Image: tradingforexamrik.blogspot.com

Embark on a financial voyage where the tides of uncertainty can engulf the unprepared. The forex factory, a bustling marketplace for currency exchange, demands a keen eye for trends that can either lead to bountiful harvests or treacherous shipwrecks. In this comprehensive guide, we unveil the secrets of accurate trend analysis, empowering you to navigate the choppy waters with confidence and precision.

Understanding the Forex Factory’s Rhythm

The forex factory, unlike its brick-and-mortar counterparts, operates around the clock, influenced by a myriad of factors ranging from economic indicators to geopolitical events. This constant ebb and flow presents a unique challenge for traders, who must decipher the complex dance of currencies to predict future movements.

To unravel these intricate patterns, trend analysis emerges as an indispensable tool. By observing the direction and momentum of price fluctuations over time, traders gain invaluable insights into the market’s sentiment and potential trajectories.

Pinpoint Price Patterns: The Tell-Tale Signs

Price patterns, footprints left by the forex factory’s invisible hand, serve as invaluable clues for discerning trend direction. These formations, resembling familiar shapes, offer traders a visual representation of the market’s underlying dynamics. Some of the most commonly encountered patterns include:

-

Triangles: Consolidation periods indicating indecision, often leading to a breakout in the direction of the prevailing trend.

-

Flags and Pennants: Continuation patterns that signal a temporary pause before the resumption of the dominant trend.

-

Head and Shoulders: A reversal pattern often interpreted as a bearish signal, indicating a potential downtrend.

Trend Indicators: Navigating the Murky Depths

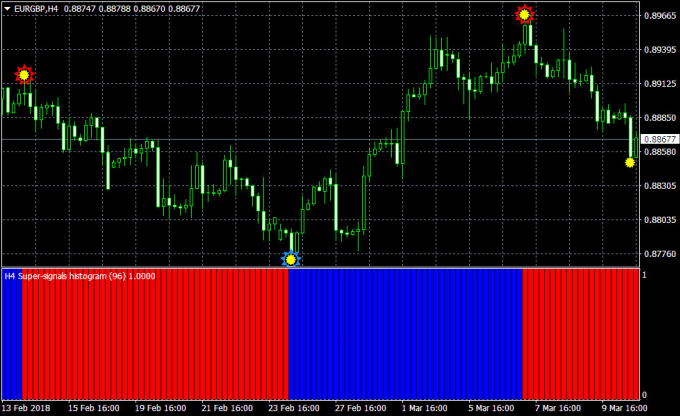

Complementing price patterns, trend indicators provide mathematical confirmation of the market’s momentum. These technical tools, drawing upon historical data, offer objective insights into trend strength and potential turning points.

-

Moving Averages: Smoothing out price fluctuations, moving averages indicate the direction and strength of the trend.

-

Bollinger Bands: Enveloping price action, Bollinger Bands identify overbought and oversold conditions.

-

Relative Strength Index (RSI): Measuring momentum, RSI helps identify potential trend reversals.

Decoding Candlesticks: The Language of the Market

In the forex factory’s bustling streets, candlesticks flicker like vibrant beacons, illuminating the market’s inner workings. These Japanese-inspired charts depict price movements over a specific time frame, offering a plethora of information:

-

Open: The price at which a candle opens.

-

Close: The price at which a candle closes.

-

High: The highest price reached within a candle’s timeframe.

-

Low: The lowest price reached within a candle’s timeframe.

-

Body: The filled portion of a candle, representing the difference between the open and close prices.

-

Wick: The thin lines extending above and below the body, denoting the highest and lowest prices reached.

Expert Insights: Unleashing the Power of Accuracy

To illuminate the path to accurate trend analysis, we turn to the wisdom of forex luminaries:

-

“Trend is your friend until the end…or until it bends.” – George Soros

-

“The trend is not a hope or a guess; it is a fact.” – Jesse Livermore

-

“The key to trading is not to predict the future, but to react to what the market gives you.” – Bill Lipschutz

Actionable Tips for Traders

-

Seek harmony: Confirm trend direction using multiple indicators and price patterns.

-

Respect trend lines: Identify and respect trend lines to gauge support and resistance levels.

-

Manage risk effectively: Implement sound risk management strategies, including stop-loss orders and position sizing.

Embracing the Power of Trend Analysis

Navigating the forex factory’s turbulent waters requires a keen understanding of trend analysis. Armed with the insights and techniques presented in this guide, you possess the tools to decipher the market’s cryptic language and seize opportunities with unwavering confidence. Embrace the art of accurate trend analysis, become a master mariner of the financial seas, and reap the rewards that await those who ride the tides of success.

Image: riset.guru

Accurate Trend Analysis In Forex Factory