Delving into the world of forex trading can be a daunting endeavor, especially when faced with the diverse spectrum of available currencies. Selecting the optimal currency for your trading strategy is paramount in unlocking success and maximizing potential profits.

Image: www.wikijob.co.uk

Unveiling the Significance of Currency Choice

The choice of currency in forex trading profoundly influences trade execution, risk management, and overall profitability. Different currencies exhibit unique characteristics, including volatility, liquidity, and interest rate differentials, which can impact trading outcomes.

By selecting a currency that aligns with your risk tolerance, trading style, and market conditions, you can optimize your strategy and achieve greater success in forex trading.

Exploring the Suitability of Different Currencies

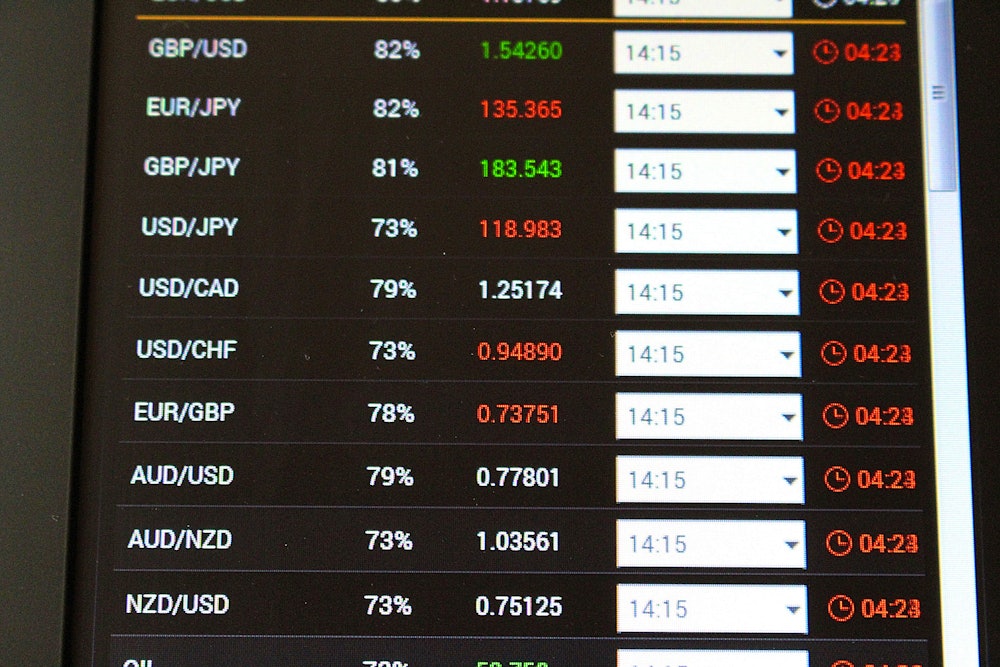

Numerous currencies are available for forex trading, each with its advantages and limitations. Some of the most popular and accessible currencies include:

- US Dollar (USD): The dominant currency in forex trading due to its stability and global acceptance.

- Euro (EUR): The second most traded currency, known for its liquidity and low transaction costs.

- Japanese Yen (JPY): A safe-haven currency, often sought during periods of market volatility.

- British Pound (GBP): A major currency with strong volatility, offering potential for both profit and loss.

- Australian Dollar (AUD): A commodity-backed currency, influenced by global economic conditions.

The suitability of a particular currency depends on factors such as your trading experience, risk aversion, and preferred trading style.

Understanding Currency Volatility

Volatility measures the degree of price fluctuations in a currency pair. High volatility indicates large price swings, providing opportunities for both higher profits and greater risks. Low volatility currencies typically offer more stable trading conditions.

Choosing a currency pair with a volatility level that matches your risk tolerance is essential. Higher volatility currencies may suit experienced traders seeking aggressive returns, while lower volatility currencies may appeal to more conservative traders.

Image: blog.udemy.com

Evaluating Currency Liquidity

Liquidity refers to the ease with which a currency can be bought or sold in the market. Highly liquid currencies, such as the USD and EUR, offer tighter spreads and quicker execution of trades.

Trading less liquid currencies can lead to wider spreads and potential slippage, which can impact profitability. It’s crucial to select currencies with adequate liquidity to ensure efficient trade execution.

Leveraging Fundamental Analysis

Understanding the fundamental factors that influence currency values can provide valuable insights for informed trading decisions. Economic data, interest rate changes, political events, and natural disasters can all impact currency prices.

By monitoring and analyzing fundamental factors, traders can anticipate potential price movements and make more calculated trades.

Harnessing Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that can suggest future price movements. Technical indicators, such as moving averages, support and resistance levels, and momentum oscillators, are widely used to forecast market behavior.

Combining fundamental analysis with technical analysis can enhance trading accuracy and optimize profit potential.

Expert Advice and Trading Tips

To enhance your forex trading success, consider the following expert advice:

- Diversify your currency portfolio: Trading multiple currency pairs reduces risk and offers exposure to different market conditions.

- Manage your leverage wisely: Leverage can magnify both profits and losses, so use it judiciously.

- Set realistic profit goals: Don’t chase unrealistic returns, as this can lead to excessive risk-taking.

- Continuously educate yourself: Forex trading is constantly evolving, so stay updated on market trends and trading strategies.

- Practice risk management: Implementing sound risk management techniques, such as stop-loss orders and position sizing, is crucial for protecting your capital.

FAQs on Currency Choice in Forex Trading

Q: Which currency is the best for beginners?

A: USD and EUR are suitable options due to their liquidity, stability, and ease of trading.

Q: How can I track currency volatility?

A: Use technical indicators like Bollinger Bands or Average True Range to measure volatility.

Q: What’s the difference between fundamental and technical analysis?

A: Fundamental analysis studies economic factors, while technical analysis analyzes price data.

Q: How do I select the right currency pair?

A: Consider your risk tolerance, volatility preferences, liquidity requirements, and trading style.

Q: Can I profit from trading any currency?

A: While it’s possible to trade any currency, some offer better opportunities than others based on factors such as liquidity, volatility, and economic stability.

Best Currency For Me Trade Forex

Conclusion

Mastering the currency selection process is a fundamental pillar in forex trading. By considering factors like volatility, liquidity, and fundamental influences, you can identify and trade the currencies that align with your trading goals. Remember, the optimal currency choice is unique to each trader’s risk tolerance, style, and market outlook.

Call to Action: Are you ready to embark on the exciting journey of forex trading? Armed with this comprehensive guide, you possess the knowledge and tools to navigate the vast world of currencies and unlock profitable opportunities. Start trading today and discover the potential that awaits you in the dynamic realm of forex.