In today’s fast-paced world, accessibility to our hard-earned money is paramount. ATM withdrawals have become an indispensable part of our daily lives, empowering us to manage our finances with ease. If you’re a frequent traveler or rely on currency exchange services, understanding the ATM withdrawal limits imposed by Thomas Cook Forex is essential.

Image: www.informalnewz.com

Thomas Cook Forex, a global leader in currency exchange and international money transfers, has established ATM withdrawal limits to safeguard customer funds and prevent fraudulent activities. These limits vary depending on account type, transaction location, and the specific ATM being used. Knowing these limits can help you avoid unexpected surprises or inconvenient situations while abroad.

Explaining ATM Withdrawal Limits

ATM withdrawal limits are set by financial institutions to restrict the maximum amount of cash that can be withdrawn from an ATM in a single transaction or within a specific period, usually daily or weekly. These limits are implemented for security reasons, to minimize the risk of theft or unauthorized transactions.

Thomas Cook Forex employs different ATM withdrawal limits based on the type of account you hold. For instance, “Classic” account holders may have a lower withdrawal limit compared to “Premium” or “Elite” account holders. Additionally, withdrawal limits may vary depending on the country and ATM location. ATMs in high-risk areas or those known for fraudulent activities may have stricter limits.

Navigating ATM Withdrawal Limits

If you anticipate needing large amounts of cash during your travels, it’s advisable to inform Thomas Cook Forex in advance. They may be able to increase your withdrawal limit temporarily to accommodate your specific needs. However, it’s important to note that such requests may be subject to verification and approval processes.

To avoid exceeding withdrawal limits, consider planning your cash withdrawals strategically. Break down your large withdrawal into smaller, more frequent ones within the permitted limits. Alternatively, you can opt for alternative methods of accessing funds, such as traveler’s checks or debit/credit card payments, which may have different transaction limits.

Ensuring Safety and Convenience

Thomas Cook Forex places great emphasis on customer security and fraud prevention. By establishing ATM withdrawal limits, they aim to protect their customers from unauthorized transactions and potential losses. These limits also help to maintain the integrity of their ATM network and reduce the risk of ATM skimming or counterfeiting.

While ATM withdrawal limits may pose temporary inconvenience, they ultimately serve as a safeguard for your hard-earned money. By adhering to these limits and taking appropriate precautions, you can enjoy the convenience of ATM withdrawals while minimizing financial risks.

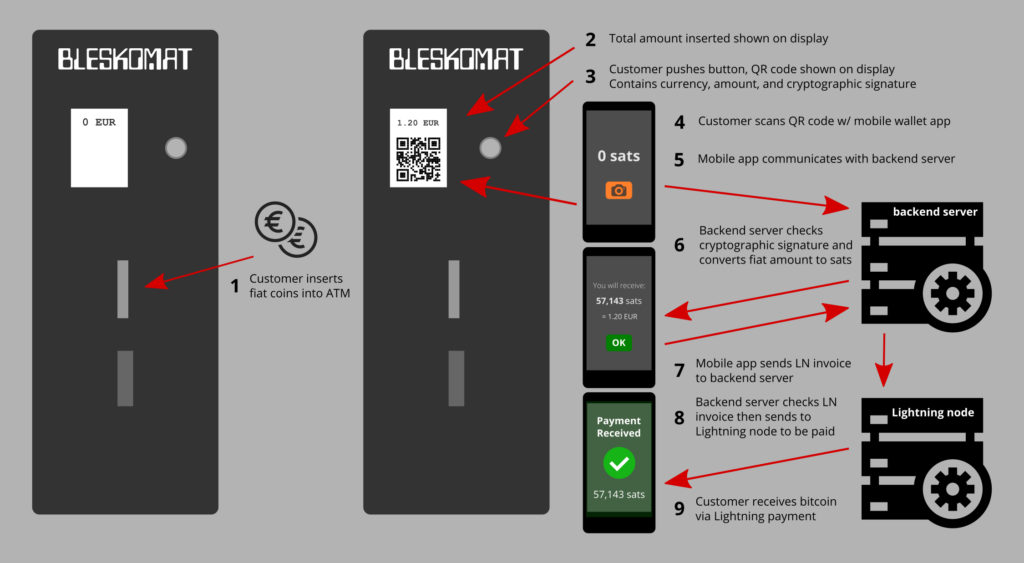

Image: blog.bleskomat.com

Expert Insights

“ATM withdrawal limits are an essential security measure to protect our customers from fraudulent activities,” emphasizes Mark Andrews, Head of Security at Thomas Cook Forex. “By setting limits, we can effectively reduce the impact of potential scams and unauthorized transactions.”

“It’s always prudent to plan your cash withdrawals in advance,” advises Susan Lee, a travel expert from Thomas Cook. “By informing us about your travel plans, we can assist you in setting appropriate withdrawal limits to ensure you have access to the funds you need during your trip.”

Atm Withdrawal Limit From Thomas Cook Forex

Conclusion

Understanding ATM withdrawal limits from Thomas Cook Forex is crucial for seamless access to your funds while traveling or managing your finances. By adhering to these limits and taking necessary precautions, you can ensure the safety and convenience of your ATM transactions. Remember to plan your withdrawals strategically, and don’t hesitate to reach out to Thomas Cook Forex for assistance if you have any specific requirements. By working together, we can empower you to manage your finances confidently and securely.