Unlock the Secrets of Forex Trading: Master Technical Analysis for Profitable Returns

Image: forexbee.co

In the fast-paced world of forex trading, where currencies dance to the rhythm of global economic forces, the ability to navigate the complexities of the financial markets is paramount. Enter technical analysis, a powerful tool that empowers traders with the insights they need to make informed decisions and increase their chances of success.

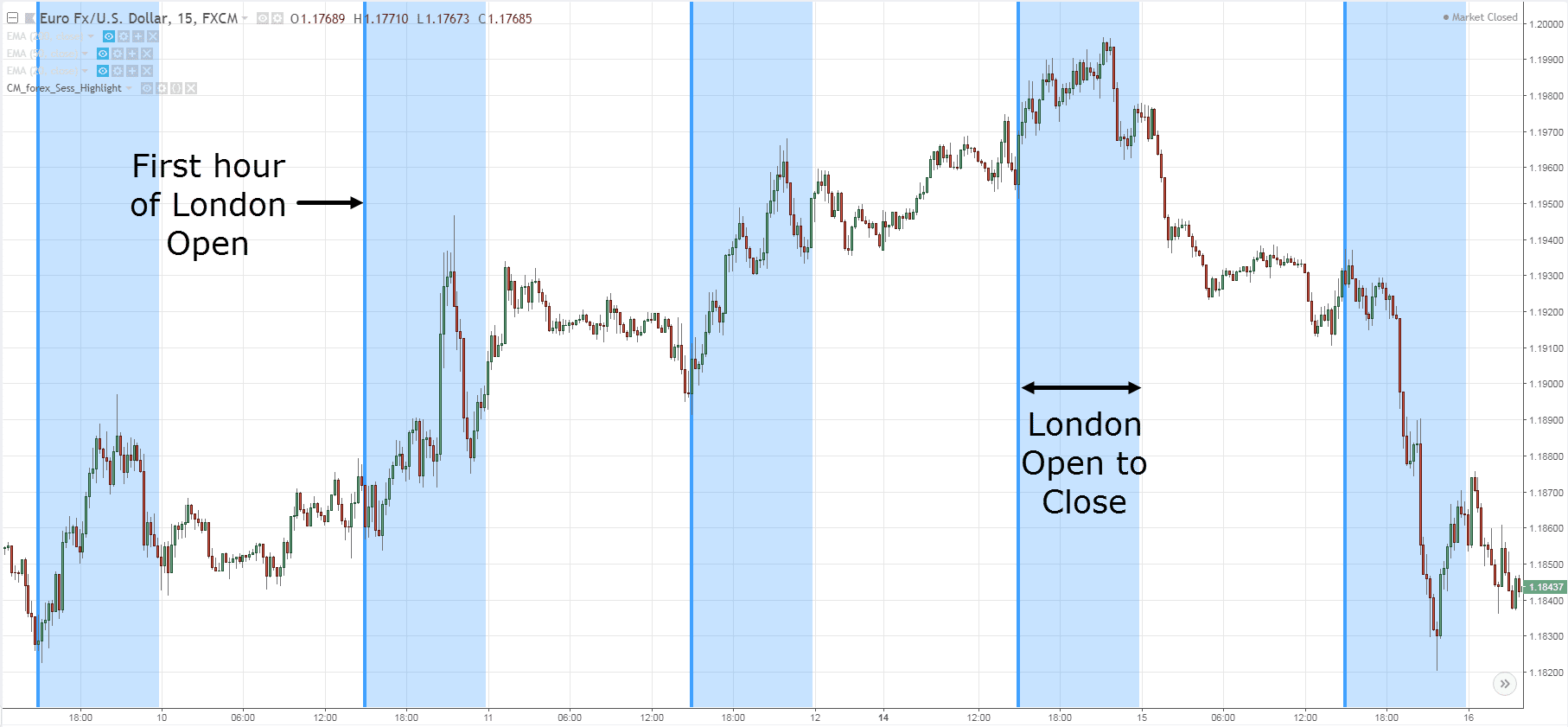

Technical analysis involves the study of historical price data and market patterns to predict future price movements. By deciphering these patterns, traders can identify trading opportunities, set stop-loss and take-profit levels, and minimize their risk exposure. Unlike fundamental analysis, which focuses on economic and political factors influencing currency values, technical analysis assumes that market behavior is repetitive and that past performance can provide valuable clues about future trends.

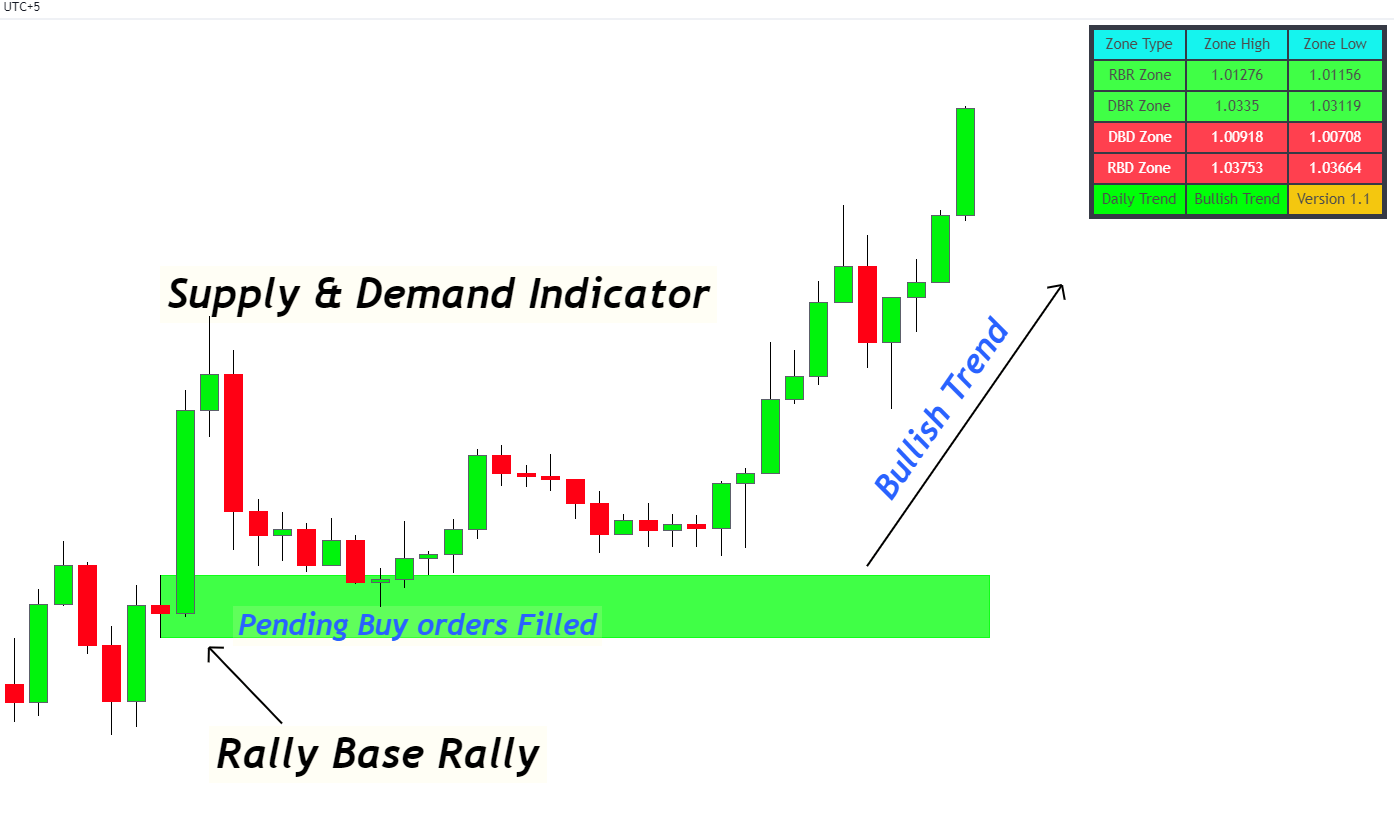

One of the cornerstones of technical analysis is chart patterns. These are specific formations that occur in price charts and indicate potential price movements. For instance, a bullish engulfing pattern suggests an upward price reversal, while a bearish head and shoulders pattern signals a downward trend. By recognizing and interpreting these chart patterns, traders can anticipate future price movements and position themselves accordingly.

Equally important are technical indicators, mathematical formulas that help traders analyze price data and identify trading opportunities. Moving averages, for example, smooth out price fluctuations and indicate the overall trend of the market. Bollinger Bands, on the other hand, measure market volatility and provide insights into potential overbought or oversold conditions. By combining chart patterns with technical indicators, traders can enhance their trading strategies and increase their accuracy.

The concept of support and resistance levels is another crucial aspect of technical analysis. Support levels represent areas where downward price movements are likely to be halted, while resistance levels indicate potential obstacles to upward movement. By identifying these levels, traders can set their profit targets and stop-loss orders accordingly.

While technical analysis provides valuable insights, it’s essential to note that it’s not an exact science. It’s a probabilistic approach that helps traders increase their chances of success, but it does not guarantee profits. Thus, it’s crucial to combine technical analysis with sound money management principles, such as risk-to-reward analysis and position sizing.

Mastering the intricacies of technical analysis requires patience and practice. By studying historical data, practicing on demo accounts, and continuously refining their skills, traders can unlock the potential of this powerful tool. Remember, the financial markets are a dynamic and ever-changing environment. By embracing the principles of technical analysis, embracing adaptability, and continually seeking knowledge, traders can gain an edge in the competitive world of forex trading.

Image: www.tradingwithrayner.com

Articles On Technical Analysis In Forex