Unleashing the Power of Charts and Patterns for Forex Success

In the realm of Forex trading, technical analysis stands as a beacon of hope, empowering traders with the ability to decipher the intricate dance of price action. This sophisticated approach harnesses historical data, charting techniques, and mathematical indicators to unravel market trends, predicting future price movements with remarkable accuracy.

Image: loadfetish659.weebly.com

Technical analysis delves deep into the intricate choreography of supply and demand, analyzing price patterns, volume, and momentum to identify potential trading opportunities. By scrutinizing historical price data and applying well-defined indicators, traders can delve into the collective consciousness of the market, gleaning insights into buyers’ and sellers’ motivations.

Technical Analysis: The Foundation

Technical analysis has its roots in the legendary work of Charles Dow, who formulated the Dow Theory in the late 1800s. Dow’s principles, based on the premise that market trends persist over time, laid the groundwork for modern technical analysis.

Since its inception, technical analysis has evolved into a sophisticated discipline, incorporating advanced mathematical formulas, computer-generated indicators, and powerful charting software. Today, it empowers traders with the tools to navigate the ever-changing forex market with increased confidence and clarity.

Charting the Market’s Narrative

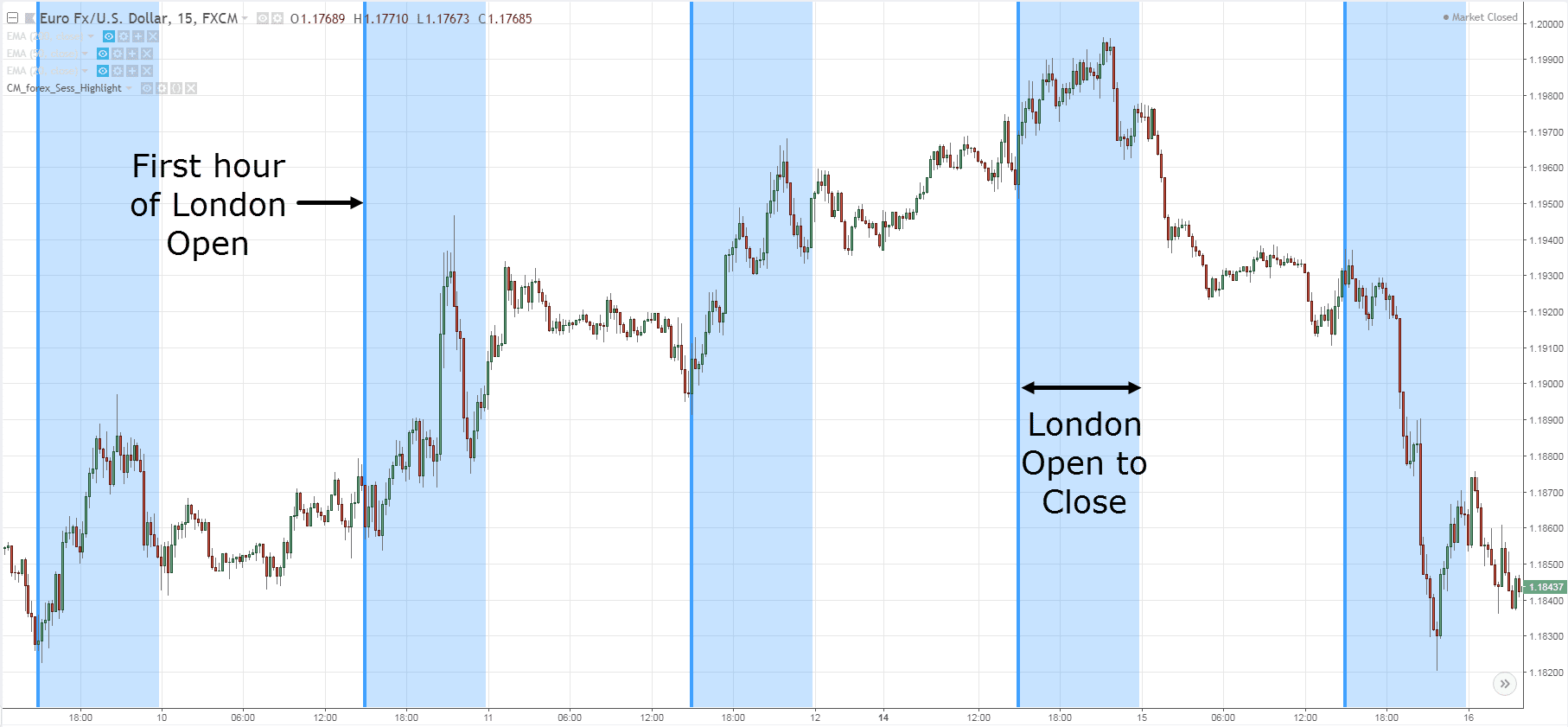

Technical analysis revolves around the art of charting, which involves plotting price data over time to visualize market trends and identify patterns. From simple line charts to advanced candlestick patterns, each chart configuration offers a unique perspective on price action.

Traders meticulously analyze these charts, searching for recurring patterns that may signal potential turning points or trading opportunities. By identifying familiar formations, such as head-and-shoulders patterns, triangles, and double tops, traders can gain a valuable edge in predicting future price movements.

Indicators: Quantifying Market Behavior

In addition to charting techniques, technical analysis employs a vast array of mathematical indicators that quantify market behavior. These indicators, derived from price, volume, and other variables, provide objective insights into market momentum, volatility, and potential trading signals.

Examples of widely used technical indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). By incorporating these indicators into their analysis, traders gain numerical confirmation of their observations, enhancing their ability to make informed trading decisions.

Image: www.tradingwithrayner.com

Tips and Expert Advice: Navigating the Forex Landscape

To enhance your technical analysis skills, consider implementing these expert recommendations:

- Start with a strong foundation: Thoroughly grasp the principles of technical analysis, ensuring a solid understanding of its concepts and methods.

- Master a few key indicators: Instead of trying to master all indicators, focus on a select few that resonate with your trading style

Remember, technical analysis is not a crystal ball but rather a tool that enhances your decision-making. By combining historical data, charting techniques, and technical indicators, you can gain a deeper understanding of market dynamics, increasing your chances of success in the ever-evolving Forex market.

FAQ: Unraveling Technical Analysis

Q: Is technical analysis effective in Forex trading?

A: Technical analysis provides valuable insights into market trends and potential trading opportunities. However, it is not foolproof, and traders must use it in conjunction with other analytical techniques.

Q: What are some limitations of technical analysis?

A: Technical analysis relies on historical data, which may not always reflect future price movements. It is essential to consider factors such as fundamental analysis and economic events to gain a comprehensive market perspective.

A Study On Technical Analysis In Forex Market

Conclusion: Empowering Traders with Knowledge

Technical analysis is a cornerstone of Forex trading, providing traders with the knowledge and insights to navigate the market’s complexities. Whether you are a seasoned trader or just starting, embracing this powerful approach can significantly enhance your ability to identify trading opportunities and make informed decisions.

Are you ready to unlock the potential of technical analysis in Forex trading? Let the charts and indicators be your guide as you embark on a journey of profitability and market mastery.