In the realm of international travel and transactions, navigating currency exchange can be daunting. Axis Bank offers a solution tailored to the needs of globetrotters with its Forex Card, a secure and convenient way to manage your finances abroad.

Image: cred.club

Global Acceptance and Competitive Rates

Axis Bank Forex Card empowers you with global acceptance, enabling you to make purchases and withdraw cash in over 200 countries. The card is electronically linked to your linked bank account, ensuring seamless access to your funds. Moreover, Axis Bank offers competitive exchange rates to reduce transaction costs and maximize savings.

Safety and Security

Your financial security is paramount. Axis Bank Forex Card is equipped with advanced security features to protect against fraud and unauthorized access. Chip and PIN technology ensures secure payments, while 24/7 emergency assistance provides peace of mind in case of card loss or theft.

Cashless Convenience

Bid farewell to the hassles of carrying bulky cash overseas. Axis Bank Forex Card eliminates the need for currency conversion and counting. Simply swipe or insert your card to make payments, enjoying the convenience of cashless transactions.

Image: www.paisabazaar.com

Tax Benefits

For individuals and businesses, Axis Bank Forex Card offers tax benefits. Transactions made using the card can be tracked, providing documentation for expense reimbursements or tax deductions. This traceability eliminates the need for manual record-keeping and simplifies tax management.

Convenience and Value

Using an Axis Bank Forex Card offers a suite of conveniences that enhance your travel experience. You can access real-time exchange rates through online or mobile platforms, reload your card effortlessly, and set spending limits to manage your expenses. The card also grants access to exclusive deals and discounts at partner merchants, delivering additional savings.

Expert Tips for Using Axis Bank Forex Card

To maximize the benefits of your Axis Bank Forex Card, follow these expert tips:

- Plan Ahead: Order your card well before your international trip to avoid any last-minute delays.

- Multiple Currencies: Load multiple currencies onto your card to protect against exchange rate fluctuations.

Frequently Asked Questions

Q: What is the daily withdrawal limit for Axis Bank Forex Card?

A: The daily withdrawal limit varies depending on your card type and account balance. Please contact Axis Bank for specific details.

Q: Are there any fees associated with using the Forex Card?

A: Exchange rate charges and minimum transaction fees may apply. Verify these details with Axis Bank.

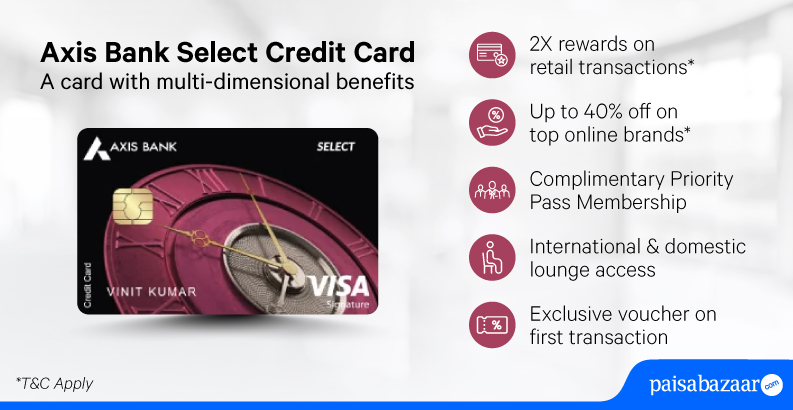

Benifit For Axis Bank Forex Card

Conclusion

In the dynamic world of international travel and finance, Axis Bank Forex Card is an indispensable tool. Its global acceptance, competitive rates, security, and convenience make it the ideal companion for seamless financial management overseas. Embrace the benefits of this remarkable card and unlock a world of financial freedom on your next global adventure.

Are you ready to explore the benefits of the Axis Bank Forex Card and elevate your international financial experience? Visit their website or contact your nearest branch today!