The foreign exchange market (forex) is the world’s largest financial market, where currencies are traded against each other. It’s an ever-evolving landscape marked by constant fluctuations that can significantly impact economies and investors alike. Understanding the factors that influence these fluctuations is crucial for anyone navigating the forex market.

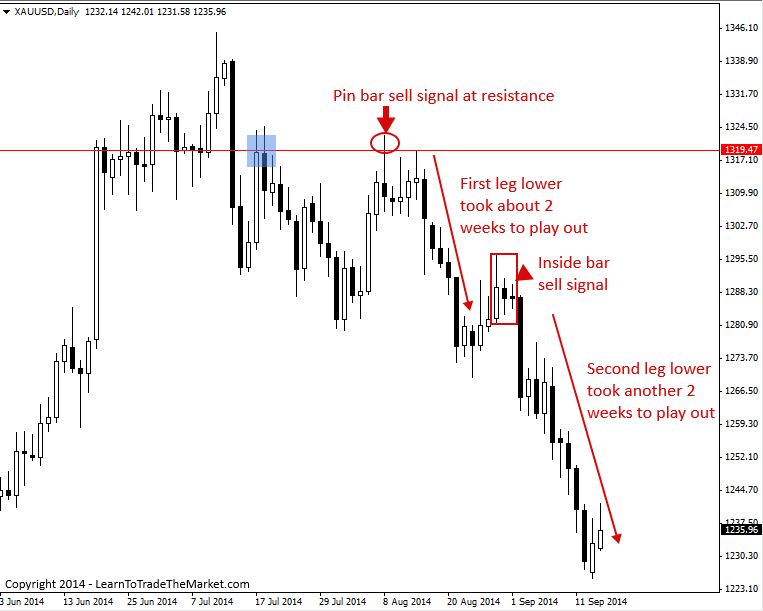

Image: www.learntotradethemarket.com

Fundamental Drivers Shaping Forex Fluctuations

Economic data and political events play a significant role in determining the value of currencies. For instance, strong economic indicators like low unemployment and high growth prospects typically increase the demand for a country’s currency, leading to its appreciation. Conversely, unfavorable economic conditions can weaken the currency’s value.

Political stability and uncertainty also influence exchange rates. Currencies of countries perceived as politically stable tend to be in higher demand, while currencies associated with political instability can depreciate. Major political events, such as elections or coups, can introduce volatility into the forex market.

Market Participants and Their Influence

Central banks, commercial banks, hedge funds, and multinational corporations play a major role in influencing forex market fluctuations. Central banks intervene in the market to maintain price stability by manipulating interest rates and purchasing or selling currencies. Commercial banks are involved in currency exchange for their clients, which can impact supply and demand dynamics.

Hedge funds and multinational corporations speculate on currency movements, often taking large positions that can influence exchange rates. The influx of such large amounts of capital can lead to sudden fluctuations in currency values.

Psychological Factors: Market Sentiment and “Herding” Behavior

The forex market is heavily influenced by market sentiment, which refers to the collective belief and expectations of market participants. Optimistic sentiment can lead to a “rally effect,” where currency values appreciate due to increased demand. Conversely, a pessimistic sentiment can trigger a “herd instinct,” where investors sell their currencies en masse, leading to depreciation.

Image: tradeveda.com

Geopolitical Events and Natural Disasters

Geopolitical events, such as wars, trade disputes, and natural disasters, can have a significant impact on currency values. For example, the Russian-Ukrainian conflict led to a surge in demand for the US dollar, considered a safe haven currency in times of uncertainty. Similarly, natural disasters can disrupt economic activity, affecting supply and demand for a currency.

Implications of Forex Market Fluctuations

Fluctuations in the forex market have a wide range of implications for individuals, businesses, and economies. Businesses involved in international trade are affected by currency fluctuations, as it impacts the cost of imported and exported goods. Investors seeking returns from foreign investments need to consider the potential impact of currency fluctuations on their profits.

Economies also feel the effects of forex market volatility. Sudden depreciations can lead to inflation, while appreciations can affect export competitiveness. Governments may intervene to stabilize exchange rates and mitigate the impact of excessive volatility on their economies.

At What Amound Does Forex Market Fluctuate

Conclusion

Understanding the factors that influence forex market fluctuations is essential for navigating this ever-changing landscape. By staying informed about economic data, political developments, and market sentiment, participants can make informed decisions and mitigate risks. The forex market’s volatility presents both opportunities and challenges, and a deep understanding of its underlying drivers enables investors and businesses to capitalize on market dynamics and protect their interests.