In today’s globally connected business landscape, seamless financial transactions across borders are indispensable. For global travelers, business professionals, and anyone dealing with foreign currency, Axis Bank’s Multi Currency Forex Card stands as an invaluable tool in managing multiple currencies and optimizing currency exchange.

Image: forexscalpingmoneymanagement1.blogspot.com

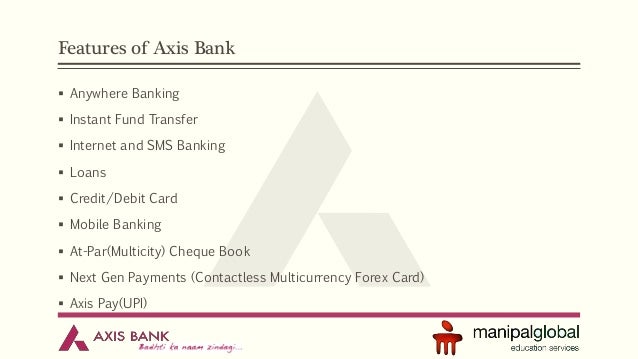

The Axis Bank Multi Currency Forex Card is a prepaid card that enables cardholders to load, store, and spend in up to 16 major currencies, including USD, EUR, GBP, JPY, and SGD. It offers unparalleled convenience and security when traveling or making purchases in foreign currencies, eliminating the need for carrying multiple cards or exchanging cash at unfavorable rates.

Advantages of Axis Bank’s Multi Currency Forex Card

1. Multi-Currency Convenience:

Load up to 16 currencies onto a single card, allowing you to switch between currencies effortlessly, saving time and hassle during international transactions.

2. No Hidden Charges:

Avoid costly transaction fees, markups, and hidden charges associated with other currency exchange methods. Enjoy real-time currency conversion at interbank rates.

3. Superior Exchange Rates:

Access competitive exchange rates directly from your mobile device or online portal, ensuring you get the best possible value for your money.

4. Integrated ATM Access:

Withdraw cash from ATMs globally, using the currency you need at the most convenient location. Access over 1 million ATMs worldwide without worrying about currency conversion hassles.

Easy Usage with ATM Transactions

1. ATM Withdrawal:

- Insert your Axis Bank Multi Currency Forex Card into the ATM.

- Select “Withdraw Cash.”

- Choose your preferred currency from those loaded on your card.

- Enter the amount you wish to withdraw, and the ATM will dispense cash in your chosen currency.

2. ATM Balance Inquiry:

- Insert your card into the ATM.

- Enter your PIN.

- Select “Balance Inquiry.”

- Review your available balance in each loaded currency.

Image: www.chargeplate.in

Axis Bank Multi Currency Forex Card Statement In Atm Machine

Tips for Optimal Usage

- Pre-load Currencies: Before your travel or transaction, load the necessary currencies onto your card to avoid last-minute exchange rate fluctuations.

- Monitor Exchange Rates: Stay updated with real-time exchange rates using Axis Bank’s convenient mobile app or online portal.

- Save on Large Transactions: For large foreign currency transactions, consider using your Axis Bank Multi Currency Forex Card instead of cash or credit cards to save on exchange rates and fees.

- Check ATM Fees: While Axis Bank does not charge ATM withdrawal fees, some ATMs may impose small fees. Check for ATM fees before making withdrawals.

Axis Bank’s Multi Currency Forex Card empowers you with financial flexibility and cost-effective currency management. Whether you’re a frequent traveler, a global business executive, or simply seeking convenience in foreign currency exchanges, this innovative card offers a convenient and cost-effective solution to all your multi-currency needs. Embrace a world of financial freedom with Axis Bank’s Multi Currency Forex Card today!