In the fast-paced and dynamic world of forex trading, precision is paramount. From navigating market volatility to securing profitable returns, every decision you make can significantly impact your financial success. Among these crucial decisions, determining the optimal position size is arguably one of the most critical yet often overlooked. Enter the FX position size calculator – an indispensable tool that empowers traders with unparalleled accuracy and confidence.

Image: forextraininggroup.com

Imagine yourself as a seasoned trader, perched at the edge of your trading desk, armed with the knowledge and expertise to conquer the markets. You’ve identified a high-probability trading opportunity, your heart pounding with anticipation. But before you execute your trade, a nagging question lingers: How much should I risk on this trade? A reckless approach could lead to devastating losses, while an overly conservative one could hinder your profit potential. This is where the FX position size calculator steps in, providing you with the precision you need to make informed decisions and optimize your trading outcomes.

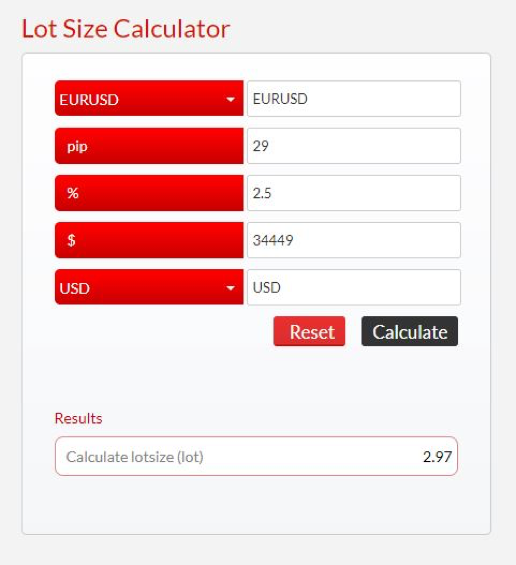

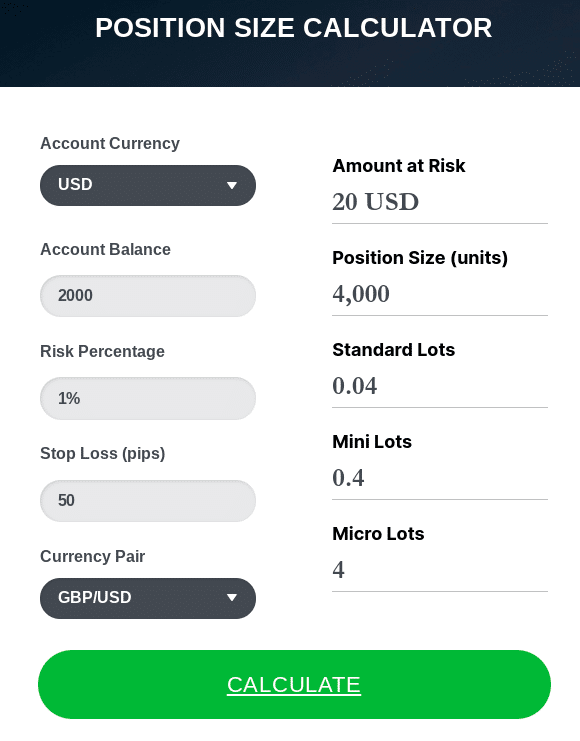

At its core, the FX position size calculator is a mathematical formula that considers various factors to determine the appropriate position size for a given trade. These factors include your account balance, risk tolerance, desired trading leverage, and the stop-loss level you’re willing to accept. By incorporating these variables, the calculator generates a position size that minimizes risk while maximizing profit potential.

To harness the full power of the FX position size calculator, it’s essential to understand the underlying concepts. Firstly, risk tolerance refers to your comfort level with potential losses. If you’re a risk-averse trader, you’ll opt for a smaller position size, limiting your exposure. Conversely, if you’re willing to tolerate higher risk in pursuit of greater rewards, a larger position size might be more suitable.

Secondly, leverage plays a crucial role, essentially amplifying your trading capital and allowing you to control larger positions. However, it’s a double-edged sword: while leverage can magnify profits, it can also exacerbate losses. Therefore, using leverage wisely is essential, and the FX position size calculator takes this into account.

With a firm grasp of these concepts, operating the FX position size calculator is a breeze. Simply input your account balance, risk tolerance, desired leverage, and stop-loss level. Within seconds, the calculator will provide you with the optimal position size, empowering you to trade with confidence, knowing that your risk is carefully managed.

To further enhance your trading prowess, leverage the insights of industry experts. Seasoned traders recommend adhering to strict risk management guidelines, such as risking no more than 1-2% of your account balance on any single trade. Additionally, they emphasize the importance of backtesting your trading strategies to optimize your parameters and minimize risk.

Embracing the FX position size calculator is a transformative step towards becoming a successful forex trader. By precisely calculating your position size, you gain control over your risk, increase your profit potential, and trade with unwavering confidence. Remember, the markets are constantly evolving, so continuous learning and adaptation are key. With the FX position size calculator as your trusted companion, you can navigate the ever-changing landscape of forex trading, consistently making informed decisions that lead to financial success.

In the realm of forex trading, precision is the ultimate weapon. Don’t leave your trading outcomes to chance. Unleash the power of the FX position size calculator today and unlock the path to consistent profitability.

Image: learn2.trade

Fx Position Size Calculator