Unveiling the Advantages of a Student Forex Card

As a student venturing into the limitless opportunities abroad, navigating the complexities of foreign exchange can be daunting. A student forex card provides a solution, opening doors to a wealth of benefits that empower you financially and simplify your international endeavors.

Image: onlinestudy.guru

Embark on a Cost-Effective Adventure

- Reduced Transaction Fees: Compared to traditional methods, student forex cards offer significantly lower transaction fees, allowing you to save more on every exchange.

- Favorable Exchange Rates: Forex cards provide competitive exchange rates, ensuring you get the most value for your money when converting currencies.

- Ease of Payment: Eliminate the hassle of carrying large amounts of cash or exchanging currencies at inconvenient rates. Simply use your card for seamless transactions and online purchases.

Enhanced Security and Parental Control

- Safe and Secure: Student forex cards incorporate robust security features, protecting your funds from theft or fraud.

- Parental Control: Many cards offer parental controls, enabling guardians to monitor spending, set limits, and ensure responsible financial management.

- Multi-Currency Support: Forex cards typically support multiple currencies, allowing you to manage your finances in various countries with ease.

Convenience and Flexibility

- Instant Access: Upon activation, student forex cards provide instant access to your funds, maximizing convenience during emergencies or unexpected expenses.

- Emergency Assistance: Forex card providers often offer emergency assistance, providing support and guidance in case of lost cards or other emergencies abroad.

- Easy Top-Up: Reload your card conveniently through online portals or designated partner locations, ensuring you never run out of funds.

Image: leverageedu.com

Uncovering the Latest Trends and Developments

- Mobile Integration: Student forex cards are increasingly integrated with mobile apps, allowing you to monitor your finances, track expenses, and reload your card on the go.

- Biometric Security: Advanced cards feature biometric security measures such as fingerprint or facial recognition, enhancing security and eliminating the need for PINs.

- Forex Market Analysis Tools: Some forex cards offer access to online trading platforms, providing students with real-time insights into currency markets.

Expert Tips and Advice

- Compare Multiple Providers: Research various student forex card providers to find the one that offers the best combination of fees, features, and security.

- Estimate Your Expenses: Calculate your expected expenses to determine the appropriate amount to load onto your card before traveling.

- Monitor Currency Fluctuations: Stay informed about currency exchange rates to take advantage of favorable rates and minimize losses.

Frequently Asked Questions (FAQ)

-

Q: Can I use a student forex card for ATM withdrawals?

-

- A: Yes, most student forex cards allow ATM withdrawals, but fees may apply.

-

Q: Is there an age limit for obtaining a student forex card?

-

- A: Student forex card eligibility requirements may vary from provider to provider, but most cards are available to students over the age of 18.

-

Q: How do I reload my student forex card?

-

- A: Reloading options typically include online portals, bank transfers, and designated partner locations.

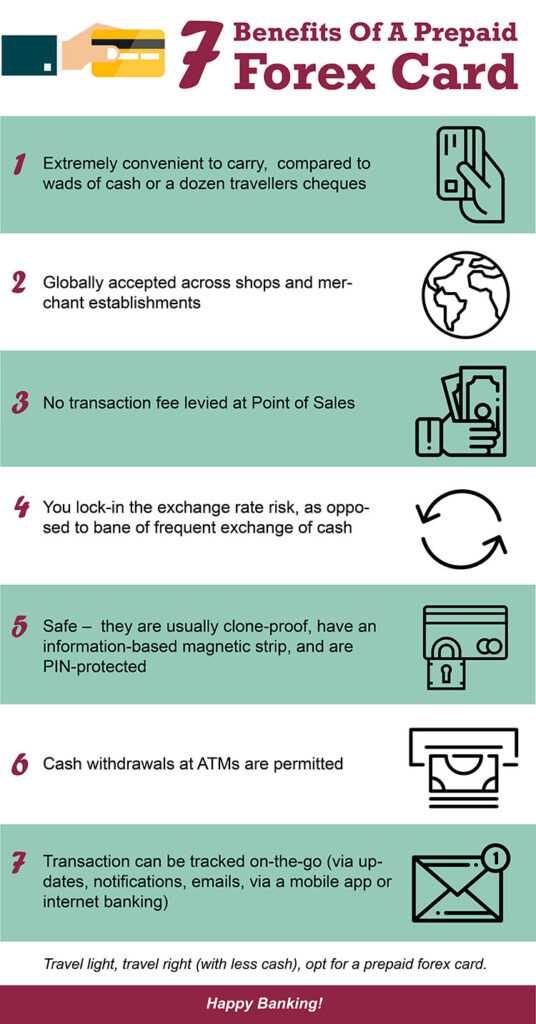

Benefits Of Student Forex Card

Conclusion

A student forex card is an indispensable financial tool that empowers students pursuing international education. By unlocking the benefits of reduced fees, secure transactions, parental control, and convenience, forex cards simplify the complexities of foreign exchange, allowing you to focus on your studies and make the most of your time abroad.

Are you a student looking to navigate the challenges of foreign exchange while pursuing your education overseas? Then, it’s time to unleash the power of a student forex card!