Simple Moving Average (SMA), Exponential Moving Average (EMA), Weighted Moving Average (WMA), and Linear Weighted Moving Average (LWMA).

- SMA: This simple yet effective moving average calculates the average price over a defined period, providing a basic representation of the trend.

- EMA: Assigning greater weightage to recent prices, the EMA responds quickly to price movements, making it ideal for short-term scalping strategies.

- WMA: The WMA assigns higher weightage to the most recent prices, enhancing its sensitivity to price changes and potential trading signals.

- LWMA: Similar to the WMA, the LWMA also emphasizes recent prices but with a more gradual weighting system, resulting in smoother fluctuations.

Identifying the Best Moving Average for Scalping

The selection of an appropriate moving average for scalping hinges on several factors, including the time frame, currency pair, and trading strategy employed.

For short-term scalping strategies, where rapid price movements are prevalent, the EMA and WMA offer superior responsiveness. The EMA, with its higher weightage on recent prices, provides a more accurate reflection of the current trend, while the WMA’s focus on recent fluctuations aligns well with the frequent trades characteristic of scalping.

Image: scuba-dawgs.com

Regarding time frames, the 5-minute and 15-minute charts are popular among scalpers due to their ability to capture short-term price movements. The 50-period EMA and 100-period WMA have proven effective on these time frames, providing a balance between responsiveness and noise reduction.

Leveraging Moving Averages in Scalping Strategies

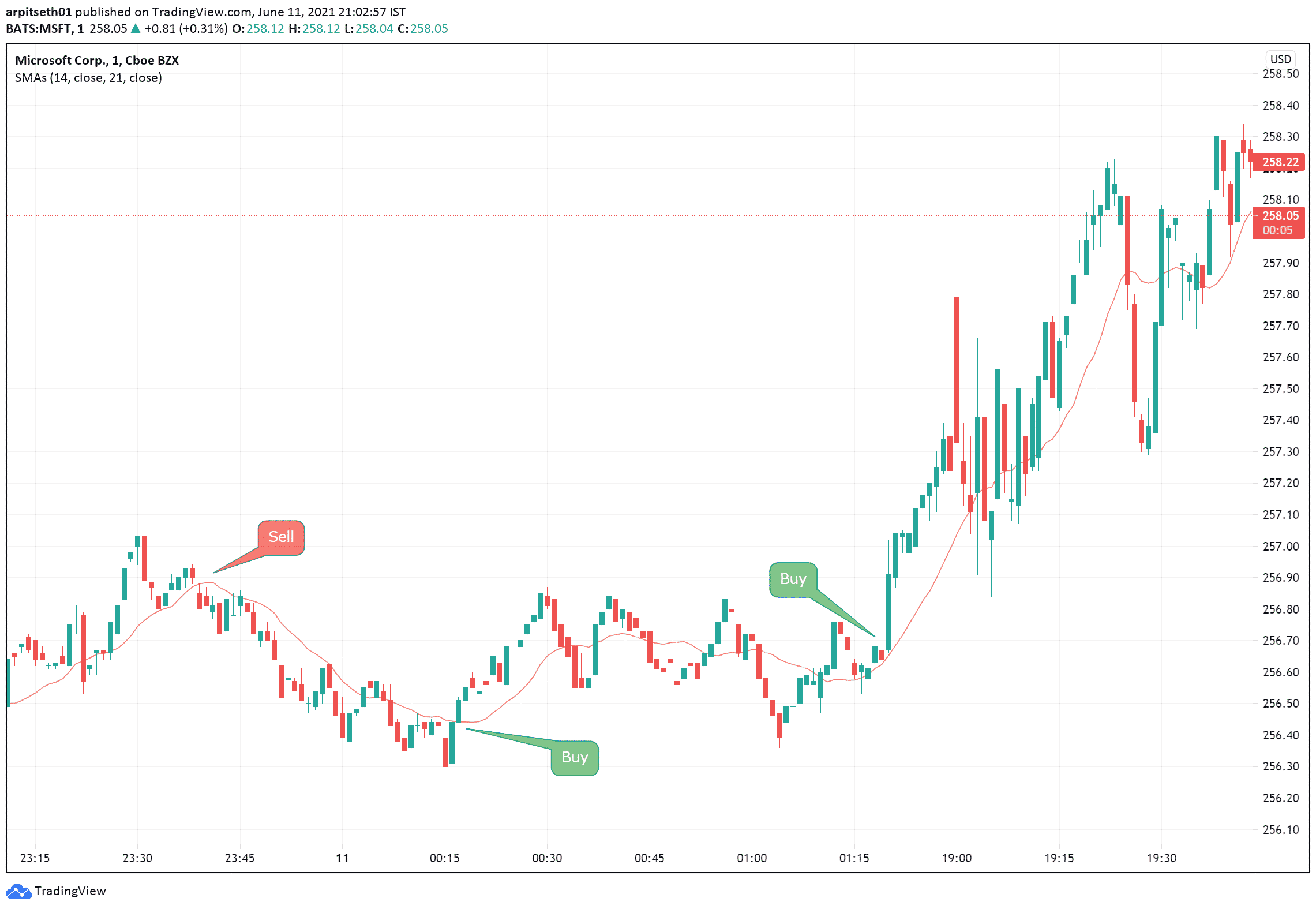

Incorporating moving averages into scalping strategies can enhance trading performance by providing objective signals and identifying favorable trading conditions.

- Trend Identification: Moving averages establish the general market trend, enabling scalpers to align their trades accordingly. An upward-sloping moving average suggests an uptrend, while a downward-sloping moving average indicates a downtrend.

- Support and Resistance: Moving averages can serve as dynamic support and resistance levels. When the price approaches a moving average, it often acts as a point of consolidation, offering potential trading opportunities.

- Convergence and Divergence: Observing the convergence or divergence between the price action and the moving average can provide valuable insights. When the price and moving average move in tandem, it reinforces the current trend. Conversely, when they diverge, it can signal a potential trend reversal.

Image: optionstradingiq.com

Best Moving Average For Scalping Forex

Conclusion

Selecting the optimal moving average for forex scalping is a crucial step in developing a profitable trading strategy. Understanding the various moving average types and their characteristics empowers traders to make informed decisions that align with their trading style and time frame.

Remember, combining appropriate moving averages with a comprehensive trading plan, risk management techniques, and a disciplined approach is key to unlocking the full potential of scalping in the dynamic forex market. As you embark on this exciting trading adventure, may this guide serve as a valuable resource, propelling you toward consistent scalping success.