As I ventured into the realm of international travel, I was faced with a daunting challenge: managing my finances seamlessly. I had heard whispers of a magical instrument, a forex card, that promised to alleviate the woes of currency exchange and hefty bank fees. Intrigued, I embarked on a quest to uncover its secrets, and I was not disappointed. Prepare yourself to delve into the extraordinary world of forex cards and witness how they can revolutionize your financial adventures abroad.

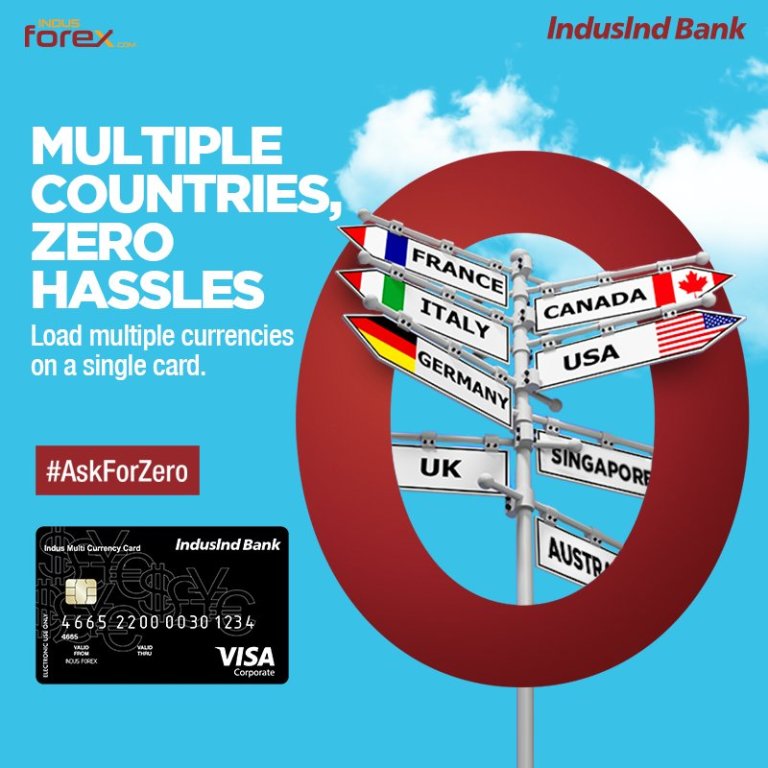

Image: onlineforexcard.wordpress.com

Empowering Travelers: A Gateway to Convenience

A forex card is a prepaid, multicurrency card that empowers you with unprecedented convenience. Unlike traditional credit or debit cards, forex cards allow you to load multiple currencies onto a single card, eliminating the need to carry wads of cash or worry about multiple exchange rates. With a forex card in hand, you can forget about hidden fees and exchange rate fluctuations that can eat into your travel budget. It’s your key to unlocking a world where financial transactions are swift, secure, and effortlessly convenient.

Navigating the Dynamic World of Forex:

The world of forex is constantly evolving, geprägt by economic and political factors. To stay abreast of the latest trends and developments, consider these insights:

- Stay Updated with Forex News: Monitor reputable news sources, financial blogs, and online forums to keep your finger on the pulse of market movements and economic events that impact currency exchange rates.

- Utilize Currency Conversion Tools: Leverage the countless online tools and mobile apps that provide real-time currency conversion and rate tracking. This will equip you with the knowledge to make informed financial decisions when using your forex card.

- Embrace the Power of Social Media: Join online communities and follow financial experts on social media platforms. These channels offer valuable insights, opinions, and updates on the forex market.

Beyond Exchange Rates: Unveiling the Savings and Rewards

The benefits of forex cards extend far beyond convenient currency conversions. Many providers offer exclusive rewards and savings that can significantly enhance your travel experience:

- Enjoy Lucrative Currency Exchange Rates: Forex cards often offer competitive exchange rates, allowing you to stretch your travel budget further. Compare rates from different providers to secure the most favorable rates.

- Accumulate Reward Points: Some forex cards come with reward programs that allow you to earn points or cash back on every transaction. These rewards can add up over time, providing you with additional savings or perks.

- Access Exclusive Travel Discounts: Certain forex card providers partner with travel agencies and merchants to offer exclusive discounts on flights, accommodation, and other travel-related services.

Image: www.thebusinessguardians.com

Enhancing Your Financial Security

Forex cards prioritize your financial security, providing peace of mind during your travels:

- Safeguard Your Assets: Forex cards are protected by robust security measures, including chip-and-PIN technology, fraud detection systems, and purchase limits. In case of loss or theft, you can swiftly block the card to prevent unauthorized usage.

- Avoid Fraudulent Transactions: Forex cards utilize advanced fraud detection algorithms to identify and block suspicious transactions, ensuring that your funds remain secure.

- Protect Against Unforeseen Events: Forex cards can be linked to your bank account, providing a convenient way to access emergency funds should the need arise.

Häufig gestellte Fragen (FAQs)

Let’s delve into some frequently asked questions to provide you with a comprehensive understanding of forex cards:

1. How does a forex card differ from a regular credit card?

Unlike credit cards that allow you to borrow money, forex cards are prepaid, meaning you load funds onto the card before using it.

Forex cards offer the advantage of locking in exchange rates, avoiding the fluctuations associated with credit cards.

2. Are there any fees associated with forex cards?

Forex cards typically come with minimal fees, which vary depending on the provider.

Some cards may charge a small activation fee or a foreign transaction fee.

It’s essential to compare the fees charged by different providers before selecting a forex card.

3. Can I use my forex card worldwide?

Yes, forex cards are accepted globally at millions of ATMs and merchant locations that support the card network associated with the card.

This makes them an ideal solution for travelers who frequently visit multiple countries.

Benefits Of A Forex Card

Conclusion: Unlock the Power of Financial Freedom When You Travel

If you’re an avid traveler or regularly conduct international business, a forex card is an indispensable tool. Its convenience, cost savings, security features, and rewards make it the perfect companion for your financial adventures. Embrace the power of forex cards and unlock a world of effortless financial management abroad. Remember, knowledge is power, so stay informed about market trends and make wise financial decisions using the insights we’ve shared.

Are you ready to revolutionize your travel finances and experience the unparalleled benefits of a forex card? Embark on your financial journey today and unlock the world of possibilities.