Introduction

The ever-evolving landscape of forex trading demands traders to stay abreast of market dynamics and make informed trading decisions. Amidst the plethora of information available, forex signal providers have emerged as a guiding light, offering traders a roadmap to navigate the complexities of the forex market. In this comprehensive guide, we will delve into the world of forex signal providers, uncovering their intricacies and empowering you to identify the best provider for your trading endeavors.

Image: www.pipsmake.com

Navigating the Forex Signal Provider Landscape

Forex signal providers act as intermediaries between market analysis and traders. They meticulously study market trends, identify trading opportunities, and convey these signals to subscribers. These signals typically include specific instructions on when to enter and exit a trade, as well as the targeted profit level. The quality and accuracy of these signals significantly impact traders’ profitability, rendering the choice of signal provider paramount.

Choosing the Best Forex Signal Provider: A Comprehensive Checklist

Selecting the right forex signal provider is akin to finding the missing piece of a trading puzzle. To guide you in this pursuit, we have compiled a comprehensive checklist of key factors to consider:

1. Historical Accuracy and Track Record:

The past performance of a signal provider is an invaluable indicator of future success. Scrutinize their trading history, analyze the percentage of winning trades, and assess the consistency of their signals. A proven track record instils confidence and demonstrates their expertise.

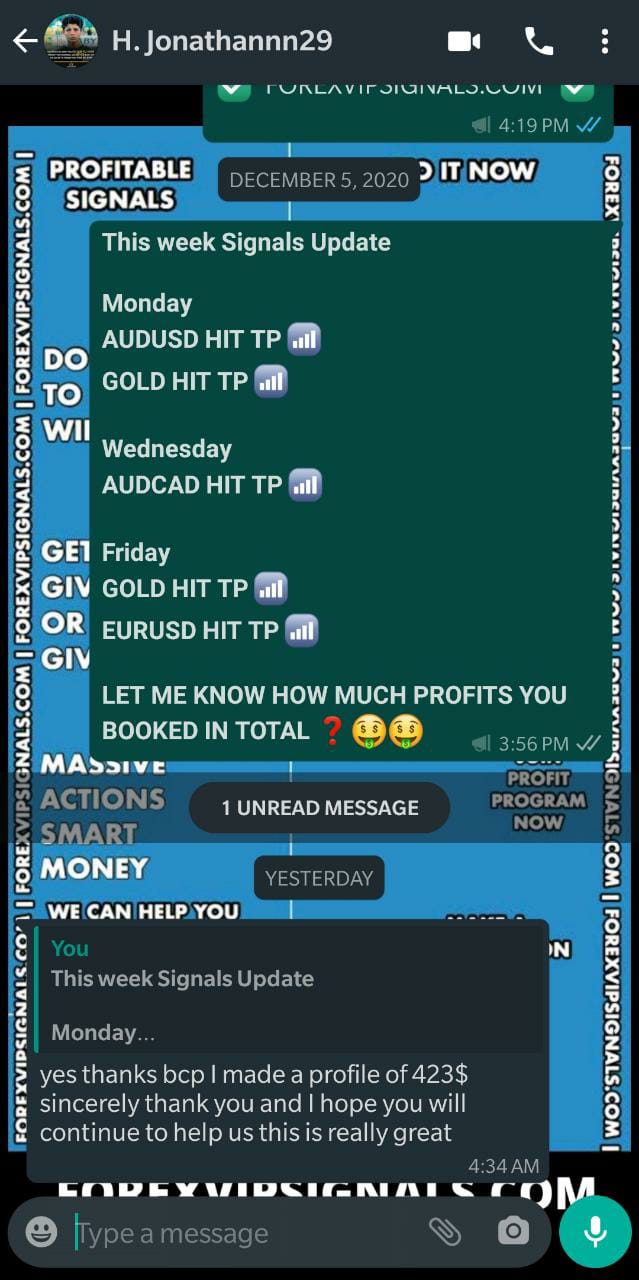

Image: www.forexvipsignals.com

2. Transparency and Trust:

Reputable signal providers embrace transparency, openly sharing their trading strategies, execution methods, and risk management practices. They actively engage with subscribers, fostering trust and empowering traders to make informed decisions.

3. Market Analysis and Trading Methodology:

Inquire about the provider’s approach to market analysis and the trading methodologies they employ. Successful providers utilize sophisticated tools and techniques to identify profitable trading opportunities, maximizing their signals’ effectiveness.

4. Signal Delivery Platform:

Assess the efficiency and reliability of the provider’s signal delivery platform. Consider accessibility, ease of use, and the ability to integrate with your trading platform. Timely and seamless signal delivery is crucial for successful execution.

5. Risk Management:

Forex trading inherently involves risk, and it is imperative that signal providers prioritize risk management strategies. Evaluate their approach to position sizing, stop-loss orders, and profit-taking targets, ensuring alignment with your risk tolerance.

6. Customer Support:

Exceptional customer support is a cornerstone of a reliable signal provider. Assess their responsiveness, professionalism, and willingness to address your queries. Prompt and effective support can mitigate concerns and enhance your trading experience.

Additional Tips for Maximizing Success with Forex Signal Providers

• Diversify your signals: Subscribe to multiple signal providers to minimize risk and broaden your market exposure.

• Utilize demo accounts: Most signal providers offer demo accounts to test their services risk-free. Experiment with different providers and strategies to find the best fit.

• Monitor and evaluate: Continuously track the performance of your chosen signal providers. Reassess their accuracy, profitability, and risk management strategies periodically to ensure they remain aligned with your expectations.

Best Forex Signal Provider Online

Conclusion

Navigating the forex market armed with reliable forex signal providers is an invaluable asset for traders seeking profitability. By meticulously evaluating the factors outlined in this guide and implementing additional tips, you can make an informed decision and choose the best signal provider to empower your trading journey. Remember that forex trading involves risks, and it is imperative to approach it with a comprehensive understanding, prudent risk management, and a realistic outlook.