In the dynamic world of foreign exchange (forex) trading, where currencies are bought and sold 24 hours a day, the influence of government policies can be felt like a ripple effect. From interest rate decisions to fiscal stimulus packages, policymakers’ actions have the power to shape the value of currencies and impact the strategies of forex traders.

Image: morethandigital.info

Understanding Government Influence on Forex

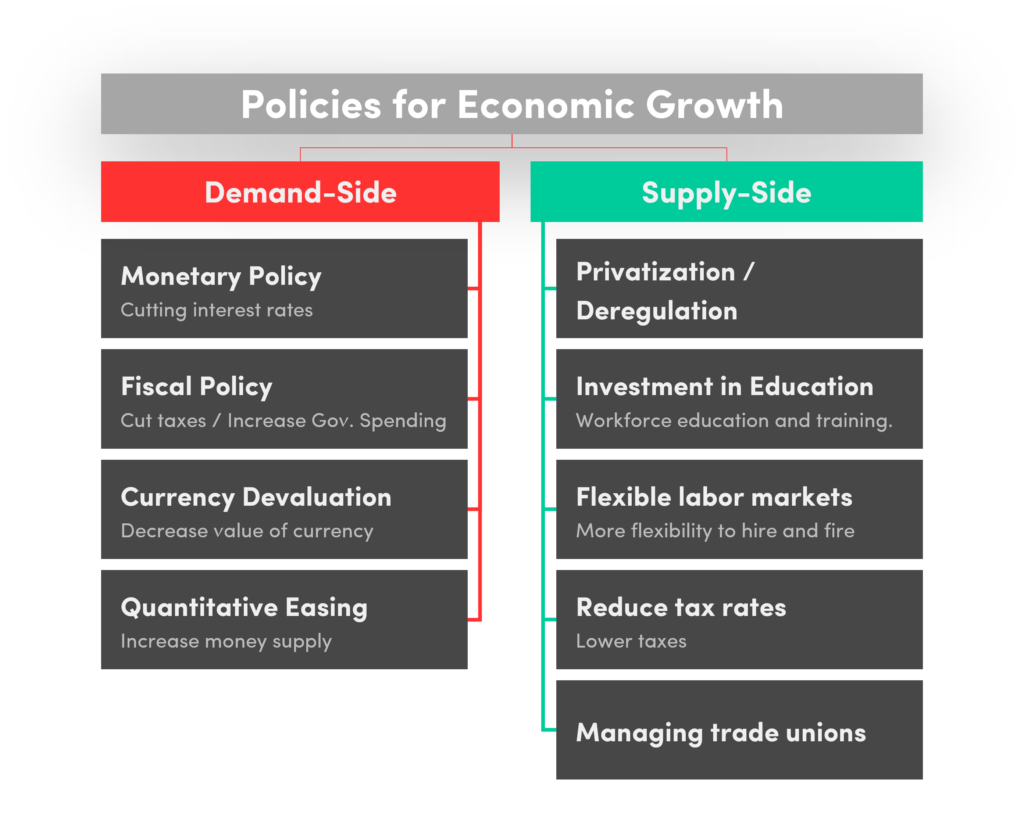

Governments wield considerable authority over the economic and financial landscape that affects forex markets. Their policies shape the overall health of an economy, which in turn influences the demand and supply of its currency. For instance, when a central bank raises interest rates, it typically strengthens its currency by making it more attractive to foreign investors.

Interest Rate Decisions and Currency Strength

Interest rates play a crucial role in currency valuations. When interest rates are high in a particular country, it entices foreign investors to invest in its bonds and other debt instruments. This increased demand for the currency drives up its value. On the other hand, lower interest rates tend to weaken a currency as it becomes less appealing to foreign investors.

Fiscal Stimulus Packages and Economic Growth

Governments also implement fiscal stimulus packages to boost economic growth. These packages involve increasing government spending or offering tax cuts to stimulate economic activity. A boost in economic activity can lead to increased demand for a currency, thereby strengthening it.

Image: offshorelicense.com

Government Intervention in Currency Markets

In extreme cases, governments may intervene directly in currency markets to influence their value. This intervention can take various forms, such as buying or selling large amounts of a specific currency to manage its exchange rate. Such interventions can be used to stabilize a currency, prevent excessive volatility, or achieve a desired level of competitiveness for domestic exports.

Navigating the Impact of Government Policies

As a forex trader, staying abreast of government policies and their potential impact is essential. By monitoring government announcements, economic data, and news updates, traders can anticipate how policies may affect currency values and adjust their strategies accordingly.

Expert Tips for Forex Traders

Here are some expert tips for navigating the influence of government policies on forex markets:

- Monitor economic data releases: Keep track of key economic indicators, such as GDP growth, inflation, and unemployment rates, which can provide insights into the health of a country’s economy and potential policy adjustments.

- Follow central bank meetings and statements: Central bank decisions regarding interest rates and monetary policy significantly impact currency values. Monitor these meetings and pay attention to the statements of policymakers for potential clues about future policy direction.

- Analyze government budget and spending plans: Fiscal stimulus packages and government spending can affect economic growth and currency demand. Study these plans to anticipate their potential impact on the forex markets.

- Stay informed about political events: Political instability or changes in government can create uncertainty and impact currency valuations. Pay attention to news updates and geopolitical events that may influence market sentiment.

- Diversify your currency exposure: Don’t rely heavily on one currency or currency pair. Diversify your portfolio to manage risk and minimize the impact of government policies on a single currency.

FAQ

Q: How do interest rate decisions impact forex markets?

A: Higher interest rates typically strengthen a currency by attracting foreign investment, while lower interest rates tend to weaken it.

Q: What are fiscal stimulus packages, and how do they affect forex?

A: Fiscal stimulus packages are government measures designed to boost economic growth through increased spending or tax cuts. They can lead to increased currency demand and appreciation.

Q: How can I stay informed about government policies that affect forex markets?

A: Monitor economic data releases, follow central bank meetings, analyze government budget plans, and stay updated on political events that may influence market sentiment.

Are Forex Markets Affected By Government Policies

Conclusion

The interplay between government policies and forex markets is complex yet crucial for forex traders. By understanding the influence of interest rate decisions, fiscal stimulus packages, and government intervention, traders can make informed decisions and navigate the dynamic forex landscape more effectively. Remember, staying informed, adapting to policy changes, and diversifying your portfolio is key to navigating government policy impacts and maximizing trading success in the forex markets.

Are you interested in learning more about the influence of government policies on forex markets? If so, feel free to explore additional resources and engage with experts in the field to further your understanding and improve your trading strategies.