Introduction

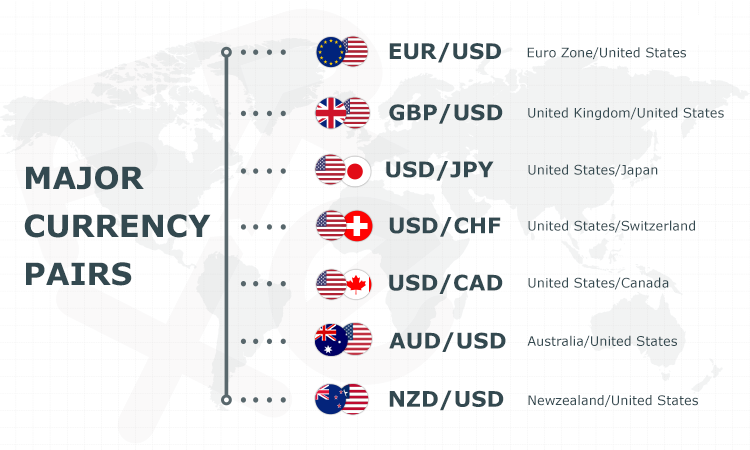

The foreign exchange market, or Forex, is the largest financial market in the world, with an estimated daily trading volume of over $5 trillion. Forex trading involves the exchange of currencies from different countries, and it can be a lucrative way to make money. However, not all currency pairs are created equal. Some pairs are more volatile than others, and some are more difficult to trade. In this article, we will discuss the best forex pairs to trade in 2018.

Image: forexoctavesystemreview.blogspot.com

What Makes a Good Forex Pair?

There are a few factors that make a good forex pair for trading. These include:

- Volatility: Volatility is a measure of how much a currency pair moves up and down in price. A volatile pair can be more difficult to trade, but it can also offer greater profit potential.

- Liquidity: Liquidity is a measure of how easy it is to buy and sell a currency pair. A liquid pair will have a high volume of trades, which makes it easier to get in and out of positions quickly.

- Correlation: Correlation is a measure of how two currency pairs move in relation to each other. A positively correlated pair will move in the same direction, while a negatively correlated pair will move in opposite directions.

- Trading Costs: The trading costs for a currency pair include the spread and the commissions. The spread is the difference between the bid and ask prices, and the commissions are the fees that your broker charges you for each trade.

The Best Forex Pairs to Trade in 2018

Now that we know what makes a good forex pair, let’s take a look at the best forex pairs to trade in 2018.

- EUR/USD: The EUR/USD is the most heavily traded currency pair in the world. It is a highly liquid pair with a low spread, which makes it a good choice for both beginners and experienced traders.

- USD/JPY: The USD/JPY is another popular currency pair. It is a volatile pair with a high spread, but it can also offer great profit potential.

- GBP/USD: The GBP/USD is a trending pair that is often traded by breakout traders. It is a volatile pair with a low spread, which makes it a good choice for both trend traders and scalpers.

- USD/CHF: The USD/CHF is a safe haven pair that is often traded during times of market turmoil. It is a less volatile pair with a low spread, which makes it a good choice for beginners and risk-averse traders.

- AUD/USD: The AUD/USD is a commodity currency pair that is often traded in relation to the price of gold. It is a volatile pair with a high spread, but it can also offer great profit potential.

Conclusion

These are just a few of the best forex pairs to trade in 2018. The best pair for you will depend on your individual trading strategy and risk tolerance. If you are a beginner, it is important to start with a less volatile pair such as the EUR/USD or the USD/CHF. As you gain experience, you can start to trade more volatile pairs such as the USD/JPY or the AUD/USD.

Image: furtherafrica.com

Best Forex Pairs To Trade 2018

Actionable Tips

- Do your research: Before you start trading any currency pair, it is important to do your research and understand the risks involved.

- Start with a demo account: A demo account is a great way to practice trading without risking any real money.

- Use a stop loss order: A stop loss order is an order that you place with your broker to automatically sell your position if the price falls below a certain level.

- Manage your risk: Never risk more money than you can afford to lose.

- Be patient: Forex trading is not a get-rich-quick scheme. It takes time and effort to become a successful trader.

By following these tips, you can increase your chances of success in the forex market.