In the ever-evolving world of global finance, foreign exchange rates play a pivotal role in facilitating international trade and investments. For individuals and businesses alike, securing the most favorable exchange rates can make a significant difference in their financial dealings. If you’re planning to exchange currencies in India, navigating the intricacies of the forex market can be daunting. That’s where this comprehensive guide comes in, empowering you with the knowledge and strategies to find the best forex exchange rates in India.

Image: forexeahft1.blogspot.com

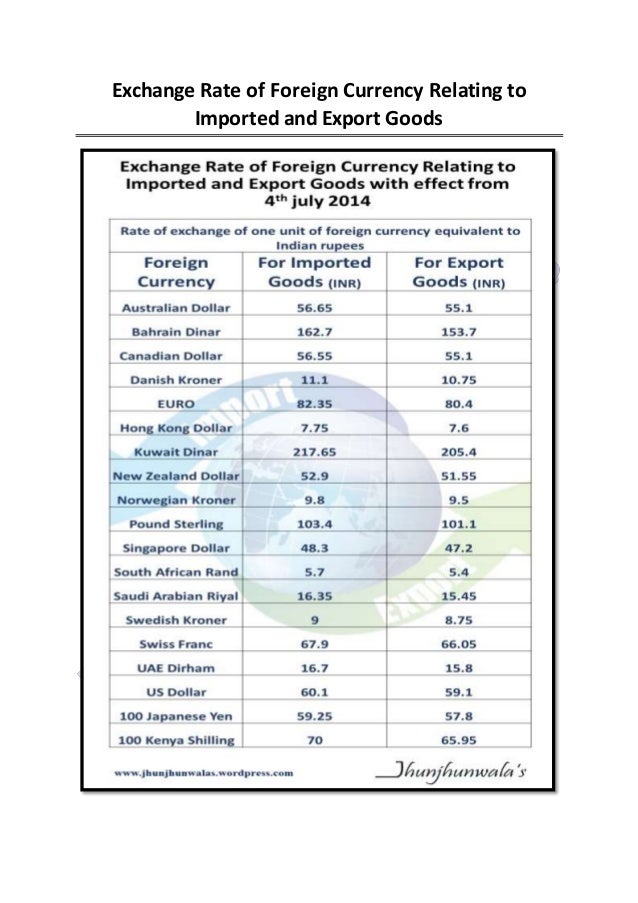

Understanding the dynamics of the forex market is crucial to unlocking the best exchange rates. Forex rates are constantly fluctuating based on various factors, including economic conditions, political events, and central bank policies. Real-time monitoring of these fluctuations is essential to seizing the most opportune moments for currency exchange. Additionally, it’s worth familiarizing yourself with the different types of exchange rates available, such as interbank rates, forward rates, and spot rates.

Finding the Best Forex Exchange Rates in India

With a plethora of forex service providers operating in India, finding the best exchange rates can be a challenge. To streamline this process, consider the following strategies:

- Compare Rates from Multiple Providers: Take the time to compare exchange rates offered by various banks, money changers, and online platforms. By shopping around, you can identify providers who offer competitive rates and minimize potential losses.

- Negotiate for Better Rates: Don’t hesitate to negotiate with forex providers, especially if you’re exchanging large sums of currency. By presenting yourself as an informed customer, you’re more likely to secure a more favorable exchange rate.

- Use Online Comparison Tools: Leverage the convenience of online comparison tools that allow you to compare exchange rates from multiple providers in real-time. These tools provide a quick and easy way to find the best available rates.

- Consider Specialist Forex Brokers: For frequent currency exchanges or large transactions, consider partnering with a specialist forex broker. Brokers have access to wholesale exchange rates and can often offer competitive rates compared to banks or money changers.

Factors to Influence Your Exchange Rate

In addition to comparing rates and negotiating with providers, several factors can influence the exchange rate you receive:

- Transaction Type: The type of transaction, such as a spot transaction or forward contract, can affect the exchange rate.

- Currency Pair: The exchange rate varies depending on the currency pair being traded. Some currency pairs are more popular and have tighter spreads, while others may have less liquidity and wider spreads.

- Transaction Size: The amount of currency being exchanged can also impact the exchange rate. Larger transactions may qualify for preferential rates.

- Market Volatility: Market volatility can lead to fluctuations in exchange rates. Keep an eye on market news and economic events that may affect currency values.

Legal and Regulatory Framework

In India, the foreign exchange market is regulated by the Reserve Bank of India (RBI). It’s essential to only deal with authorized forex dealers licensed by the RBI to ensure the authenticity and security of your transactions. The RBI has implemented regulations to protect consumers and maintain the stability of the forex market in India.

Image: www.livemint.com

Tips for Securing the Best Forex Exchange Rates in India

To maximize your chances of securing the best forex exchange rates in India, consider the following tips:

- Stay Informed: Monitor forex rates regularly to stay updated on market fluctuations and spot favorable exchange rates.

- Avoid Tourist Traps: Steer clear of money changers located in high-traffic tourist areas, as they often offer less favorable exchange rates to capitalize on uninformed travelers.

- Consider Online Transactions: Online forex platforms often provide competitive exchange rates compared to traditional brick-and-mortar providers.

- Look for Hidden Fees: Read the terms and conditions carefully before finalizing a transaction to avoid any hidden fees or charges that may erode your exchange rate.

- Plan Your Transactions: If possible, plan your currency exchanges in advance to avoid making impulsive decisions under pressure.

Best Forex Exchange Rate In India

Conclusion

Navigating the world of forex exchange rates in India can be a rewarding experience with the right knowledge and strategies. By comparing rates from multiple providers, understanding the factors that influence exchange rates, and staying informed about market conditions, you can secure the best possible exchange rates for your foreign exchange transactions. Remember to prioritize security by only dealing with authorized forex dealers regulated by the Reserve Bank of India. With the insights provided in this guide, you’re now empowered to make informed decisions and maximize the value of your foreign exchange transactions in India.