Navigating the complexities of international currency exchange can be a daunting task, especially when you’re looking for competitive rates and reliable service. Enter ABSA Bank, a leading financial institution with a robust network and exceptional reputation in the global forex market.

Image: forexstrategiesrevealedpdf.blogspot.com

Understanding Forex and the Role of ABSA Bank

Forex, or foreign exchange, refers to the process of converting one currency into another. ABSA Bank acts as an intermediary in this process, enabling individuals and businesses to exchange currencies at the most favorable rates available. The bank’s extensive network of global affiliates and cutting-edge trading platforms ensure seamless and cost-effective transactions for clients worldwide.

Benefits of Using ABSA Bank for Forex Exchange

- Competitive Rates: ABSA Bank’s strong market presence and substantial trading volume allow it to offer highly competitive exchange rates, ensuring that you get the best value for your money.

- Transparent and Secure Transactions: The bank operates under strict regulatory compliance, ensuring the transparency and security of every transaction. You can rest assured that your funds are handled securely and in accordance with international best practices.

- Convenience and Flexibility: ABSA Bank’s online and mobile banking platforms allow you to execute forex transactions conveniently at a time that suits you. Whether you’re dealing with large amounts or small, the bank’s intuitive interface makes the process easy and straightforward.

- Expert Guidance and Support: ABSA Bank’s dedicated team of forex specialists is available to answer your queries and provide expert guidance throughout the exchange process. You can access professional advice and tailored solutions that meet your specific requirements.

How to Exchange Forex with ABSA Bank

- Open an Account: To initiate forex transactions, you’ll first need to open an account with ABSA Bank. This can be done online or at any of the bank’s branches worldwide.

- Fund Your Account: Once your account is active, you can deposit funds using various methods, including wire transfers and electronic payments. The bank accepts a wide range of currencies, offering flexibility and convenience.

- Execute Your Trade: After funding your account, you can execute forex transactions in real-time through the bank’s online or mobile banking platforms. Select the currencies you wish to convert, enter the desired amount, and confirm the transaction.

- Receive Your Funds: The converted funds will be credited to your designated account within a specified time frame, depending on the type of transaction and the currencies involved.

Image: forexbestscalpingindicator.blogspot.com

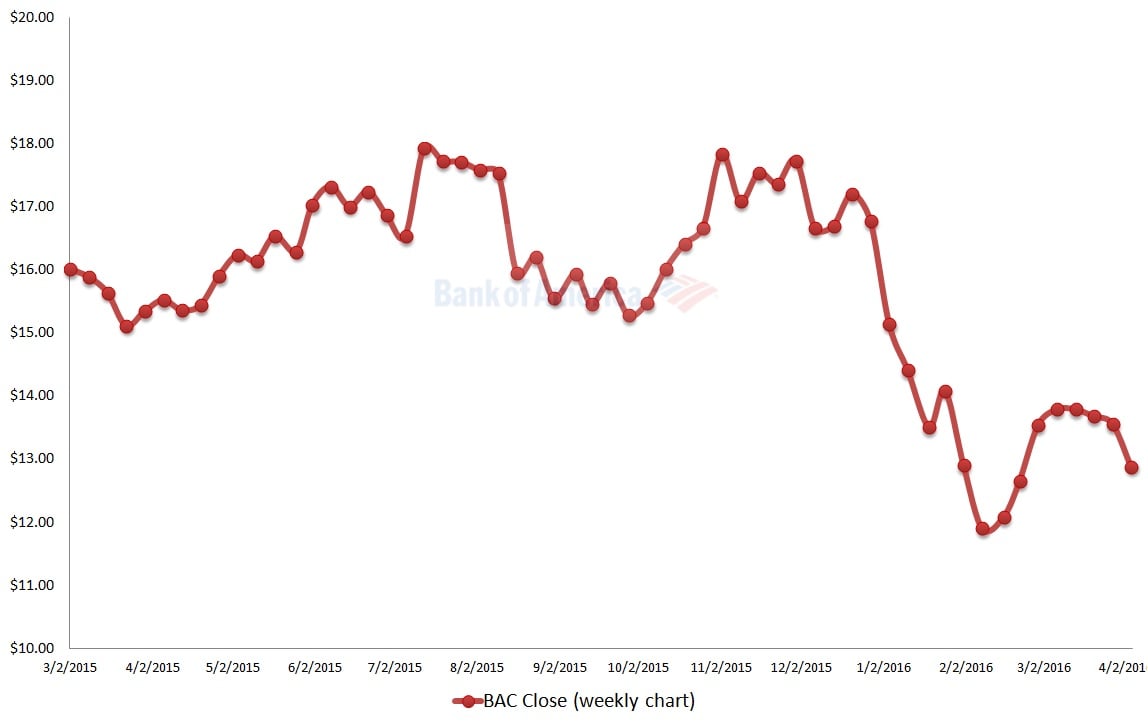

Current Forex Trends and Outlook

The forex market is constantly evolving, influenced by various economic and political factors. ABSA Bank’s market analysts continuously monitor these trends and provide up-to-date information to help clients make informed decisions. By staying abreast of the market dynamics, you can optimize your exchange strategies and take advantage of favorable market conditions.

Absa Bank Forex Exchange Rates

Conclusion

ABSA Bank is the ideal partner for all your forex exchange needs. With competitive rates, transparent and secure transactions, convenience, and expert guidance, the bank offers a comprehensive solution that simplifies the complexities of international currency exchange. Whether you’re an individual managing personal finances or a business navigating global markets, ABSA Bank empowers you to make informed decisions and achieve your financial goals.