For those seeking to navigate the dynamic world of foreign exchange (forex), unlocking the power of fundamental analysis is paramount. This multifaceted approach delves deep into the underlying economic and political factors that influence currency valuations, empowering traders with a multifaceted understanding of the market’s ebbs and flows.

Image: www.fpmarkets.com

Defining Fundamental Analysis: A Trader’s Guide to Success

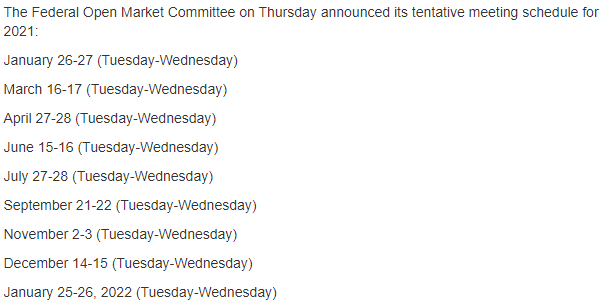

Fundamental analysis, a cornerstone of forex trading, is the meticulous examination of a currency’s intrinsic value by assessing the economic health of its underlying country. By monitoring key indicators, such as GDP growth, inflation rates, interest rates, and trade data, traders gain a comprehensive grasp of the forces shaping exchange rates.

Surpassing technical analysis, which primarily focuses on historical price patterns, fundamental analysis allows traders to make informed decisions based on real-world events and long-term trends. This comprehensive approach equips traders with the ability to identify imbalances and anomalies in the market, potentially profiting from economic strengths and identifying potential risks.

Delving into Forex Fundamentals: A Comprehensive Exploration

The forex market operates under a complex tapestry of interconnected factors, all contributing to the ebb and flow of currency valuations. By understanding these variables, traders can navigate the market with confidence.

-

Gross Domestic Product (GDP): A measure of a country’s overall economic output, GDP serves as a barometer of economic health. Robust GDP growth often signifies a strong currency, fostering investor confidence. Conversely, sluggish GDP growth can be a harbinger of economic weakness, potentially leading to currency depreciation.

-

Inflation and Inflation Rates: Monitoring inflation, the rate at which prices rise over time, is crucial in forex trading. Elevated inflation can erode the purchasing power of a currency, making it less desirable in the eyes of investors. As such, central banks often raise interest rates to curb inflation, bolstering currency value.

-

Central Bank Policy: Central banks play a pivotal role in managing a nation’s currency. Decisions regarding interest rates, quantitative easing, and other monetary policies can have a profound impact on forex markets. By influencing the supply of money, central banks can influence the value of their currencies.

-

Political Stability and Economic Stability: Political and economic stability are cornerstones of a thriving currency. Internal conflicts, regime changes, or economic crises can destabilize a country’s economy, leading to currency depreciation. Conversely, stable political and economic environments foster investor confidence, strengthening currencies.

-

Balance of Payments: The balance of payments tracks the flow of goods, services, and capital into and out of a country. A persistent deficit in the balance of payments can exert downward pressure on a currency, indicating a shortage of foreign exchange. In contrast, a consistent surplus can boost a currency’s value, suggesting a strong demand for its goods and services.

Empowering Forex Traders: Harnessing Insights for Informed Decisions

By mastering the art of fundamental analysis, forex traders gain a multifaceted understanding of the forces that shape currency movements. This empowers them to make informed and strategic decisions:

-

Spotting Trends and Anomalies: Fundamental analysis enables traders to identify emerging trends and anomalies in the market. By analyzing economic data, they can gauge the health of economies and anticipate potential shifts in currency valuations, creating opportunities to capitalize on market inefficiencies.

-

Understanding Currency Strength and Weakness: A thorough understanding of the factors influencing currency strength and weakness allows traders to assess the relative value of different currencies. This knowledge enables them to make calculated decisions, entering trades with a higher probability of profitability and effectively hedging against risk.

-

Long-Term Insights for Strategic Investments: Fundamental analysis provides valuable insights for long-term forex traders. By assessing the economic outlook of countries, traders can identify potential opportunities for investment, taking advantage of favorable exchange rates to enhance their portfolios.

Image: www.linkedin.com

A Report On Fundamental Analysis Of Forex Market

Harnessing Expert Wisdom: Insights from Seasoned Forex Traders

Seasoned forex traders offer invaluable insights for those seeking to master the art of fundamental analysis:

-

Stay Informed and Up-to-Date: Vigilantly follow economic news, publications, and reputable sources to remain abreast of the latest developments and their potential implications for forex markets.

-

Prioritize Data Quality and Credibility: Ensure that the data you rely on for analysis is accurate, reliable, and derived from reputable sources. Incomplete or inaccurate data can lead to faulty conclusions.

-

Understand the Lag Effect: Economic indicators may not immediately translate to currency movements. Allow for a time lag between the release of economic data and its impact on exchange rates.

-

Combine Fundamental and Technical Analysis: Employ both fundamental and technical analysis to gain a comprehensive understanding of the market. Combine insights from both approaches to enhance decision-making and increase your chances of success.

In conclusion, fundamental analysis is a powerful tool for forex traders, providing essential insights into the factors that influence currency valuations. By understanding the underlying economic and political forces, traders can develop informed strategies, capitalize on market opportunities, and mitigate risks. Whether you are a seasoned trader or a novice, embrace the power of fundamental analysis and unlock the secrets of the forex market.