Introduction: The Journey to Global Transactions

In today’s interconnected world, where international travel and business ventures have become commonplace, the need for a convenient and secure way to manage foreign exchange has never been greater. Axis Bank’s Forex Card emerges as a game-changer, empowering users with the flexibility to make global transactions with ease. However, before embarking on this journey, it’s crucial to understand the minimum balance requirement associated with this powerful financial tool.

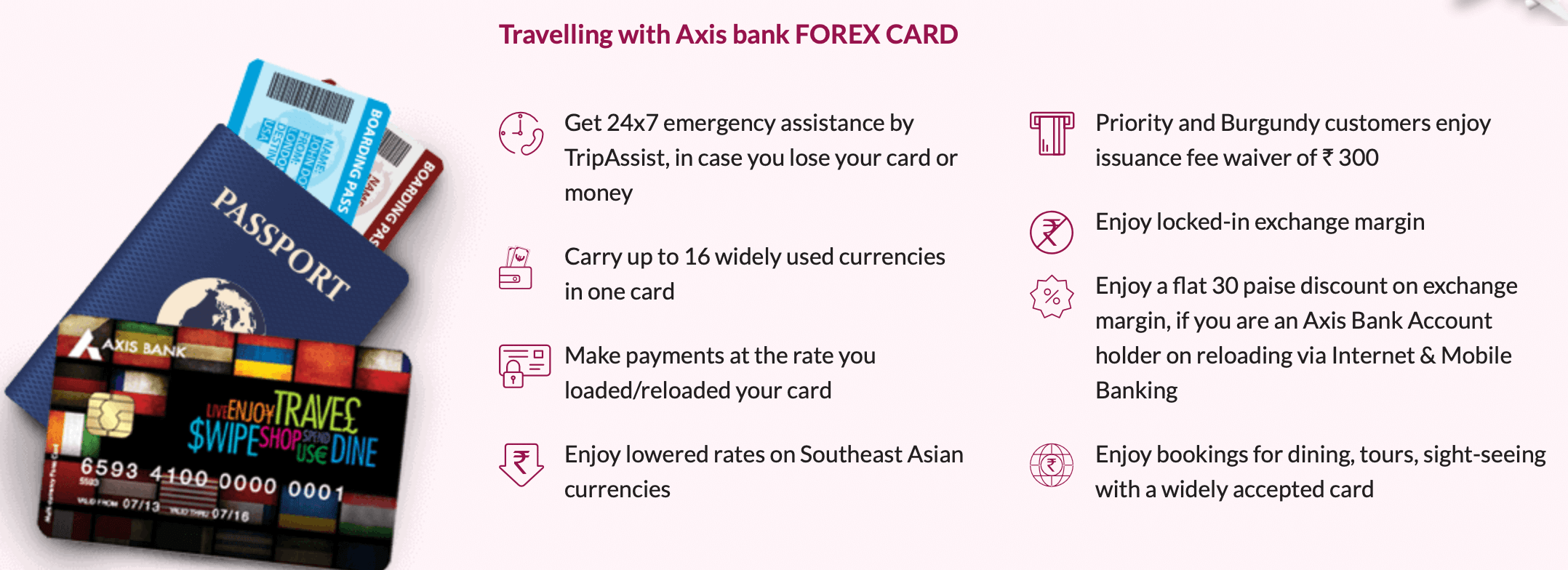

Image: forexenigmasystem.blogspot.com

Navigating the Forex Card Maze: Understanding the Minimum Balance

At the outset, it’s important to grasp the concept of a minimum balance in the context of a Forex Card. Simply put, it refers to the minimum amount of money that must be maintained in the linked account to keep the card active and functional. It serves as a safeguard to ensure that cardholders have sufficient funds to cover potential transactions and avoid any unforeseen financial setbacks. Axis Bank, like many other financial institutions, has established a specific minimum balance requirement for its Forex Card, which acts as the bedrock for its seamless operation.

Exploring Axis Bank’s Minimum Balance Guideline

To delve deeper into the specifics, Axis Bank has set a minimum balance requirement of INR 5,000 for its Forex Card. This benchmark serves as a financial threshold, ensuring that cardholders maintain a certain level of funds to facilitate their international transactions. By adhering to this requirement, users can avoid any potential inconvenience or disruption in their travel or business endeavors.

Why a Minimum Balance Matters: Uncovering the Significance

The minimum balance requirement may initially raise questions, but its significance lies in its multifaceted benefits. Firstly, it assists Axis Bank in managing risk and maintaining the integrity of its financial system. By enforcing a minimum balance, the bank can mitigate potential losses associated with fraudulent transactions or overspending. Secondly, it safeguards cardholders from overextending their financial capabilities, particularly when engaging in foreign exchange, which can involve significant currency fluctuations. The minimum balance acts as a buffer, preventing users from exceeding their predetermined financial limits.

Image: windsorwhock2002.blogspot.com

Consequences of Falling Short: Embracing Responsibility

While Axis Bank’s Forex Card offers numerous advantages, failing to maintain the minimum balance can result in certain consequences. In such cases, the bank may levy a penalty fee, which serves as a financial incentive for cardholders to adhere to the stipulated requirement. Additionally, the card’s functionality may be suspended, restricting access to essential financial services while traveling or conducting business abroad.

Axis Bank Forex Card Minimum Balance

Conclusion: A Balanced Approach to Global Transactions

In conclusion, Axis Bank’s Forex Card minimum balance requirement exists for a reason, providing a solid foundation for secure and convenient global transactions. Understanding the rationale behind this requirement empowers users to plan their financial strategy effectively, ensuring uninterrupted access to their foreign exchange needs. By maintaining the minimum balance, cardholders can confidently navigate international waters, whether for business or pleasure, without encountering any financial pitfalls. The Forex Card remains a valuable financial instrument, facilitating global transactions with ease, provided its terms and conditions are carefully observed. Embrace the power of this financial tool and embark on your international adventures with confidence, knowing that your financial footing is secure.