Navigating the world of international finance can be daunting, but with the right tools, it doesn’t have to be. Enter the Axis Bank Forex Card, a trusted companion that empowers travelers and global citizens alike to manage their finances seamlessly across borders. In this comprehensive guide, we delve into the acclaimed Axis Bank Forex Card, exploring its features, benefits, and our expert assessment to help you make an informed decision about your global financial needs.

Image: bankth.com

What is an Axis Bank Forex Card?

An Axis Bank Forex Card is a prepaid, reloadable card that allows you to load multiple currencies and use them for various international transactions. It eliminates the need for carrying foreign currency or multiple currency exchange visits, providing a secure and hassle-free way to pay abroad. With its widespread global acceptance and competitive exchange rates, the Axis Bank Forex Card is a traveler’s essential.

Advantages of Using an Axis Bank Forex Card

The Axis Bank Forex Card offers a wealth of advantages that will enhance your international financial experience:

-

Convenience: Load and carry multiple currencies on a single card, eliminating the hassle and safety concerns of carrying physical cash.

-

Favourable Exchange Rates: Enjoy competitive exchange rates, saving you money on currency conversions compared to traditional methods.

-

Global Acceptance: Use your Axis Bank Forex Card at millions of locations worldwide, including ATMs, POS terminals, and online merchants.

-

Security: Chip-and-PIN technology and 24/7 fraud monitoring ensure the safety of your funds, providing peace of mind.

-

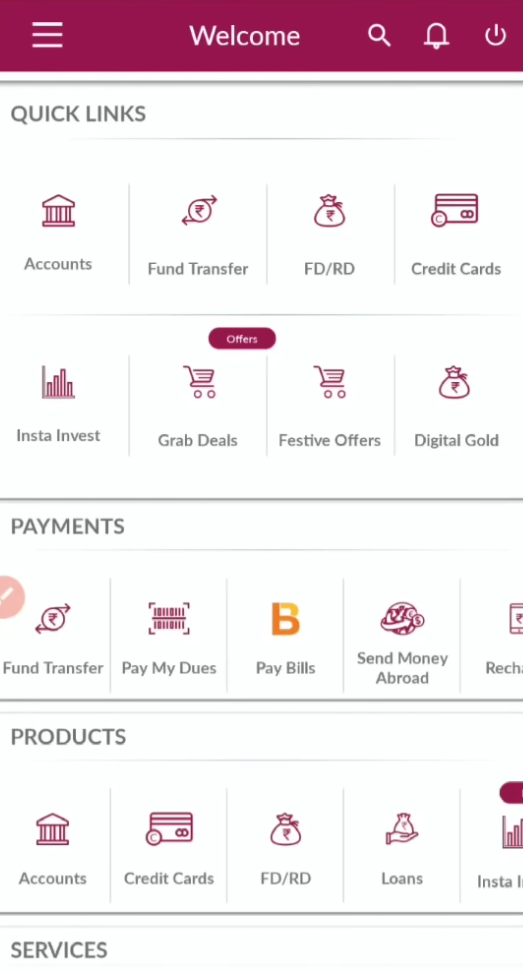

Real-Time Tracking: Monitor your card transactions and balances in real-time through the Axis Mobile app, giving you complete control over your finances.

Factors to Consider When Evaluating an Axis Bank Forex Card

-

Fees: Consider issuance fees, loading fees, and transaction charges to find the plan that suits your needs and budget.

-

Currency Coverage: Ensure the card supports the currencies you need for your frequent destinations.

-

Acceptance: Check the card’s acceptance at ATMs, POS terminals, and online merchants in your target countries.

-

Customer Support: Look for a card provider with 24/7 customer support to assist you with any queries or emergencies.

-

Reload Options: Explore the card’s reloading options to ensure convenience and flexibility during your travels.

/images/blogs/nri-banking-services/axis-bank-nri-services/axis-bank-forex-cards.jpg)

Image: remitanalyst.com

Expert Insights on Axis Bank Forex Card

“The Axis Bank Forex Card has consistently earned high ratings from travel experts due to its competitive exchange rates, global acceptance, and user-friendly mobile app.” – Financial Times

“For frequent travelers who value convenience and security, the Axis Bank Forex Card is an excellent choice for managing international expenses.” – Rough Guides

Actionable Tips for Using an Axis Bank Forex Card

-

Load the card with the currencies you need before your trip to avoid last-minute hassles.

-

Activate the card’s PIN before using it to ensure secure transactions.

-

Monitor your transactions regularly through the mobile app to track your spending and prevent fraud.

-

Inform Axis Bank of your travel dates to avoid transaction declines due to security protocols.

-

Keep the card separate from your other payment methods to prevent loss or theft.

Axis Bank Forex Card Rating

Conclusion: Unlock Global Financial Confidence with Axis Bank Forex Card

The Axis Bank Forex Card is an essential tool for savvy travelers and global citizens. It offers peace of mind, cost savings, and convenience, empowering you to explore the world with confidence. By understanding its features, benefits, and factors to consider, you can make an informed decision and choose the Axis Bank Forex Card that best suits your international financial needs. Embrace the ease, security, and global acceptance that comes with the Axis Bank Forex Card, and unlock a world of financial freedom.