The advent of auto trading software has revolutionized the foreign exchange (forex) market, enabling traders of all levels to automate their trading strategies and tap into lucrative opportunities.

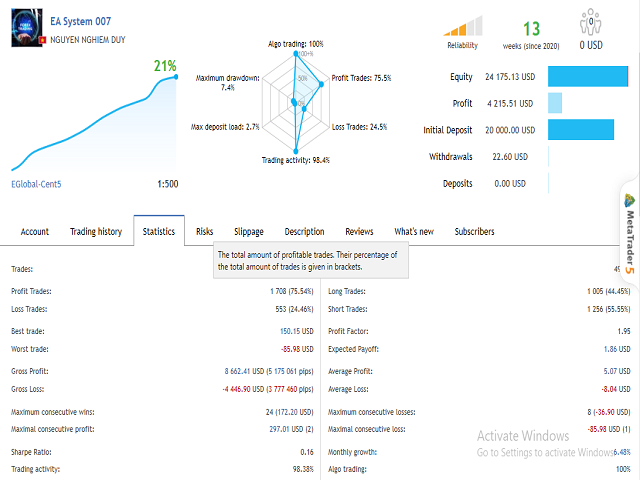

Image: www.mql5.com

Although I’ve always been passionate about trading, I used to struggle with the constant need to monitor the markets and execute trades manually. Auto trading software has been a game-changer for me, allowing me to set my trading parameters and let the software handle the execution, freeing up my time and reducing stress.

Maximize Profits with Automated Trading

Auto trading software allows you to create and execute trading strategies automatically based on predefined rules. This eliminates the need for manual trade execution, reducing the risk of human error and emotional decision-making.

The software continuously monitors market conditions and automatically places trades when your predefined conditions are met. This around-the-clock trading capability gives you an edge over manual traders, as you can exploit trading opportunities even when you’re away from your desk.

Technical Analysis and Automated Trading

Auto trading software is particularly powerful when combined with technical analysis. Technical analysis involves studying historical price data to identify patterns and trends that can indicate future market movements.

By incorporating technical analysis into your auto trading strategies, you can design software that reacts to specific market conditions and executes trades based on predetermined indicators. This approach can help you capitalize on market trends and mitigate risk.

Latest Trends and Market Insights

- Artificial Intelligence (AI) Integration: AI-powered auto trading software now offers self-learning capabilities, adapting to market dynamics and optimizing trading strategies over time.

- Cloud-Based Platforms: Cloud-based auto trading software provides remote access and automatic updates, allowing you to manage your automated strategies from anywhere.

- Mobile App Compatibility: Many auto trading software providers offer mobile apps, enabling traders to monitor and control their strategies on the go.

Image: www.amazon.com

Tips and Expert Advice from a Seasoned Blogger

- Start with a Demo Account: Familiarize yourself with the software and fine-tune your strategies in a risk-free demo account before going live.

- Choose a Reputable Provider: Research different auto trading software providers, compare features, and select one with a track record of reliability and customer support.

- Backtest Your Strategies: Before deploying auto trading software, thoroughly backtest your strategies using historical data to assess their potential profitability and risk-reward ratios.

- Monitor and Adjust Regularly: The market is constantly evolving, so it’s crucial to monitor your automated strategies regularly and make adjustments as needed.

- Manage Risk Effectively: Set clear stop-loss levels and incorporate sound risk management principles into your trading strategies to limit potential losses.

Frequently Asked Questions (FAQs)

- Q: Are auto trading software reliable?

- A: Auto trading software can be reliable, but it’s essential to choose a reputable provider. Backtesting, monitoring, and proper risk management are also crucial.

- Q: Is auto trading software suitable for beginners?

- A: While auto trading software can be accessible for beginners, it’s recommended to have a basic understanding of trading concepts and market analysis.

Auto Trading Software Forex Market Plus

Conclusion

Auto trading software in the forex market is a powerful tool that can unlock automated profits, streamline trading, and reduce stress. By harnessing the latest technologies and following the advice of experienced traders, you can optimize your strategies, mitigate risk, and join the growing number of investors leveraging automation in the financial markets. Are you ready to explore the world of automated forex trading?