Embarking on the treacherous waters of forex trading demands a keen understanding of the dynamics that govern currency pairs. Some pairings dance gracefully in the market currents, promising lucrative opportunities, while others wallow in choppy waters, threatening to capsize your financial vessel. This article aims to illuminate the forex trading landscape, revealing the best pairs to seize upon and those to steer clear of.

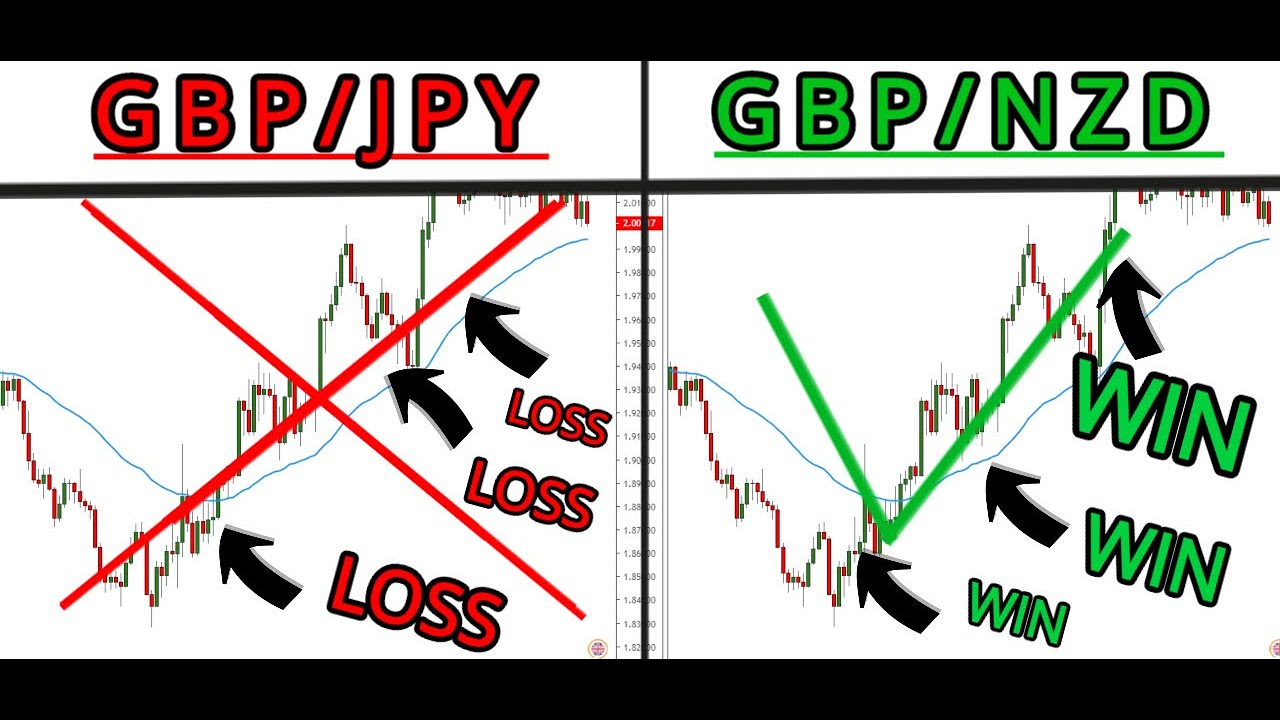

Image: www.youtube.com

Before casting our lines into the forex market, it’s essential to define our terms. A forex pair represents the exchange rate between two currencies, for instance, the euro (EUR) and the U.S. dollar (USD), denoted as EUR/USD. The left-hand currency (EUR) is the “base currency,” while the right-hand currency (USD) is the “quote currency.” Understanding this distinction proves crucial in comprehending the intricacies of forex pairs.

**The Holy Grail: Identifying the Most Traded Forex Currency Pairs**

In the world of forex, some currency pairs stand out as the most liquid and actively traded. These market heavyweights offer traders a potent cocktail of advantages, including:

-

Exceptional Market Depth:

Their massive trading volumes ensure smooth execution and minimal slippage, even for substantial orders.

-

Tiny Spreads:

The high liquidity translates into razor-thin spreads, reducing trading costs and enhancing profitability.

-

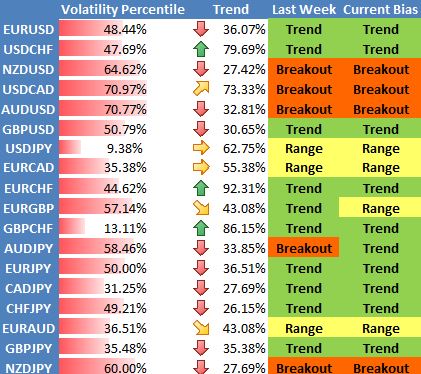

Image: forexpops.comEnhanced Volatility:

These pairs exhibit robust price fluctuations, providing ample opportunities for astute traders to exploit market movements.

The forex pairs that reign supreme in popularity and liquidity include:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

**Unveiling the Pitfalls: Forex Pairs to Avoid**

While the aforementioned pairs may gleam with allure, not all forex pairs are worthy of your trading prowess. Certain pairings harbor treacherous pitfalls that can lead to financial doom:

1. Exotic Currency Pairs:

Exotic pairs involve a major currency pitted against a currency from a developing nation. These pairs often inflict exorbitant spreads upon traders, hinder order execution, and expose them to geopolitical instability.

2. Currency Pairs with Low Liquidity:

Liquidity, as discussed earlier, plays a vital role in forex trading. Pairs with insufficient liquidity can result in lengthy execution times, wider spreads, and unpredictable price fluctuations.

3. Pairs Tied to Political Headlines:

Currency pairs influenced by geopolitical events can exhibit erratic behavior. Relying on these pairs may amplify risks as traders wrestle with unpredictable news-driven price fluctuations.

**Tips and Expert Advice for Forex Trading Success**

Nourished with an understanding of the best and worst forex pairs, let’s delve into some practical tips that may bolster your trading acumen:

-

Thorough Research:

Arm yourself with a deep understanding of the currency pairs you intend to trade. Analyze their economic fundamentals, market trends, and potential risks.

-

Risk Management:

Exercise diligent risk management strategies to safeguard your trading capital. Establish stop-loss and take-profit orders to limit potential losses.

-

Patient Approach:

Forex trading rewards patience and discipline. Avoid hasty decisions and let market conditions guide your trading endeavors.

-

Trading Plan:

Craft a comprehensive trading plan that outlines your trading strategies, risk tolerance, and entry/exit points. Adhering to a plan instills discipline and reduces impulsive trading.

**Your Forex Trading FAQ: Unveiling Common Queries**

Before we bid farewell, permit us to address some frequently asked questions that may linger in your curious minds:

- Q: What is the single best forex pair to trade?

- A: No single pair stands supreme as the “best” for all traders. The choice hinges upon various factors, including your trading style, risk tolerance, and market conditions.

- Q: How do I know which currency pair to avoid?

- A: Steer clear of exotic pairs, pairs with low liquidity, and those susceptible to political instability.

- Q: Can I trade forex pairs successfully as a beginner?

- A: While forex trading can be lucrative, it demands knowledge, skill, and discipline. Beginners are advised to tread cautiously and seek guidance from experienced traders or reputable educational resources.

Best Forex Pairs To Trade And Not

**Conclusion**

Navigating the forex trading arena can be both exhilarating and perilous. By carefully selecting the currency pairs you trade and steering clear of potential pitfalls, you can increase your chances of success. Embracing patience, thorough research, and prudent risk management may empower you to capture market opportunities and weather turbulent waters.

Are you ready to embark on the forex trading odyssey and seize the lucrative rewards that await those who delve into this fascinating market? If so, arm yourself with knowledge, discipline, and a sound trading plan. May the forex gods favor your endeavors!