Introduction

In the ever-evolving world of financial trading, where time and precision are paramount, autotrading software has emerged as a game-changer for forex traders. By leveraging advanced algorithms and automated rule execution, these sophisticated tools offer a gateway to consistent profitability, untapped opportunities, and the freedom to pursue other endeavors. Whether you’re a seasoned veteran or a novice yearning to conquer the forex market, understanding the intricacies of autotrading software is the key to unlocking its transformative potential.

Image: www.flickr.com

In this comprehensive guide, we’ll delve into the depths of autotrading, unveiling its history, unraveling its fundamental concepts, and exploring its myriad applications in the real world. Join us as we disentangle the complexities of this financial marvel, empowering you to harness its power and reap the rewards that await.

Section 1: The Genesis and Evolution of Autotrading

Autotrading has its roots in the mid-1990s, with the advent of electronic trading platforms that facilitated direct access to the forex market. As technology evolved, so did the sophistication of trading tools. In the early 21st century, expert advisors (EAs) emerged as a breakthrough, allowing traders to automate their trading strategies. These EAs, powered by programmable languages, could analyze market data, execute trades, and manage positions with minimal human intervention.

In recent years, the rise of artificial intelligence (AI) and machine learning (ML) has ushered in a new era of autotrading. AI-driven algorithms can now process vast amounts of data, identify trading patterns, and make predictions with unprecedented accuracy. They have revolutionized the way traders approach the market, enabling them to test and optimize strategies more efficiently while reducing the risk of human error and emotional decision-making.

Section 2: Navigating the Nuances of Autotrading Software

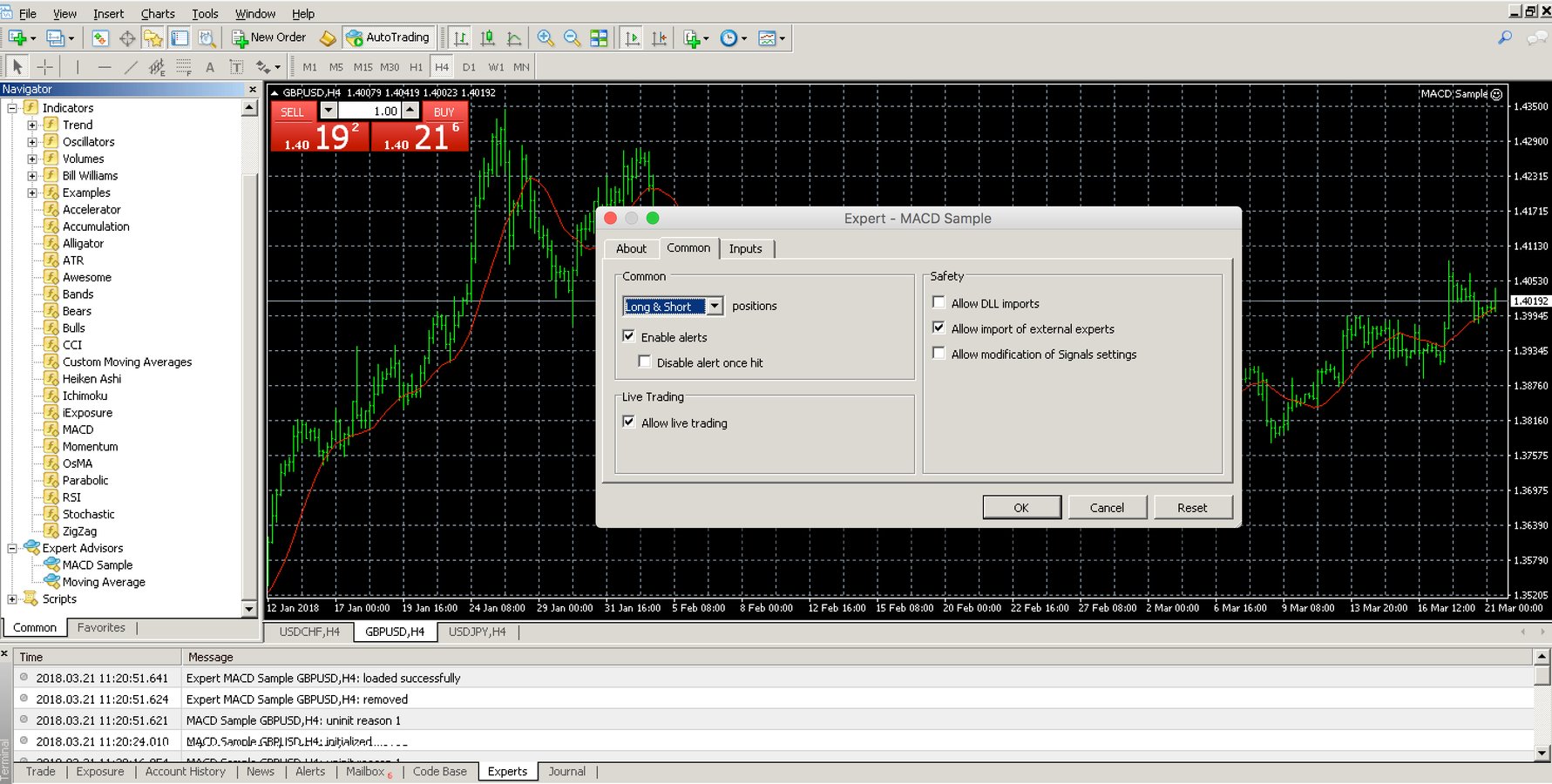

At its core, autotrading software comprises two essential components: a set of trading rules and a backtesting engine. Trading rules define the criteria that trigger trade entries, exits, and position management. The backtesting engine simulates historical market data to assess the profitability and risk-adjusted performance of the trading rules. This rigorous evaluation process allows traders to fine-tune their strategies and gauge their expected returns and drawdowns.

Modern autotrading software boasts an array of advanced features that cater to a wide range of trading styles and preferences. From customizable indicators and technical analysis tools to risk management algorithms and execution optimization modules, these tools empower traders to create sophisticated trading systems that meet their unique requirements.

Section 3: Practical Applications of Autotrading in Forex

Autotrading has revolutionized the way traders interact with the forex market. Here are some compelling reasons why traders are increasingly embracing the use of autotrading software:

Consistency and Discipline: Autotrading software adheres strictly to programmed trading rules, ensuring consistent execution and eliminating the emotional biases that can often derail manual trading. It removes the human element from the trading process, promoting disciplined decision-making and reducing the likelihood of impulsive trades.

24/7 Market Monitoring: Forex trading runs around the clock, making it impossible to monitor the markets constantly. Autotrading software offers a solution, tirelessly monitoring the markets round-the-clock and executing trades based on pre-defined criteria, regardless of your physical location or the time of day.

Time Optimization: Autotrading automates the trading process, freeing up your time for other activities. You can pursue research, analysis, or personal endeavors, while your trading system continues to operate autonomously, generating profits even when you’re away from the screens.

Image: digitalcashpalace.com

Section 4: Selecting the Right Autotrading Software

Choosing the best autotrading software for your needs is a crucial step. Consider these factors when making your selection:

Track Record: Look for software with a proven track record and positive testimonials from experienced traders. Verify the vendor’s réputation by researching online reviews and checking industry forums.

Features and Functionality: Evaluate the features offered by the software to ensure they align with your trading style and preferences. Consider technical analysis capabilities, risk management tools, execution optimization, and ease of use.

User Interface: Intuitive user interfaces facilitate easy setup and management of autotrading systems. Choose software with a clean and user-friendly design that allows you to quickly create and backtest strategies without getting lost in complex menus and settings.

Section 5: Mastering Risk Management in Autotrading

While autotrading software provides immense benefits, risk management remains paramount. Here are key strategies to mitigate risks:

Backtesting and Optimization: Thoroughly backtest your trading strategies before deploying them in live trading. Use historical data to assess profitability, risk-adjusted returns, and potential drawdowns. Optimize your strategies to strike a balance between return and risk tolerance.

Diversification: Spread your capital across multiple trading strategies and asset classes to minimize the impact of losses in any one strategy or market. Diversification helps manage risk and enhances the overall stability of your portfolio.

Stop-Loss Orders: Implement stop-loss orders to protect your capital from excessive losses. Stop-loss orders automatically close positions when the market price reaches a predetermined level, limiting your downside risk.

Autotrading Software For Forex Market

Conclusion

Autotrading software has transformed the forex trading landscape, empowering traders of all levels to achieve consistent profitability, optimize time, and pursue other interests. By embracing the latest advancements and continuously refining strategies, you can harness the full potential of autotrading to conquer the challenges of the dynamic forex market.

Remember, knowledge is power. Invest in education, stay informed about the latest trends, and seek guidance from experienced mentors to elevate your autotrading skills. By leveraging the capabilities of autotrading software and adhering to sound risk management principles, you can navigate the waters of the forex market with confidence, reaping the rewards of financial success in the years to come.