In the fast-paced world of forex trading, the temptation to delve into smaller time frames like the 1-minute or 5-minute charts can be alluring. After all, these time frames offer the potential for rapid profits, right?

Image: dotnettutorials.net

Wrong.

The Illusion of Short, Sweet Trades

While smaller time frames may appear to provide more trading opportunities, the reality is that they also amplify market noise and fluctuations. This increased volatility makes it exceedingly difficult to distinguish between genuine trends and fleeting market spikes.

Moreover, the ultra-short time frames require traders to make split-second decisions based on limited information. This can lead to impulsive trading, which is often detrimental to long-term profitability.

Technical Analysis: A Minefield in Smaller Time Frames

Technical analysis, a widely used trading strategy in forex, becomes unreliable in smaller time frames. The price action on these charts is too erratic and lacks the stability required for accurate chart patterns.

For instance, a moving average, which smooths out price data to identify trends, becomes less effective on 1-minute charts due to the high degree of volatility. As a result, traders can easily misinterpret market movements and make poor trading decisions.

Psychology: The Achilles’ Heel of Intraday Trading

Smaller time frames can wreak havoc on the psychology of traders. The constant fluctuations and the rapid pace of trading can trigger emotional trading behaviors such as fear, greed, and overconfidence.

These emotions can lead to poor decision-making, such as holding losing positions for too long or prematurely exiting profitable trades. It’s essential to recognize the psychological challenges associated with intraday trading and to develop coping mechanisms to avoid emotional traps.

Image: www.youtube.com

Exit Strategies: A Glaring Problem

Exiting trades in smaller time frames poses another significant challenge. Minor reversals and false breakouts are common, making it difficult to determine the optimal exit point.

For instance, a trader may enter a short position on a 5-minute chart when prices break below a support level. However, prices may quickly retrace and surge back above the support level within a few minutes, resulting in a loss for the trader.

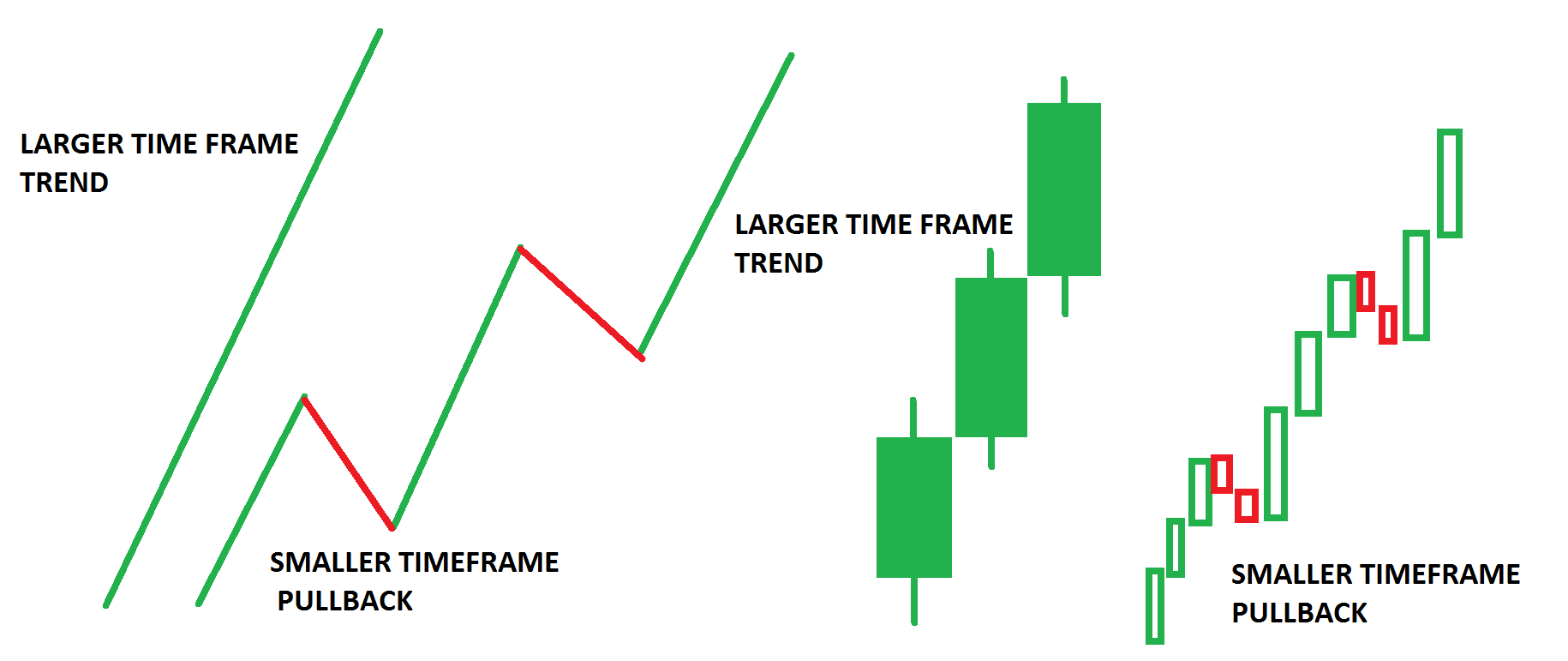

Expert Advice: Embrace Larger Time Frames

Seasoned forex traders recommend sticking to larger time frames such as the 4-hour, daily, or weekly charts. These time frames provide a broader perspective of the market, filter out noise, and allow for more reliable technical analysis.

By trading on larger time frames, traders can avoid the pitfalls of impulsive decision-making and emotional trading. They can also benefit from more consistent trends and more opportunities to implement sound risk management strategies.

FAQs on Smaller Time Frame Forex Trading

Q: Can’t smaller time frames offer lucrative profits?

While it’s possible to make profits in smaller time frames, the consistency and risk-to-reward ratio are generally lower compared to larger time frames.

Q: What are some alternative trading strategies for beginners?

For beginners, it’s advisable to focus on swing trading or position trading on larger time frames. These strategies involve holding positions for a longer duration, allowing for more stable and predictable market movements.

Avoiding Smaller Time Frame In Forex

Conclusion

Avoiding smaller time frames in forex trading is crucial for long-term success. The increased volatility, unreliable technical analysis, psychological challenges, and difficulty in exiting trades make short-term trading a risky endeavor.

By embracing larger time frames, traders can significantly enhance their trading performance, reduce emotional stress, and build a more sustainable trading strategy. So, if you’re looking to succeed in forex, it’s time to scale up your time horizons.