In the realm of international finance, the US dollar reigns supreme as the world’s reserve currency. However, savvy traders know that the true power lies not in the dollar itself but in the currencies that move against it—anti-dollar pairs. Diving into the depths of anti-dollar pairs is like embarking on a treasure hunt, where understanding their dynamics can unlock doors to profitable trading opportunities.

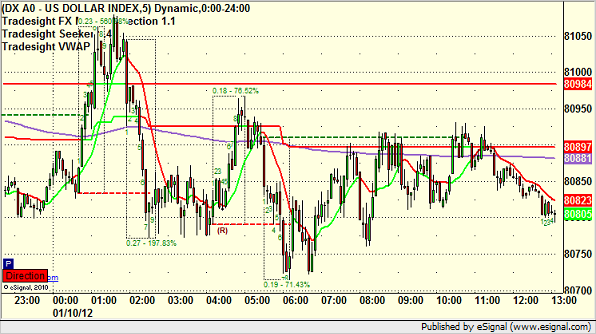

Image: www.tradesight.com

Defining Anti-Dollar Pairs: The Yin and Yang of the Forex Market

In the foreign exchange market, currency pairs are traded in tandem, with one currency quoted against another. Anti-dollar pairs defy this convention, featuring currencies that move in opposition to the US dollar. This unique relationship opens up a world of possibilities for traders seeking to exploit market inefficiencies and uncover verborgen trends.

The Major Anti-Dollar Pairs: A Towering Trio

When it comes to anti-dollar pairs, there are three titans that dominate the forex trading landscape:

-

EUR/USD (Euro/US Dollar): The undisputed heavyweight, this pair pits the eurozone’s financial powerhouse against the mighty greenback. It reflects the economic pulse of Europe and the United States, making it a barometer of global economic health.

-

GBP/USD (British Pound/US Dollar): Known as “cable” in trading circles, this pair embodies the age-old rivalry between the pound sterling and the US dollar. Its fluctuations hint at the complexities of the UK’s economy and its relationship with its across-the-pond counterpart.

-

USD/JPY (US Dollar/Japanese Yen): The “Ninja” pair, as it’s affectionately dubbed, reflects the interplay between the world’s largest economy and the enigmatic Japanese economy. Interest rate differentials, political stability, and market sentiment all dance together in this volatile yet rewarding pair.

Unlocking the Secrets of Anti-Dollar Pairs

The allure of anti-dollar pairs lies in their unique characteristics that set them apart from other currency pairs:

-

Inverse Correlation: Unlike traditional currency pairs that rise and fall together, anti-dollar pairs move in opposite directions. This means that when the US dollar strengthens, anti-dollar pairs tend to weaken, and vice versa.

-

Global Events Sensitivity: Anti-dollar pairs are highly sensitive to global events, particularly those affecting the United States. Political turmoil, economic news, and central bank policy decisions can send these pairs swinging like a pendulum.

-

Volatile yet Rewarding: The inverse correlation and global event sensitivity of anti-dollar pairs make them notoriously volatile. However, with volatility comes the potential for significant rewards. Skilled traders can harness this volatility to their advantage, profiting from the ebb and flow of market sentiment.

Image: umypecodayok.web.fc2.com

A Step-by-Step Guide to Navigating Anti-Dollar Pairs

Venturing into the world of anti-dollar pairs requires a tailored approach:

-

Establish a Trading Strategy: First and foremost, develop a trading strategy that aligns with your risk tolerance and trading goals. Whether it’s scalping, day trading, or longer-term trend trading, choose a strategy that suits your appetite for risk and time commitment.

-

Stay Informed: Keep a watchful eye on global events and economic indicators that can influence anti-dollar pairs. Subscribe to financial news outlets, follow market analysts, and stay updated on the latest developments.

-

Technical Analysis and Indicators: Technical analysis and indicators can add a layer of precision to your trading decisions. From Fibonacci retracements to moving averages and RSI, leverage these tools to identify potential entry and exit points.

-

Risk Management: Risk management is the cornerstone of successful forex trading. Employ stop-loss orders to limit potential losses and position sizing strategies to control your overall exposure.

-

Practice Makes Perfect: The best way to hone your skills is through practice. Utilize demo accounts or micro-trading to test your strategies without risking real capital.

Anti Dollar Pairs In Forex

The Power of Anti-Dollar Pairs: A Key to Forex Trading Success

By unlocking the secrets of anti-dollar pairs, traders can unlock a lucrative world of trading opportunities. The inverse correlation, global event sensitivity, and volatility of these pairs make them a captivating asset class that rewards the prepared. Embrace the thrill of navigating this dynamic market and reap the rewards of your newfound knowledge.