In the ever-evolving global economy, navigating international transactions can often be a daunting task. However, with the Axis Bank Forex Card, you can embark on global adventures or manage business expenses effortlessly. This guide will delve into the intricacies of the Axis Bank Forex Card and its bank statement, empowering you with the knowledge to make informed decisions and maximize your financial experience.

Image: www.bankindia.org

Introducing the Axis Bank Forex Card: Your Gateway to Global Finance

The Axis Bank Forex Card is a prepaid card that allows you to access funds anywhere in the world, eliminating the need for bulky cash or the hassle of currency exchange. It offers a convenient and secure means of making international purchases, paying for travel expenses, or transferring funds overseas. By loading the card with multiple currencies, you can avoid fluctuating exchange rates and enjoy competitive rates.

Understanding Your Axis Bank Forex Card Bank Statement

Mehul, a seasoned traveler, recently returned from a thrilling expedition across Europe. Eager to reconcile his expenses, he logged into his Axis Bank account to access his Forex Card bank statement. The statement provided a detailed breakdown of his transactions, each meticulously listed with essential information.

Mehul discovered that the bank statement not only recorded his purchases but also displayed the exchange rates applicable to each transaction. This transparency gave him a clear understanding of the actual cost of his expenses, allowing him to budget accurately for future endeavors. Additionally, the statement facilitated the categorization of transactions by categories such as accommodation, dining, and transportation, enabling him to track spending patterns.

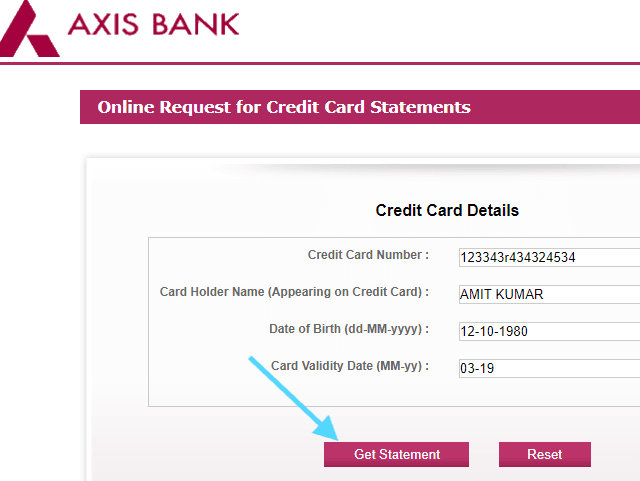

Navigating Your Bank Statement: A Step-by-Step Guide

Exploring your Axis Bank Forex Card bank statement is a simple and informative process. Here’s a step-by-step guide to help you navigate its intricacies:

-

Access Your Statement: Log in to your Axis Bank account, navigate to the “Card Services” tab, select “Forex Card,” and then click on “View Statements.”

-

Transaction History: The statement chronologically lists all your transactions, including the merchant name, transaction amount, transaction date, and currency conversion if applicable.

-

Foreign Currency Transactions: For each foreign currency transaction, the statement clearly indicates the exchange rate used and the actual amount deducted from your card.

-

Transaction Fees: Some transactions may incur additional fees, such as ATM withdrawal fees or currency conversion fees. These fees are separately listed in the statement.

-

Transaction Categorization: The statement categorizes transactions based on merchant types, making it easier to track expenses and identify spending trends.

-

Balance Information: The statement displays the current balance on your Forex Card, allowing you to monitor your spending and plan future transactions accordingly.

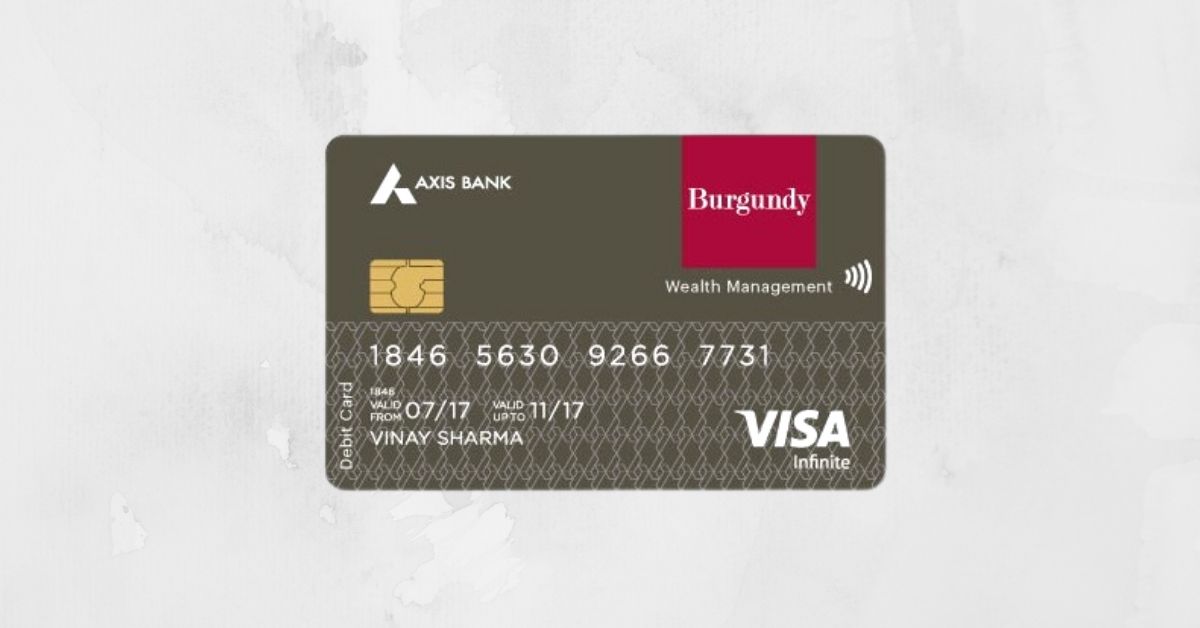

Image: fincards.in

Harnessing the Power of Your Bank Statement

Your Axis Bank Forex Card bank statement is a valuable tool that empowers you to:

-

Reconcile Expenses: Ensure that all transactions made on your card are accurately reflected against your budget and receipts.

-

Identify Spending Trends: Analyze expenses by category to pinpoint areas where adjustments can be made for greater financial control.

-

Plan Future Transactions: Forecast future expenses based on past spending patterns, ensuring you have sufficient funds available.

-

Detect Fraudulent Transactions: Monitor transactions closely to identify any unauthorized or anomalous activity promptly.

Axis Bank Forex Card Bank Statement

Conclusion: Empowering Global Financial Success

The Axis Bank Forex Card, coupled with the comprehensive bank statement, provides a seamless and secure solution for managing international transactions. Its user-friendly interface and transparent reporting empower you to take control of your global expenses, make informed decisions, and maximize your financial potential. By embracing the insights offered by your Axis Bank Forex Card bank statement, you unlock the freedom to explore the world’s markets with confidence and peace of mind.