In the fast-paced, ever-evolving world of Forex trading, traders seek every conceivable advantage to navigate the treacherous market waters. Among the indispensable tools that empower traders with market insights are spared indicators, providing a powerful arsenal to enhance trading strategies. In this comprehensive guide, we delve into the realm of Best Forex Spared Indicators, illuminating their unique functionalities, benefits, and unlocking the secrets to their judicious utilization. By harnessing the wisdom embedded within these indicators, traders can embark on a path toward increased profitability and mitigate potential risks.

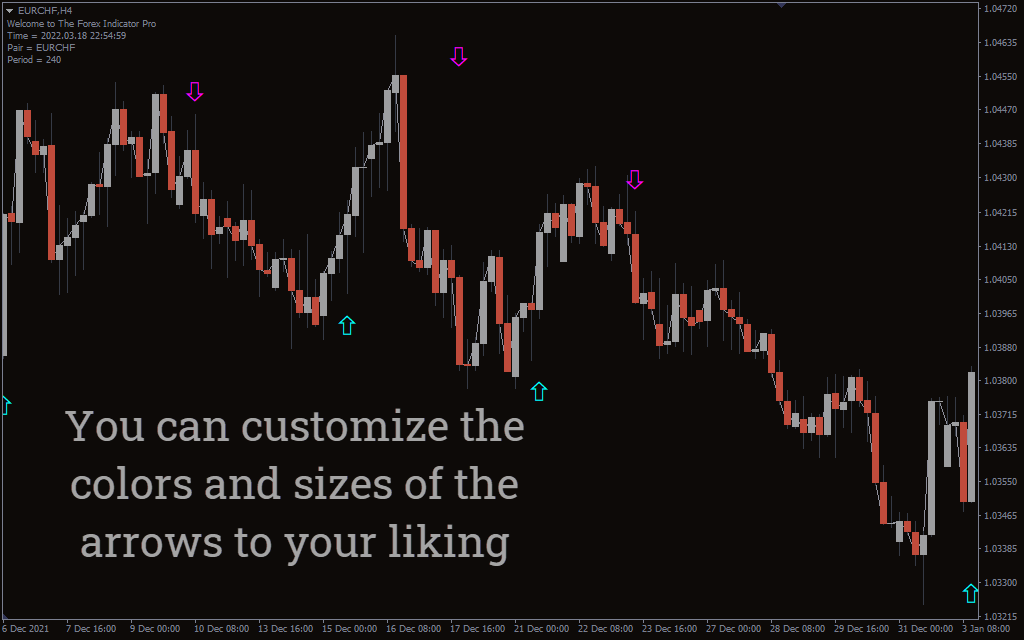

Image: www.hotzxgirl.com

Deciphering the Essence of Spared Indicators: A Guiding Light in Market Volatility

Spared indicators, also known as lagging indicators, are an invaluable category of technical analysis tools designed to provide traders with insights into past price movements and market trends. Unlike leading indicators that endeavor to predict future price action, spared indicators focus on analyzing historical data, assisting traders in identifying trends, spotting potential reversals, and evaluating market momentum. These indicators play a pivotal role in confirming existing trends, adding a layer of confidence to trading decisions, and helping traders identify potential entry and exit points with greater accuracy.

Embracing the Power of Best Forex Spared Indicators: Unveiling Performance-Enhancing Gems

-

Moving Average (MA): The Moving Average (MA) stands as a quintessential spared indicator, smoothing out price fluctuations to reveal the underlying trend direction. Traders can choose from diverse MA types, including Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA), each catering to varied trading styles.

-

Relative Strength Index (RSI): The Relative Strength Index (RSI) gauges the magnitude of recent price changes, assisting traders in identifying overbought and oversold market conditions. By oscillating between 0 and 100, RSI helps determine when an asset is potentially overvalued or undervalued, providing valuable inputs for timing entries and exits.

-

Stochastic Oscillator: The Stochastic Oscillator complements the RSI by measuring the relative position of a security’s closing price within its trading range over a specific period. This indicator, too, aids in identifying overbought and oversold conditions, enhancing trade execution precision.

-

Bollinger Bands: Bollinger Bands encompass three lines: a simple moving average in the middle and two outer bands that represent standard deviations above and below the moving average. These bands provide valuable insights into market volatility, acting as dynamic support and resistance levels, and indicating potential trading opportunities.

-

Ichimoku Kinko Hyo (Ichimoku Cloud): The Ichimoku Cloud is a comprehensive technical analysis tool that combines multiple indicators into a single, visually intuitive display. This indicator offers an array of insights, including trend direction, support and resistance levels, and potential trading signals, empowering traders with a holistic market perspective.

Mastering the Art of Spared Indicator Integration: A Path to Trading Success

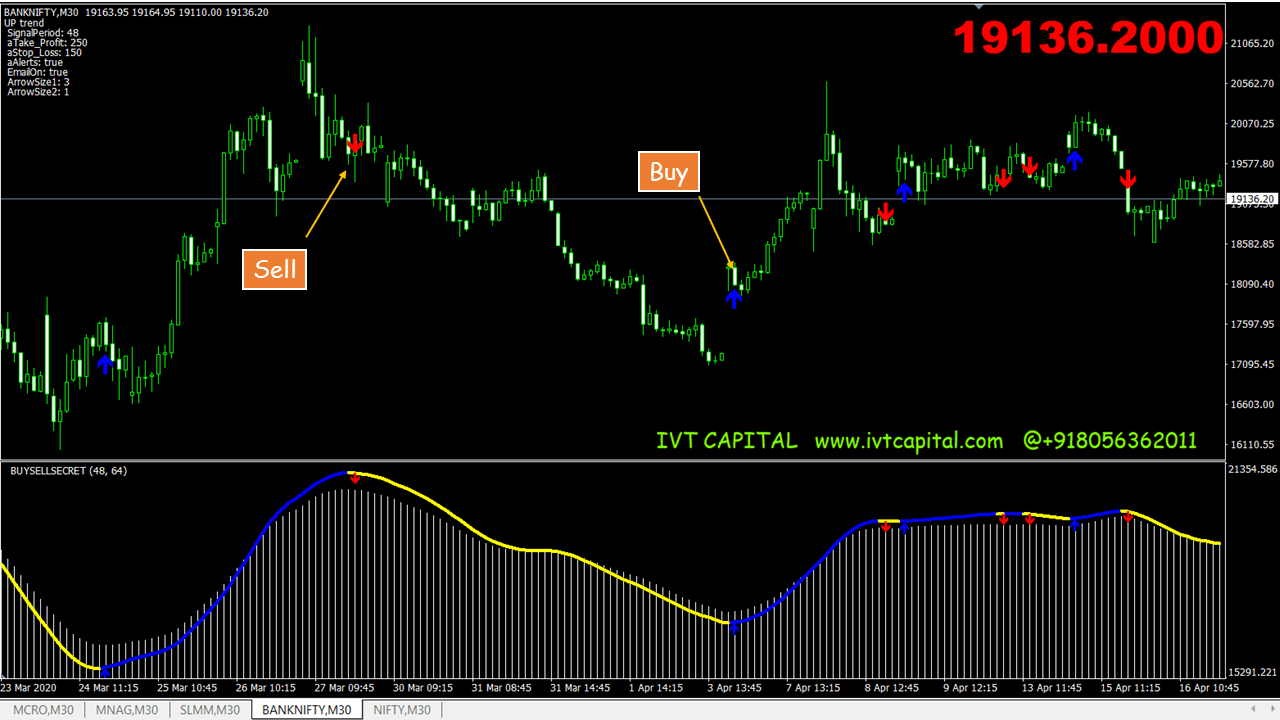

To fully harness the potential of spared indicators, traders must master the art of integrating them into their trading strategies. Effective deployment involves identifying the most suitable indicators for their trading style, understanding their respective strengths and limitations, and combining them synergistically to mitigate potential weaknesses. Additionally, traders need to optimize indicator parameters based on their trading timeframe and market conditions, ensuring they align with their risk tolerance and trading objectives.

Image: howtotradeonforex.github.io

Best Forex Showing Sapred Indicators Free Download

Conclusion: Embarking on a Journey of Forex Mastery with Spared Indicators

Equipping oneself with the Best Forex Spared Indicators is akin to acquiring a treasure trove of market intelligence. By incorporating these indicators into their trading strategies, traders gain a profound understanding of market dynamics, empowering them to make informed decisions and navigate market fluctuations with greater agility. While technical analysis tools provide valuable insights, they should never be the sole basis for trading decisions. Traders must complement indicator analysis with sound fundamental research, prudent risk management, and a disciplined trading approach. By embracing the knowledge imparted in this comprehensive guide, traders can unlock the potential of spared indicators, enhancing their trading proficiency, and propelling themselves toward consistent profitability in the ever-evolving Forex market landscape.