When navigating the dynamic world of forex trading, technical indicators serve as indispensable tools for discerning market trends and making informed decisions. Among the myriad of indicators available, support and resistance levels stand out as foundational concepts that can dramatically enhance your trading strategies. This comprehensive guide will delve into the intricacies of support and resistance and empower you with the knowledge to harness their potential for trading success.

Image: www.andreaforex.com

What are Support and Resistance Levels?

Imagine the ever-changing forex market as a battleground, where buyers and sellers constantly vie for dominance. Support levels represent the prices at which buyers consistently step in to prevent further declines, creating a “floor” below which the market struggles to fall. Conversely, resistance levels indicate prices where sellers emerge to halt upward momentum, establishing a “ceiling” that impedes the market’s ascent. These levels act as pivotal zones where the balance of power between bulls and bears is put to the test.

Historical Roots and Significance

The concept of support and resistance has stood the test of time, originating in the 19th century with the Dow Theory, a cornerstone of technical analysis. These levels are not mere technical constructs but reflect real-world market dynamics. Support levels often coincide with areas where large orders have been placed to buy or defend a specific price, while resistance levels may indicate the presence of formidable sellers keen on taking profits. By identifying these pivotal points, traders can anticipate price reversals and position themselves accordingly.

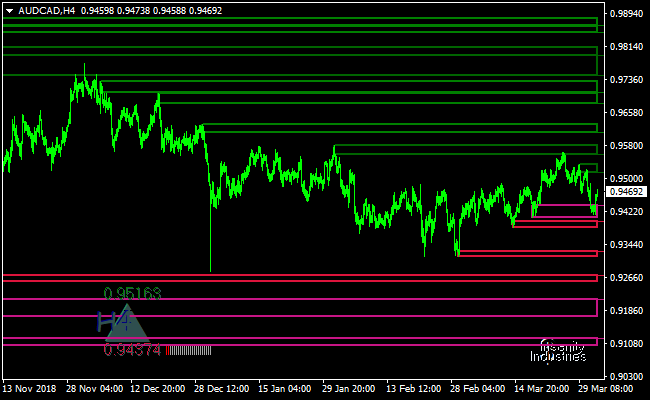

Identifying Support and Resistance Levels

The art of identifying support and resistance levels lies in analyzing historical price data. Horizontal lines are typically drawn across price charts, connecting previous highs and lows that have been respected by the market multiple times. Common charting patterns, such as double tops and double bottoms, can also serve as visual cues to pinpoint potential support and resistance zones. By combining these methods, traders can develop a robust understanding of key market levels.

Image: easyforexpips.com

Trading with Support and Resistance

Equipped with the ability to identify support and resistance, traders can employ robust trading strategies. When the price approaches a support level, a buying opportunity may arise, as buyers are likely to step in and push the price higher. Conversely, when the price reaches a resistance level, selling positions may yield profitable outcomes as sellers emerge to take profits. Traders can also use support and resistance levels to set stop-loss and take-profit orders, managing risk and locking in gains while anticipating market reversals.

Case Study: A Support and Resistance Trading Example

Consider a hypothetical scenario where the EUR/USD currency pair is trading at 1.1200. Suppose traders identify a support level at 1.1150 and a resistance level at 1.1250. If the price falls towards 1.1150, traders can anticipate a potential buying opportunity, as buyers are likely to defend that support level. On the other hand, if the price rises towards 1.1250, selling positions may be warranted as sellers will likely emerge to protect that resistance level. By recognizing and trading with support and resistance, traders can increase their chances of success in navigating the forex market.

Best Forex Indicator Support And Resistance

Conclusion

Support and resistance levels hold immense significance in the forex trading arena. By embracing the concepts outlined in this comprehensive guide, you can unlock the potential of these pivotal zones and enhance your trading strategies. Remember, the key to success lies in diligent analysis, informed decision-making, and disciplined execution. Embrace the power of support and resistance and elevate your forex trading prowess to new heights.