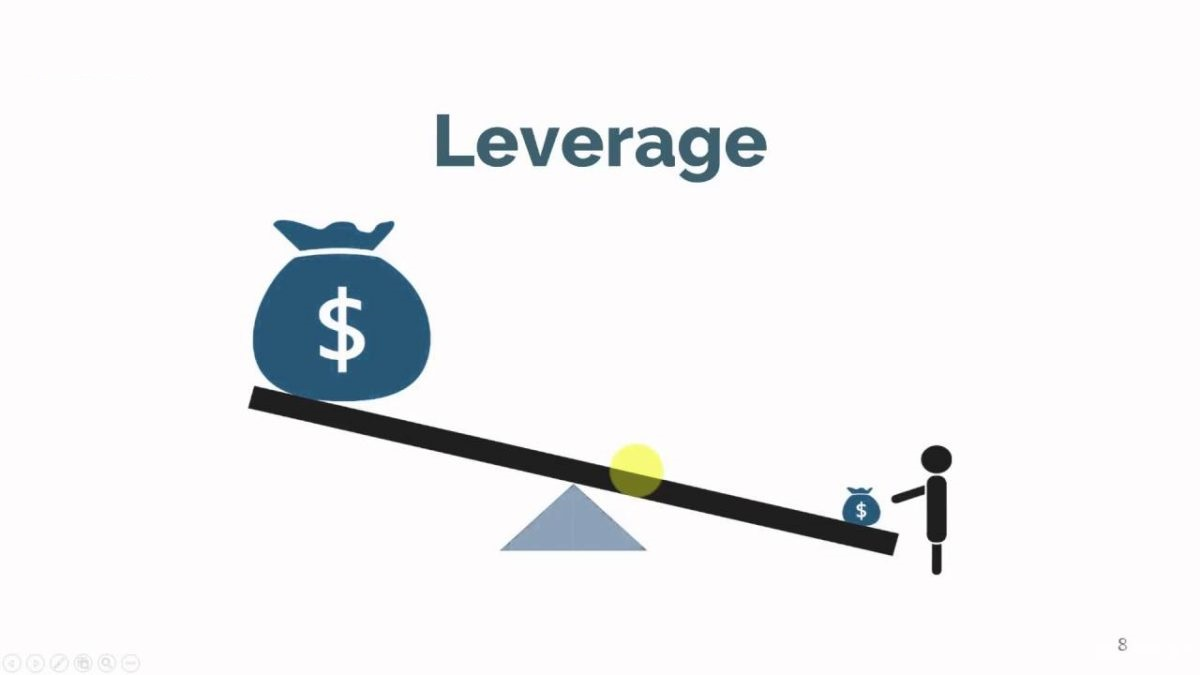

In the fast-paced realm of forex trading, leverage is a double-edged sword that can magnify both profits and losses like a magnifying glass. Understanding the advantages and disadvantages of high leverage is crucial for navigating this volatile market with confidence.

Image: www.financedepth.com

The Thrill of Amplified Returns: The Advantages

-

Magnified Profits: Leverage acts as a multiplier, allowing traders to harness larger market movements with limited capital. This can result in exponential returns, exponentially increasing the potential profits.

-

Enhanced Liquidity: Leverage enables traders to execute large-scale positions with minimal investment, enhancing liquidity and minimizing the slippage between buying and selling prices.

-

Flexibility and Diversification: High leverage provides traders with greater flexibility in managing their portfolio, allowing them to diversify their positions and potentially hedge against market fluctuations.

The Perilous Edge: The Disadvantages

-

Magnified Losses: Just as leverage boosts profits, it also intensifies losses proportionately. A sudden reversal in market sentiment can lead to substantial financial losses, potentially wiping out initial investments.

-

Intensified Volatility: Leverage amplifies price fluctuations, exposing traders to extreme volatility and widening the range of possible outcomes. It’s like juggling knives in a hurricane.

-

Margin Calls and Liquidation: Forex trading with high leverage carries the risk of margin calls. When a trader’s losses exceed their account balance, they are forced to close their positions, often leading to hasty and potentially costly withdrawals.

Balancing the Scales: Finding the Golden Mean

The key to successful forex trading with leverage lies in finding the optimal balance between potential rewards and risks. Factors to consider include:

-

Risk Tolerance: Determine your financial appetite for loss and align your leverage accordingly.

-

Market Volatility: Assess the prevailing market conditions and adjust your leverage to match the volatility.

-

Expertise and Knowledge: Leverage amplifies both risks and rewards, so it’s imperative to possess a thorough understanding of market dynamics and effective risk management techniques.

Image: www.studytienganh.vn

Expert Insights and Actionable Tips

-

“Leverage can be a powerful tool, but it should be used responsibly. Know your risk tolerance and manage your positions wisely.” – Jeremy Frost, Forex Expert

-

“Don’t let leverage become a crutch. Focus on building a solid trading foundation, and leverage will complement your skills, not replace them.” – Sarah James, Forex Analyst

-

“Always use a stop-loss to limit your potential losses, regardless of your leverage level.” – Mark Wilson, Forex Trader

Advantages And Disadvantages Of High Leverage In Forex

Conclusion

Leverage in forex trading is a double-edged sword that can enhance profits or inflict significant losses. By comprehending the advantages and disadvantages, traders can navigate the market with informed decisions. Balancing risk tolerance, market volatility, and expertise is key to finding the optimal leverage level. Remember, leverage is a tool, not a guaranteed path to riches. Use it wisely, and may fortune favor your trades.