In the dynamic world of foreign exchange (forex) trading, every transaction involves two currencies: the base currency and the quote currency. Understanding these concepts is crucial for traders to navigate the forex market effectively. Let’s delve into their specifics and significance in this comprehensive guide.

Image: www.ig.com

Base Currency: Your Reference Point

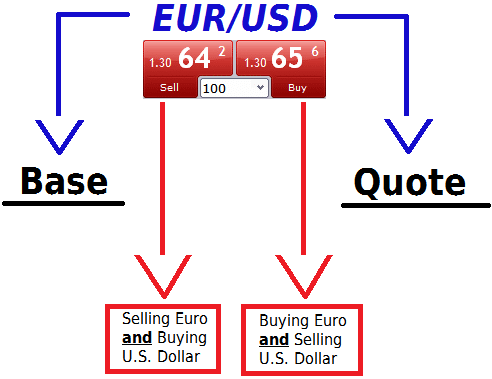

The base currency is the currency you are selling or buying. It is the foundation of the currency pair and remains unchanged throughout the trade. For instance, in the currency pair EUR/USD, the euro (EUR) acts as the base currency, while the US dollar (USD) represents the quote currency.

Quote Currency: The Exchange Rate Measure

The quote currency is the currency you are purchasing or selling in exchange for the base currency. Fluctuations in the quote currency’s value relative to the base currency dictate the exchange rate. Traders aim to predict these movements and profit from their accurate predictions.

Comprehensive Overview

The value of a currency pair is always expressed in the following format: 1 unit of base currency = X units of quote currency. This ratio, or exchange rate, determines how many units of the quote currency you will receive for each unit of the base currency.

When the base currency appreciates in value relative to the quote currency, the exchange rate rises, meaning you get more quote currency for each unit of base currency. Conversely, if the base currency depreciates, you receive less quote currency for the same unit.

Image: forexezy.com

Latest Trends and Developments

The forex market is constantly evolving, influenced by global economic news, central bank policies, and geopolitical events. Monitoring market sentiment and staying updated on forex trends is essential for successful trading.

Real-time news, economic indicators, and technical analysis tools can provide insights into potential currency value fluctuations. Active traders utilize these resources to make informed decisions and adjust their trading strategies accordingly.

Tips and Expert Advice

- Choose currency pairs that align with your risk tolerance and trading style.

- Understand the market spreads and commissions associated with each currency pair.

- Employ risk management techniques such as stop-loss orders and position sizing.

- Discipline and patience are key in forex trading, as quick gains can often lead to losses.

By incorporating these tips into your trading strategy, you can potentially mitigate risks and improve your overall trading performance.

Frequent Asked Questions

- Q: Which currencies are the most traded?

A: The major currency pairs, including EUR/USD, USD/JPY, GBP/USD, and USD/CHF, dominate the forex market due to their high liquidity and global significance. - Q: How are exchange rates determined?

A: Exchange rates are influenced by a combination of economic factors, such as interest rates, inflation, economic growth, and geopolitical events. - Q: How can I learn about forex trading?

A: Numerous online resources, courses, and books provide comprehensive information on forex trading and its nuances.

Base Currency And Quote Currency Forex Basics

Conclusion

Understanding the base and quote currencies is fundamental for successful forex trading. By grasping their relationship and staying informed about market trends, traders can make strategic decisions and potentially achieve profitability. Whether you are a seasoned trader or a curious newcomer, delving into the world of forex can unlock exciting opportunities and enhance your financial savvy.

Are you ready to embark on your forex trading journey? Dive deeper into this fascinating subject by exploring trusted educational resources and engaging with experienced traders. Remember, success in forex requires diligence, risk management, and a thirst for knowledge.