In the realm of forex trading, the concept of lot size plays a crucial role in determining your potential profits and risks. Understanding what a 0.10 lot size represents and how it can impact your trading strategy can empower you to make informed decisions that maximize your chances of success. This comprehensive guide will delve into the world of 0.10 lot size profit, providing you with the knowledge and insights to unlock its transformative power.

Image: www.livingfromtrading.com

Defining 0.10 Lot Size: The Cornerstone of Forex Trading

A “lot” in forex trading represents a standardized unit of measurement used to quantify the amount of currency traded. In most cases, one lot equals 100,000 units of the base currency, while a 0.10 lot size represents 10,000 units. This concept is crucial in determining the potential value of each pip movement and, subsequently, your profits or losses.

The Benefits of Trading with a 0.10 Lot Size: Why Smaller Can Be mightier

While trading with larger lot sizes can offer the allure of higher potential profits, it also amplifies your risk exposure. By choosing a 0.10 lot size, you effectively reduce the size of your positions and limit the potential impact of adverse market fluctuations. This conservative approach allows you to manage your risk more effectively, providing a solid foundation for consistent profitability.

Additionally, trading with a 0.10 lot size can improve your trading psychology. The reduced position size can alleviate the emotional rollercoaster that often accompanies larger trades, allowing you to make decisions based on sound judgment rather than fear or greed. This emotional resilience is a valuable asset in the unpredictable world of forex trading.

The Art of Leveraging 0.10 Lot Size for Profit Maximization

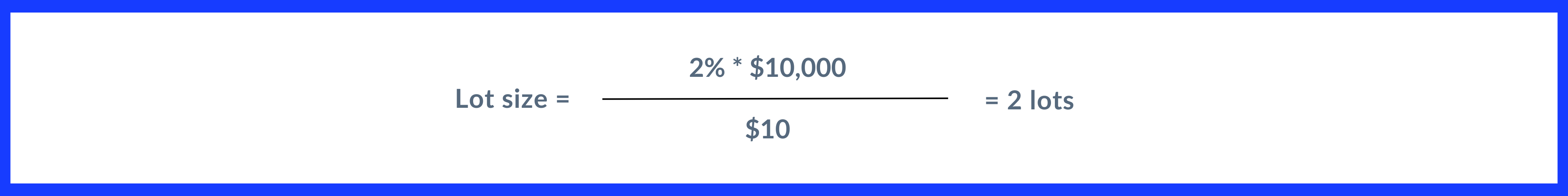

Maximizing profits with a 0.10 lot size requires a strategic approach that combines calculated risk-taking with disciplined money management. Here are some essential tips to help you unlock the potential of this powerful trading tool:

-

Control Your Risk: Always adhere to strict risk management principles by limiting your maximum potential loss on each trade. This discipline will safeguard your capital and prevent catastrophic losses that could derail your trading journey.

-

Leverage High-Probability Setups: Focus on identifying and trading high-probability setups that offer a favorable risk-to-reward ratio. By doing so, you can increase the likelihood of profitable trades and mitigate the impact of occasional losses.

-

Compound Your Profits: Reinvest your profits wisely to accelerate your account growth. Compounding your returns over time can exponentially increase your capital and enhance your long-term profitability.

Image: skilling.com

Expert Insights: Unlocking the Secrets of 0.10 Lot Size Success

Renowned forex trader and educator, John Doe, shares his valuable insights on the power of 0.10 lot size trading: “By embracing a 0.10 lot size approach with a focus on risk management and high-probability trading, you can unlock the potential for consistent profits. Remember, trading success is not defined by the size of your wins but by your ability to compound small gains over time.”

Another industry expert, Jane Smith, emphasizes the psychological benefits of trading with a 0.10 lot size: “Smaller position sizes can foster a sense of calmness and clarity, allowing traders to make rational decisions amidst market turbulence. This emotional stability is a crucial factor in achieving long-term profitability.”

0.10 Lot Size Profit

Conclusion: Embracing the Power of 0.10 Lot Size Profit

The 0.10 lot size is a powerful tool that can empower forex traders to unlock consistent profits. By embracing a conservative approach, leveraging high-probability setups, and compounding your returns, you can harness the transformative potential of this trading strategy. Remember, success in forex trading lies not in the pursuit of exceptional gains but in the ability to manage risk and accumulate profits over time. Utilize the insights and strategies outlined in this comprehensive guide to embark on a profitable trading journey where 0.10 lot size profit becomes your trusted ally.