Imagine navigating a maze of intricate financial regulations, seeking clarity and guidance. Annexure 1 of Forex Circular No. 52, issued by the Reserve Bank of India (RBI) on November 6, 2018, serves as a beacon, shedding light on the ever-evolving landscape of foreign exchange management in India.

Image: www.shikshanjagat.in

Deciphering the Labyrinth: A Simplified Overview

Forex Circular No. 52 stands as a comprehensive directive, providing a framework for individuals and entities engaged in foreign exchange transactions. Annexure 1, in particular, focuses on the liberalization of certain outward remittances, expanding the horizons for Indian residents to invest and engage in international financial activities.

Exploring the Liberalization Measures: Unlocking Opportunities

The liberalization measures introduced by Annexure 1 aim to facilitate greater financial flexibility for Indian residents. Key highlights include:

-

Increased Remittance Limits: Individuals can now freely remit up to $250,000 per financial year for education, medical expenses, and maintenance of close relatives abroad. This relaxation allows for more substantial financial support and coverage of essential expenses.

-

Relaxed Documentation Requirements: The circular simplifies the documentation process, eliminating the need for detailed documentation for remittances below specified limits. This streamlined approach reduces administrative burdens and expedites transactions.

-

Liberalized Gift Remittances: Individuals are now permitted to gift up to $250,000 per fiscal year without prior RBI approval. This provision facilitates family support, charitable donations, and other gifting purposes.

Empowering Indian Residents: A Catalyst for Global Engagement

The liberalization measures outlined in Annexure 1 represent a significant step forward in empowering Indian residents to engage in global financial activities. It enables them to pursue higher education abroad, access specialized medical facilities, and support family members overseas without excessive financial constraints.

Image: www.chegg.com

Expert Insights: Navigating the Nuanced Details

To delve deeper into Annexure 1, let’s consult experts in the field:

-

“The revised remittance limits are a welcome move, as they provide Indian residents with greater flexibility in managing their foreign exchange requirements,” says Dr. Ashutosh Maheshwari, an esteemed economist. “This opens up new avenues for investment and personal financial planning.”

-

“The relaxation of documentation requirements is a progressive step that reduces compliance burdens,” adds Ms. Nikita Patel, a renowned foreign exchange expert. “It streamlines the remittance process, making it more convenient for individuals.”

Practical Guidance: Making Informed Decisions

Based on our expert insights, here are some actionable tips to maximize the benefits of Annexure 1:

-

Understand the specific remittance limits and documentation requirements for your intended purpose.

-

Plan your remittances strategically to optimize within the annual limits.

-

Explore different channels for remittance, such as authorized banks, money transfer operators, and foreign exchange dealers, to compare rates and fees.

-

Keep proper records and documentation related to your remittances for future reference and compliance purposes.

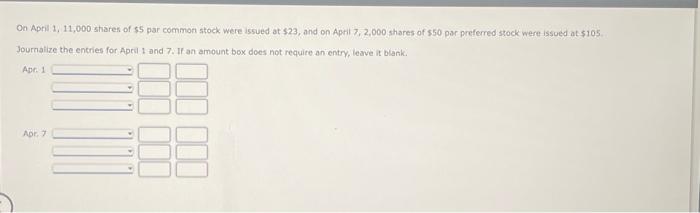

Annexure-1 Of Forex Circuluar No.52 Dated 6th November 2018

Conclusion: Empowered and Informed in the Global Financial Arena

Annexure 1 of Forex Circular No. 52 has undoubtedly unlocked new opportunities for Indian residents to venture into the global financial sphere. By providing clarity and liberalization measures, it empowers individuals to participate in international transactions with greater confidence and ease. Embracing these enhanced regulations, Indian residents can harness their financial potential and expand their horizons both domestically and globally.