Are you contemplating an international transaction? Axis Bank, renowned for its innovative financial services, offers a convenient platform for forex transactions. To navigate the complexities of forex fees, let’s delve into the nitty-gritty of Axis Bank’s forex transaction charges.

Image: zeenews.india.com

When venturing into the realm of foreign exchange, it’s crucial to be well-informed about the associated costs. Understanding the fees involved in currency exchange empowers you to make calculated financial decisions. With Axis Bank, you can choose from various forex services, including online transactions, in-branch conversions, and foreign currency drafts.

Factors Influencing Forex Transaction Charges

Several factors impact the transaction charges imposed by Axis Bank on forex transactions. These include:

- Transaction Amount: The larger the transaction amount, the higher the charges.

- Currency Pair: Different currency pairs have varying transaction fees. Exotic currencies tend to have higher charges.

- Mode of Transaction: Online transactions typically attract lower charges compared to in-branch or draft transactions.

li>Account Type: Forex transaction charges may vary based on the type of account you hold with Axis Bank.

Detailed Explanation of Charges

Axis Bank typically charges a combination of service fees and currency conversion charges. The service fee varies based on the mode of transaction and ranges from INR 50 to INR 500. Additionally, a currency conversion spread is applied, which represents the difference between the buy and sell rates of the currencies involved.

For instance, if you wish to convert INR 100,000 into US Dollars, you would need to pay a service fee of INR 100 (assuming an online transaction). Let’s say the buy rate of US Dollar is INR 69.50, and the sell rate is INR 69.75. The conversion spread would be INR 0.25 per US Dollar. Thus, you would receive approximately 1,435.78 US Dollars after deducting the service fee and currency conversion spread.

Tips to Minimize Forex Transaction Charges

To reduce forex transaction charges, consider the following tips:

- Choose online transactions: Online forex transactions generally have lower service fees compared to other modes.

- Opt for large transactions: Larger transaction amounts attract lower percentage-based charges.

- Monitor currency rates: Keep an eye on currency exchange rates to identify favorable times for currency conversions.

By implementing these strategies, you can optimize your forex transactions and minimize the impact of charges on your finances.

Image: cardinsider.com

FAQs on Axis Bank Forex Transaction Charges

- Q: What are the service fees charged by Axis Bank for forex transactions?

A: Service fees for online transactions range from INR 50 to INR 500, while in-branch and draft transactions may incur higher charges. - Q: What factors affect the currency conversion spread?

A: The currency conversion spread is determined by market demand and supply for the respective currencies. - Q: How can I check the live forex rates before making a transaction?

A: You can access real-time forex rates on the Axis Bank website or mobile banking app. - Q: Is there a minimum transaction amount for forex transactions with Axis Bank?

A: Yes, Axis Bank typically requires a minimum transaction amount of INR 5,000 for online transactions.

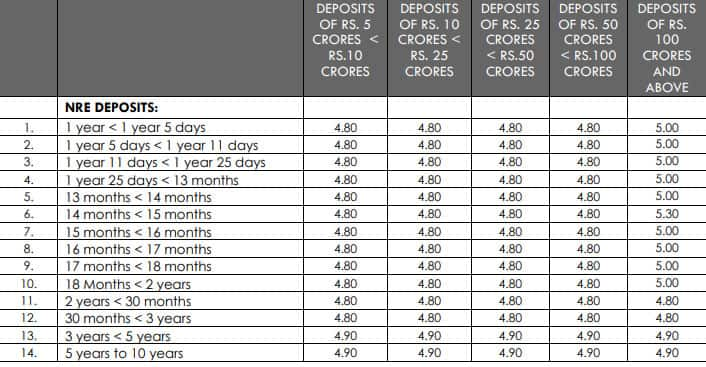

Axis Bank Forex Transaction Charges Details

Conclusion

Understanding Axis Bank’s forex transaction charges empowers you to make informed decisions and avoid unexpected expenses. By choosing the right mode of transaction, optimizing your transaction amount, and monitoring currency rates, you can minimize the impact of charges on your finances. If you have any further queries, feel free to reach out to Axis Bank’s customer support for assistance.

Are you interested in learning more about forex transactions and managing your currency conversion needs effectively? Stay tuned for future articles exploring these topics in greater depth.