Introduction

In the ever-evolving world of finance, staying abreast of regulatory frameworks is paramount. Annexure-1 of Forex Circular No. 52, issued by the Reserve Bank of India (RBI) on November 6th, 2018, is a crucial document that encapsulates key regulations governing foreign exchange (forex) transactions. This comprehensive guide delves into the intricacies of Annexure-1, empowering businesses, individuals, and financial institutions to navigate the forex landscape with confidence.

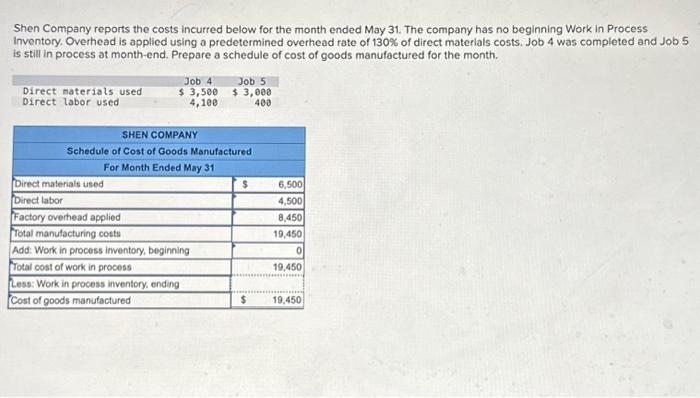

Image: www.chegg.com

Overview of Annexure-1

Annexure-1 establishes a consolidated framework for forex dealings in India. It outlines permissible transactions, documents required, reporting obligations, and compliance procedures. The document aims to maintain orderly and transparent forex markets, safeguard the Indian economy from illicit financial flows, and align with international best practices. Understanding the provisions of Annexure-1 is essential for entities involved in international trade, cross-border investments, and personal remittances.

Key Provisions of Annexure-1

The document covers a wide range of topics, including:

Permissible Forex Transactions:

Annexure-1 provides clarity on permissible forex transactions, including current account transactions (e.g., trade payments, outward remittances), capital account transactions (e.g., foreign direct investment, external commercial borrowings), and remittances for personal purposes (e.g., travel, education, medical expenses).

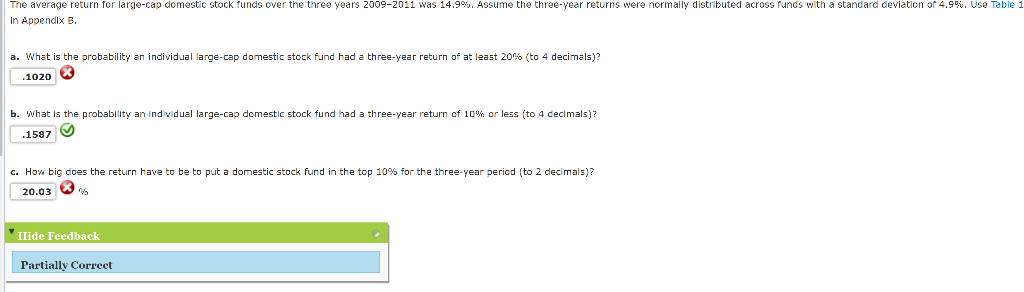

Image: www.chegg.com

Documentation Requirements:

The document specifies the mandatory documentation required for different types of forex transactions. This includes invoices, contracts, KYC documents, and supporting documents for remittances. By adhering to these requirements, businesses and individuals can avoid delays or scrutiny during transaction processing.

Reporting Obligations:

Annexure-1 imposes reporting obligations on authorized dealers and corporates to report specified types of forex transactions to the RBI. Timely and accurate reporting facilitates monitoring of forex flows and helps combat illicit financial activities.

Compliance Procedures:

To ensure compliance, the document outlines procedures for obtaining Prior Approval, filing Foreign Exchange Declarations, and maintaining records of forex transactions. Following these procedures minimizes the risk of contraventions and potential legal implications.

Authorized Dealers:

Annexure-1 empowers specified banks and financial institutions as Authorized Dealers to conduct forex transactions on behalf of their customers. These entities must meet the prescribed eligibility criteria and comply with all applicable regulations.

Benefits of Compliance with Annexure-1

Compliance with the provisions of Annexure-1 offers several benefits for entities involved in forex transactions:

Enhanced Clarity and Predictability:

By adhering to the guidelines outlined in Annexure-1, businesses and individuals can gain clarity on the regulatory framework governing forex transactions. This reduces uncertainty and facilitates smooth and compliant operations.

Mitigation of Risks:

Compliance with Annexure-1 helps mitigate risks associated with foreign exchange transactions. It ensures that transactions are conducted legally and in accordance with the prescribed procedures, minimizing the risk of penalties or legal challenges.

Access to Authorized Dealers:

Compliance enables businesses and individuals to engage with Authorized Dealers, who offer specialized services and expertise in forex transactions. This facilitates efficient execution of transactions and access to professional guidance.

Annexure-1 Of Forex Circular No.52 Dated 6th November 2018

Conclusion

Annexure-1 of Forex Circular No. 52 is an indispensable resource for understanding the regulatory framework governing forex transactions in India. By comprehending the key provisions outlined in this guide, businesses, individuals, and financial institutions can confidently navigate the forex landscape, ensuring compliance, mitigating risks, and unlocking the potential of international trade and cross-border investments.