In the fast-paced world of forex trading, having a reliable and efficient platform can make all the difference. One emerging solution that has gained traction is algorithm-based forex trading platforms, offering traders a host of advantages and opportunities.

Image: laisasantos.com.br

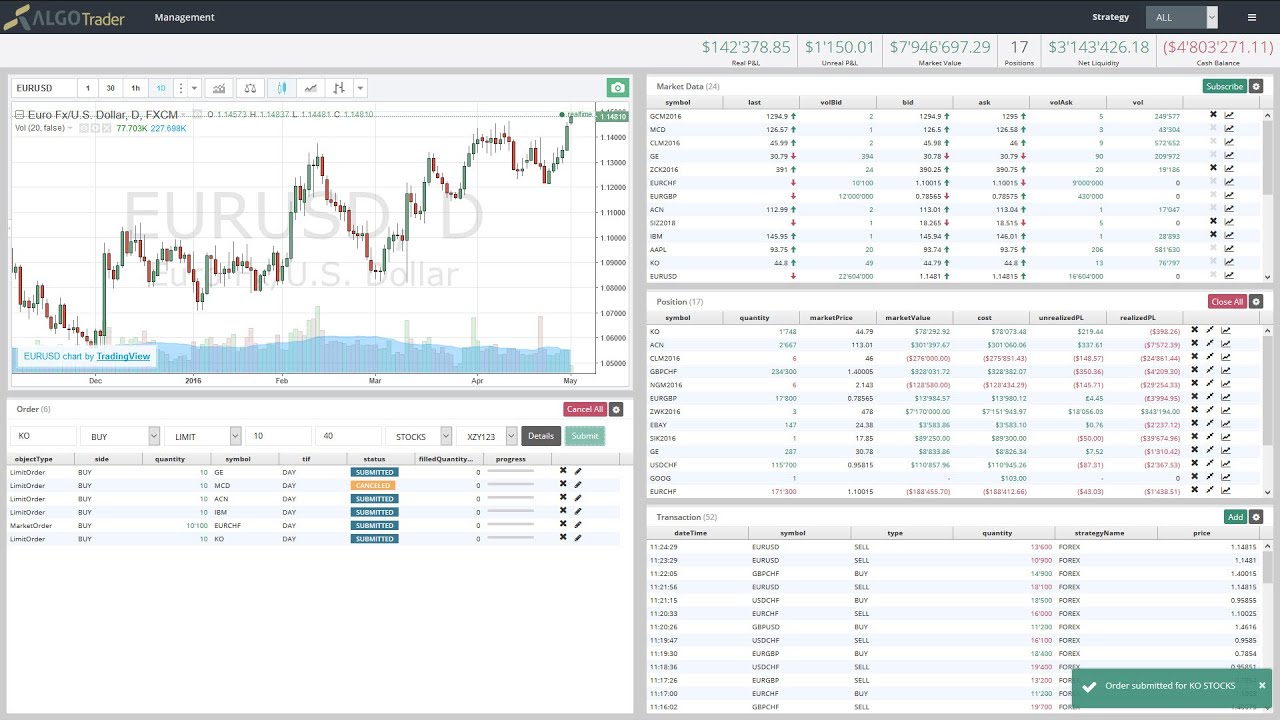

Algorithm-based trading, also known as algo trading, uses sophisticated algorithms and complex mathematical models to automate trading decisions. These platforms analyze market data, identify patterns, and execute trades in real-time based on pre-defined parameters.

Elevate Your Trading with Algo Trading Platforms

Algo trading platforms provide numerous benefits over traditional manual trading, including:

- Enhanced Speed and Accuracy: Algorithms operate at lightning-fast speeds, making it possible to capitalize on market opportunities instantly and execute trades with precision.

- Reduced Emotional Bias: By automating trading decisions, algo trading eliminates the influence of human emotions, which can often lead to rash and irrational choices.

- Backtesting Capabilities: Algo platforms allow traders to test and refine their strategies by simulating historical market conditions, thereby increasing the probability of success.

- Increased Efficiency: Automated trading allows traders to focus on other aspects of their business, freeing up time and resources.

Exploring the Genesis of Algorithm-Based Trading

The concept of algo trading originated in the early 1980s when quantitative analysts began using computer programs to automate trading strategies. Over the years, advances in computing power and the availability of real-time market data have fueled the exponential growth of algo trading platforms.

Navigating the Nuances of Algorithm-Based Trading

Becoming proficient in algorithm-based forex trading requires a deep understanding of the underlying concepts. Traders must:

- Grasp Market Dynamics: Understand the factors that drive currency prices, such as economic data, political events, and market sentiment.

- Develop Algorithmic Strategies: Design and implement trading algorithms that align with their specific trading objectives and risk appetite.

- Optimize Algorithm Performance: Monitor and fine-tune algorithms to maximize profitability and minimize risk.

Image: www.madhyam.org.in

Expert Insights and Practical Advice

Seasoned traders recommend the following tips for mastering algo trading:

- Acquire Technical Knowledge: Invest time in educating yourself about financial markets, trading strategies, and algorithmic concepts.

- Practice with Simulation: Use backtesting and simulation tools to test and refine your algorithms before deploying them in live trading.

- Monitor Algorithms Closely: Regularly track performance and make adjustments as needed to ensure optimal outcomes.

- Seek Professional Guidance: Consider consulting experienced traders or financial advisors for personalized advice and support.

Empowering Forex Traders

Embracing algorithm-based forex trading platforms offers traders an impressive array of benefits. These advanced platforms provide the speed, accuracy, and automation that can empower traders to reach new heights of success.

Whether you’re a seasoned professional or a novice trader, algo trading represents an exciting opportunity to transform your approach to the forex market. Explore the potential of these platforms today and unlock the potential for superior trading results.

Algo Baed Forex Trading Platform

Frequently Asked Questions

- What types of algorithms are used in algo trading?

- There are numerous types of algorithms used in algo trading, such as moving average models, trend-following algorithms, and arbitrage strategies.

- How do I choose an algo trading platform?

- Consider factors like the platform’s features, user-friendliness, brokerage integration, and reliability when selecting an algo trading platform.

- Is it necessary to have programming knowledge for algo trading?

- While programming skills can be beneficial, many algo trading platforms offer graphical user interfaces that simplify strategy development without extensive coding.

Are you ready to elevate your forex trading experience? Embrace the power of algorithm-based trading platforms and unlock new opportunities for success in the dynamic world of currency markets.