In the realm of global finance, where currencies ebb and flow like the tides, a crucial concept emerges: the bank forex ask and bid rate. Before diving into the intricate world of foreign exchange, let’s embark on a captivating journey that unveils the significance of these seemingly cryptic terms.

Image: www.zrivo.com

Imagine you’re planning a once-in-a-lifetime trip to the vibrant streets of Tokyo, Japan. As you meticulously plan your itinerary, you realize the imperative of exchanging your hard-earned currency into Japanese yen. This is where the enigma of forex rates comes to the forefront.

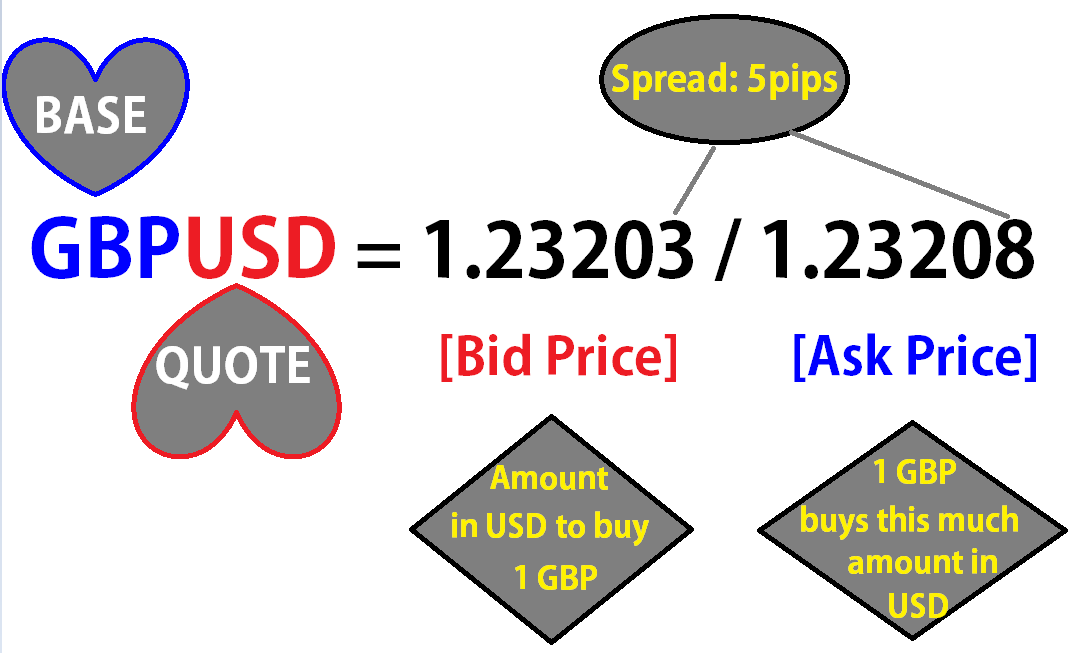

When you approach a bank or currency exchange, you’ll encounter two distinct rates: the ask rate and the bid rate. The ask rate represents the price at which the bank is willing to sell you Japanese yen, while the bid rate denotes the price at which the bank is prepared to buy Japanese yen from you.

Decoding the Ask and Bid Rates

The ask rate is perpetually higher than the bid rate, mirroring the inherent profit margin that banks employ to facilitate currency conversions. This spread between the ask and bid rates is known as the “pip,” a term commonly used in the forex market to quantify price fluctuations.

In our Tokyo expedition, let’s assume the ask rate for Japanese yen is 110.50, while the bid rate is 110.30. If you wish to convert $1,000 into Japanese yen, you’ll receive 110,300 yen at the bid rate. Conversely, if you’re offloading Japanese yen, you’ll receive $907.27 at the ask rate.

Navigating the Forex Landscape

Understanding the ask and bid rates is paramount in the forex market, a decentralized, electronic network where traders buy, sell, and speculate on the value of currencies from around the globe. Forex traders capitalize on the subtle fluctuations in currency exchange rates to generate profits.

The interplay of supply and demand governs the movement of forex rates. When demand for a currency outstrips supply, its value rises, leading to a higher ask rate and a lower bid rate. Conversely, if supply outweighs demand, the currency’s value falls, resulting in a lower ask rate and a higher bid rate.

Expert Insights and Actionable Guidance

Master forex trading with these invaluable tips from seasoned experts:

-

Monitor economic news and events that can significantly impact currency values. Stay attuned to political changes, interest rate decisions, and economic data releases.

-

Employ technical analysis tools such as charts and indicators to identify potential trading opportunities. Study price patterns, moving averages, and support and resistance levels to make informed decisions.

-

Manage risk prudently. Employ stop-loss orders to minimize potential losses and utilize leverage cautiously, as it amplifies both profits and losses.

Image: howtotradeonforex.github.io

Bank Forex Ask And Bid Rate

Conclusion: Empowering Forex Navigation

Navigating the world of forex can be daunting initially, but armed with the knowledge of ask and bid rates, you can confidently venture into currency exchange and forex trading. Remember, understanding these fundamental concepts is key to making informed decisions and seizing trading opportunities wisely.

As you embark on your financial adventures, embrace the excitement of forex trading while exercising caution and prudence. Embrace the dynamic dance of forex rates, and may your investment endeavors bear fruitful returns.