When it comes to delving into the world of forex trading in Australia, understanding the regulatory landscape and the associated charges levied by ASIC-licensed brokers is crucial. In this comprehensive guide, we take a deep dive into the intricacies of ASIC Australia forex brokers’ charges, empowering you with the knowledge to optimize your trading experience. Dive in and gain valuable insights to navigate the forex market with confidence.

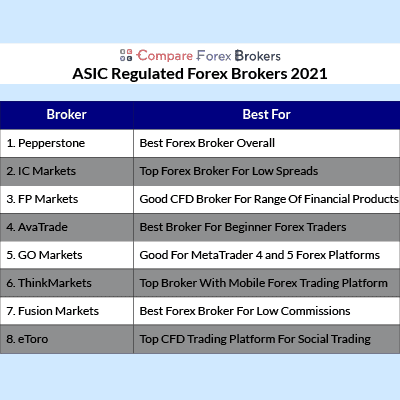

Image: www.compareforexbrokers.com

ASIC Regulation: Ensuring Transparency and Fairness

The Australian Securities and Investments Commission (ASIC) plays a pivotal role in regulating the Australian financial markets, including the forex industry. ASIC’s stringent regulations aim to protect the interests of investors and traders, ensuring a transparent and fair trading environment. ASIC-licensed forex brokers are obligated to adhere to these regulations, which include clear disclosure of all fees and charges associated with their services. This regulatory framework provides a robust foundation for forex trading in Australia, fostering trust and confidence among market participants.

Brokerage Fees: Commission vs. Spread

Forex brokers primarily generate revenue through two fee structures: commissions and spreads. Commissions are direct charges levied on each trade executed, typically calculated as a percentage of the trade volume. Spreads, on the other hand, represent the difference between the bid and ask prices of a currency pair. When entering a trade, the trader either buys at the ask price or sells at the bid price, resulting in the spread serving as the broker’s fee. The choice between commission-based or spread-based pricing depends on the individual trader’s preferences and trading style.

Non-Trading Fees to Consider

Beyond brokerage fees, forex brokers may also impose a range of non-trading charges. These fees can include account maintenance fees, withdrawal fees, deposit fees, and inactivity fees. Account maintenance fees are ongoing charges levied periodically, typically on a monthly or annual basis, to cover the costs of maintaining the trading account. Withdrawal fees are charged when a trader transfers funds out of their trading account, while deposit fees apply when funds are deposited into the account. Inactivity fees may be imposed if the trading account remains dormant for an extended period.

Image: tapaas.com

Understanding the Impact of Fees

The charges levied by ASIC Australia forex brokers can have a significant impact on the profitability of your trades. High fees can erode your returns, especially if you engage in frequent trading. Therefore, it is crucial to carefully consider the fee structure of different brokers and select the one that best aligns with your trading strategy and budget. Prioritizing brokers with competitive fees and transparent pricing practices will help maximize your trading profits in the long run.

Tips for Minimizing Forex Broker Charges

As a seasoned trader, I have accumulated valuable insights into minimizing the impact of forex broker charges on your trading endeavors. Here are a few expert tips to help you navigate the market and optimize your profitability:

- Compare fee structures: Thoroughly research and compare the fee structures of different ASIC Australia forex brokers to identify the most competitive options. Consider both brokerage fees and non-trading charges to make an informed decision.

- Negotiate fees: Don’t hesitate to negotiate with brokers to secure favorable fee arrangements. If you are a high-volume trader, you may be able to negotiate reduced commissions or spreads.

- Bundle services: Some brokers offer bundled service packages that include reduced fees on multiple services. Consider bundling your trading account with other services, such as managed accounts or educational resources, to save money on overall fees.

Frequently Asked Questions (FAQs)

To further enhance your understanding of ASIC Australia forex brokers’ charges, I present a comprehensive FAQ section addressing common queries:

- Are all ASIC-licensed forex brokers required to disclose their fees?

Yes, ASIC regulations mandate all licensed brokers to provide transparent disclosure of all fees and charges associated with their services. - What is the average spread charged by ASIC Australia forex brokers?

The average spread varies depending on the broker and the currency pair being traded. However, it typically ranges from 1 to 3 pips for major currency pairs. - Can forex brokers charge hidden fees?

No, ASIC regulations prohibit forex brokers from charging hidden fees. All fees must be clearly disclosed and agreed upon by the trader before executing any trades.

Additional FAQs can be added as needed to address specific queries or provide further clarification.

Asic Australia Forex Brokers Charge

Conclusion

Understanding the charges levied by ASIC Australia forex brokers is an essential aspect of successful forex trading. By carefully considering the fee structures of different brokers and implementing strategies to minimize costs, you can optimize your trading profitability. A thorough comprehension of the regulatory environment and the various charges involved empowers you to make informed decisions and navigate the market with confidence. Whether you are a seasoned trader or just starting out, this guide provides valuable insights to help you succeed in the dynamic world of forex trading in Australia.

Thank you for investing your time in reading this comprehensive guide. I encourage you to continue exploring the topic and delving deeper into the complexities of ASIC Australia forex brokers’ charges. Empower yourself with knowledge and stay ahead in the financial markets. Are you ready to embark on your forex trading journey? Let us know if you have any further questions or require additional guidance. We are committed to supporting your trading endeavors and empowering you to reach your financial goals.