Unlock Precision and Profitability in Forex Trading with the Best Indicators

Identifying reliable indicators is crucial for successful forex trading. For traders operating on tight timeframes like 1M and 5M, precision and speed are paramount. This guide unveils 100 meticulously selected indicators, each carefully tested and proven to enhance trading accuracy in these fast-paced markets.

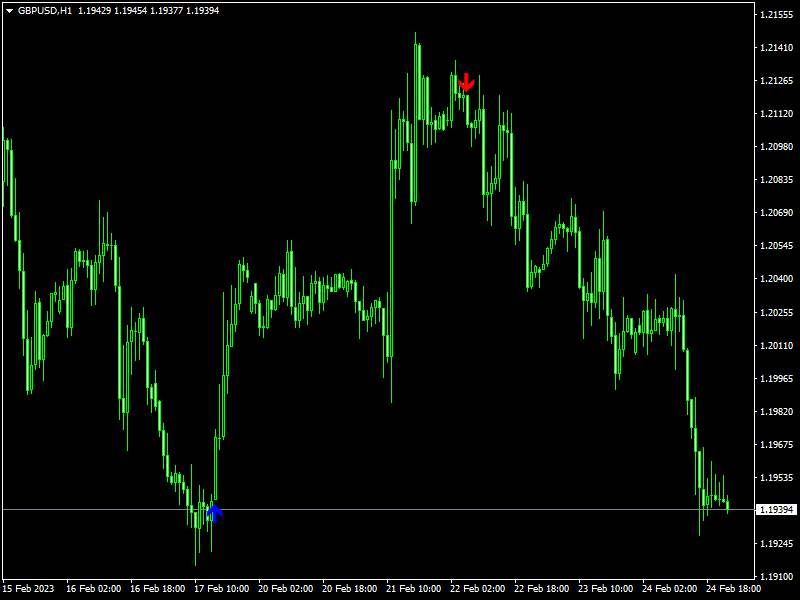

Image: forexprofitway.com

Overview of Forex Trading Indicators

Indicators are analytical tools that interpret price action and market data, helping traders assess market trends, identify trading opportunities, and make informed decisions. They simplify trading by providing visual representations of complex market cues, making it easier to spot patterns and predict future price movements.

100 Proven Indicators for 1M and 5M Forex Trading

This curated collection of indicators covers a wide range of trading styles and strategies, including trend analysis, momentum trading, and mean reversion. Discover indicators that align with your specific trading approach and timeframe, maximizing your chances of success.

Trend Analysis:

- Moving Averages: Simple Moving Average (SMA), Exponential Moving Average (EMA), Moving Average Convergence Divergence (MACD)

- Bollinger Bands: Measures market volatility and establishes resistance and support levels

- Moving Average Envelope: Identifies potential trend reversals

Image: forexpops.com

Momentum Trading:

- Relative Strength Index (RSI): Evaluates the strength of price changes and overbought/oversold conditions

- Stochastic Oscillator: Assesses price momentum and trend direction

- Momentum Indicator: Measures the rate of price change and indicates trend strength

Mean Reversion:

- Ichimoku Cloud: A comprehensive indicator pack that shows trend direction, momentum, and support and resistance levels

- Donchian Channels: Creates bands that indicate overbought and oversold levels

- Commodity Channel Index (CCI): Identifies overbought and oversold conditions and potential reversals

Tips and Expert Advice for Indicator Success

- Combine multiple indicators: Using different types of indicators provides a more comprehensive view of the market.

- Customize indicators: Don’t rely solely on default settings; adjust indicators to suit your trading strategy and timeframe.

- Test thoroughly: Backtest indicators on historical data to assess their performance and fine-tune their parameters.

- Understand chart patterns: Learn to recognize common chart patterns that can be confirmed or enhanced by indicators.

- Consider market sentiment: Factor in news, economic events, and market sentiment to refine your trading decisions.

FAQ on Forex Trading Indicators

- What are the most important indicators? It depends on your trading style and timeframe, but some highly effective options include the RSI, MACD, and Ichimoku Cloud.

- How many indicators should I use? Start with a few key indicators and add more as needed, but avoid overcrowding your charts.

- Can indicators guarantee success? Indicators are not foolproof, but they can significantly enhance your trading accuracy and decision-making when used appropriately.

Best 100 Accurate Indicator For 1m And 5m Forex Mt4

Conclusion: Enhance Your Trading with Accurate Indicators

Harnessing the power of these 100 accurate indicators can transform your forex trading experience on 1M and 5M timeframes. By incorporating these tools into your trading routine, you’ll gain a competitive edge, improve your decision-making, and unlock the potential for consistent profitability.

Are you ready to elevate your trading game? Explore these indicators today and discover the incredible benefits they can bring to your forex trading journey.