Overview: Your Gateway to Borderless Transactions

Traveling abroad can be an exhilarating experience, but managing your finances seamlessly is crucial. This is where the Axis Bank Forex Card comes into play, empowering you with convenient and secure access to your funds while exploring the world.

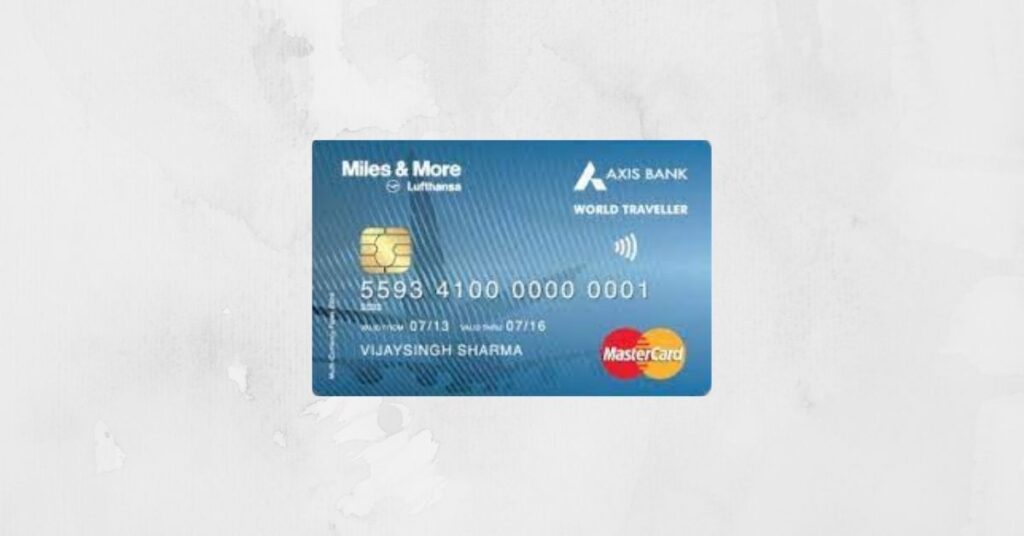

Image: fincards.in

Benefits and Features: Unlocking a World of Convenience

- Global Acceptance: Unleash the freedom to spend at millions of establishments worldwide, from swiping at retail stores to booking accommodations.

- Competitive Exchange Rates: Access favorable exchange rates compared to traditional methods, ensuring you get the most value for your money.

- Chip-and-PIN Security: Enjoy peace of mind knowing that your transactions are protected by advanced chip-and-PIN technology.

- Instant Blocking and Unblocking: Empower yourself to quickly block and unblock your card in case of loss or theft, safeguarding your funds.

- 24/7 Customer Service: Stay connected with round-the-clock customer support, ensuring assistance whenever and wherever you need it.

Eligibility and Application: Embark on a Convenient Journey

To apply for an Axis Bank Forex Card, you must be an Indian resident with a valid passport and a savings or current account with Axis Bank. The application process is straightforward, and you can submit your request online or at any Axis Bank branch.

Detailed Explanation: Understanding the Intricacies of the Forex Card

Function: The Axis Bank Forex Card acts as a prepaid, multi-currency travel companion that allows you to store funds in multiple foreign currencies. This eliminates the hassle of exchanging cash, providing convenience and peace of mind.

Currency Loading: The card can be loaded with up to 10 different currencies simultaneously, enabling you to switch seamlessly between them based on your travel destination.

Load Limits: The maximum load limit for the Forex Card varies depending on your account type and frequency of travel. Please contact Axis Bank for specific details.

Validity: The card has a validity of 4 years, providing ample time to plan and enjoy your travels.

Image: allaboutforexs.blogspot.com

Latest Trends and Updates: Staying Ahead in the Digital Age

Online Currency Monitoring: Access real-time currency rates online, allowing you to make informed decisions about when to load your Forex Card.

Mobile-Friendly Interface: Manage your card on the go with the Axis Mobile app, enabling quick access to account balances, transaction history, and card blocking.

Exclusive Travel Benefits: Leverage partnerships with leading travel providers to enjoy exclusive discounts and offers on flights, hotel bookings, and more.

Insider Tips and Expert Advice: Mastering Your Forex Journey

Pre-Travel Planning: Load your card with a sufficient amount of currency based on your estimated expenses and travel duration.

Monitor Exchange Rates: Stay updated on currency fluctuations to optimize your card loading strategy and avoid potential losses.

Carry a Small Amount of Cash: Despite the global acceptance of the Forex Card, it’s wise to carry a small amount of cash as a backup.

Secure Your Card: Remember to keep your Forex Card safe and secure, just like any other financial instrument. Report any suspicious transactions immediately.

Frequently Asked Questions: Clarifying Common Queries

Q: Can I use my Forex Card to withdraw cash?

A: Yes, you can withdraw cash from ATMs worldwide using your Forex Card. However, currency conversion charges and ATM fees may apply.

Q: What are the fees associated with using the Forex Card?

A: The Forex Card has minimal fees, including an issuance fee, transaction fee, and balance inquiry fee. Please contact Axis Bank for a detailed breakdown.

Q: Can I use my Forex Card after its validity expires?

A: No, the Forex Card expires 4 years after issuance. You will need to apply for a new card to continue using the service.

Axis Bank Forex Card Logi

Conclusion: Embracing a World of Seamless Travel

In today’s interconnected world, the Axis Bank Forex Card is an indispensable tool for travelers seeking convenience, security, and cost-effectiveness. By empowering you with the freedom to manage your finances abroad, this card unlocks a world of seamless travel experiences.

Whether you’re a seasoned globetrotter or embarking on your first adventure, the Axis Bank Forex Card is your trusted companion, ensuring you embrace every journey with confidence.

So, are you ready to embark on a world of seamless travel? Apply for your Axis Bank Forex Card today and let your financial worries fade away as you explore the globe with ease and tranquility.