Image: forextradingdemo1.blogspot.com

In the dynamic arena of forex trading, traders constantly seek the upper hand to navigate market volatility with precision. Understanding the concepts of resistance and support levels is paramount for successful charting and strategic decision-making. This in-depth guide will delve into the intricacies of daily forex resistance and support levels, empowering traders with invaluable knowledge to enhance their trading outcomes.

What are Resistance and Support Levels in Forex Trading?

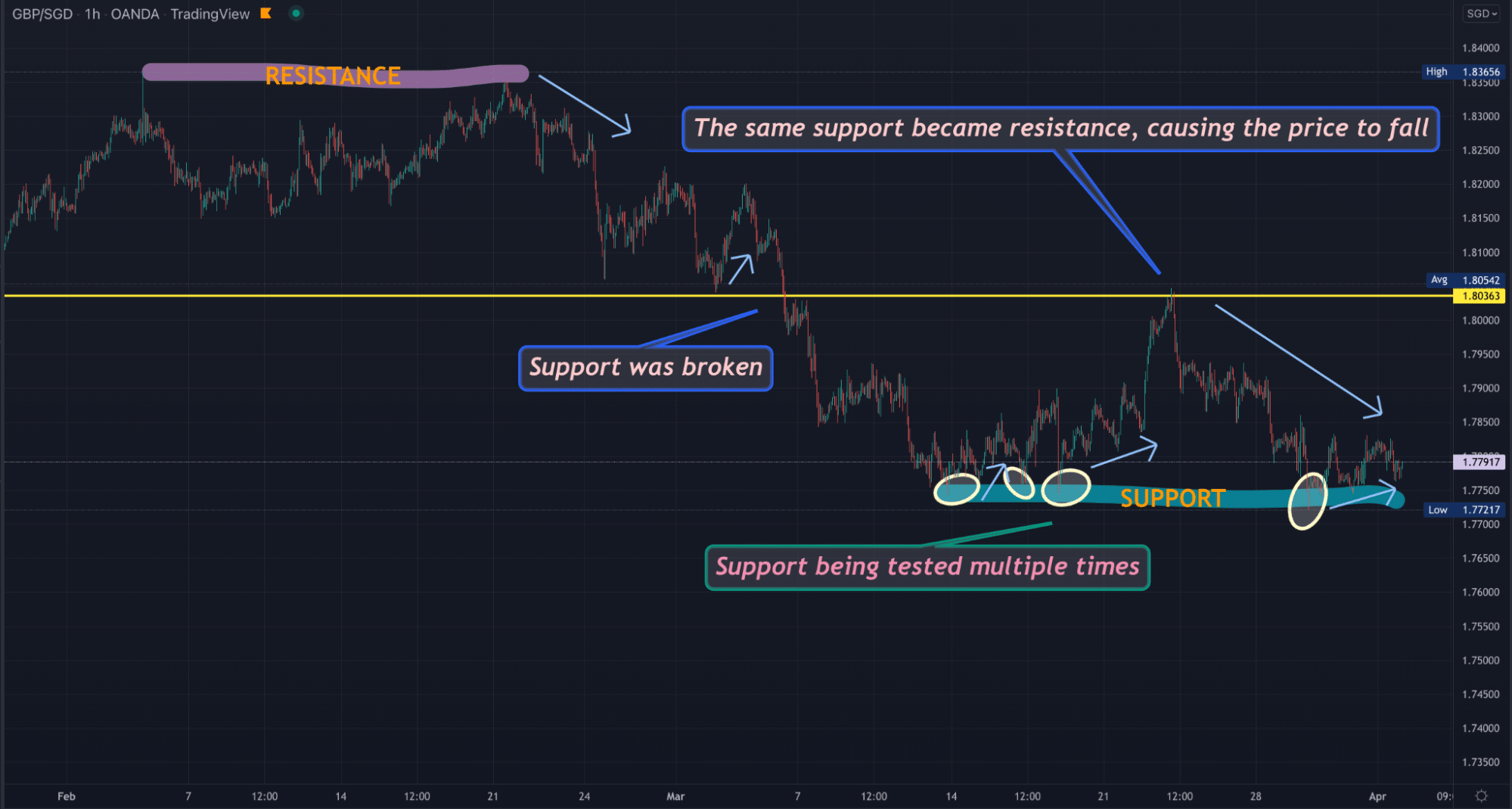

In forex, resistance levels represent price points at which an uptrending market is likely to encounter obstacles or selling pressure, leading to a reversal or stagnation in price movement. Conversely, support levels indicate price points where a downtrending market is likely to find buyers, resulting in a rally or halt in the decline. These levels serve as crucial indicators of market sentiment, helping traders anticipate potential turning points.

The Importance of Identifying Daily Resistance and Support

Identifying daily resistance and support levels is a fundamental aspect of technical analysis for forex traders. It enables them to:

-

Recognize Market Trends: Establishing these levels helps traders gauge the overall direction of the market, providing insights into the balance between buyers and sellers.

-

Predict Price Movements: By identifying key support and resistance zones, traders can anticipate potential price reversals, allowing them to adjust their positions accordingly.

-

Set Stop-Loss and Take-Profit Orders: These levels serve as strategic markers for setting stop-loss orders to minimize losses and take-profit orders to secure gains.

-

Enhance Risk Management: Understanding support and resistance levels empowers traders with the knowledge to minimize risks by avoiding trades within uncertain zones and capitalize on opportunities with higher probabilities of success.

Methods for Identifying Daily Resistance and Support in Forex

Numerous methods are employed by traders to identify daily resistance and support levels, including:

-

Historical Price Action: Examining past price charts, traders can identify areas where the market has consistently reversed course or found support.

-

Moving Averages: These indicators, such as the 200-day moving average, can act as dynamic resistance or support zones.

-

Fibonacci Retracement Levels: Fibonacci ratios can be applied to identify potential retracement areas within ongoing trends, highlighting potential support and resistance zones.

-

Trendlines: These lines connect past price highs and lows, indicating the direction of the trend and potential areas of reversal.

-

Pivot Points: Calculated based on prior day’s trading range, pivot points can provide insights into potential resistance and support levels.

Image: forextraders.guide

Trading Strategies Based on Resistance and Support

Armed with the knowledge of resistance and support levels, traders can implement various strategies to enhance their trading outcomes:

-

Bounce Trading: This strategy involves buying at support levels and selling at resistance levels, capturing profits within specific trading ranges.

-

Range Trading: Traders can identify the boundaries of a trading range using resistance and support to exploit the price fluctuations within that range.

-

Breakout Trading: Identifying and trading on breakouts above resistance or below support can yield significant profits if successful.

-

Trend Continuation Trading: Resistance and support levels can help traders identify opportunities to trade in line with established trends, targeting higher-probability trades.

Best Daily Forex Resistance And Support Levels

Conclusion

Understanding daily forex resistance and support levels empowers traders with invaluable insights into market dynamics. By embracing the concepts and techniques outlined in this guide, traders can make informed trading decisions, navigate market volatility with greater confidence, and unlock the potential for increased profitability. Whether you are a seasoned trader or just starting out, incorporating resistance and support analysis into your trading repertoire is a surefire way to elevate your technical analysis skills and enhance your trading success. So, embrace the knowledge and seize the opportunities that daily resistance and support levels present in the ever-evolving forex market.