Are you ready to unlock the secrets of the forex market and elevate your trading strategies? In this comprehensive guide, we delve into the intricacies of five fundamental forex patterns that hold the key to successful currency trading. Understanding these patterns empowers you to identify market trends, anticipate price movements, and make informed trading decisions with confidence.

Image: printable.esad.edu.br

Unveiling the Forex Pattern Toolkit

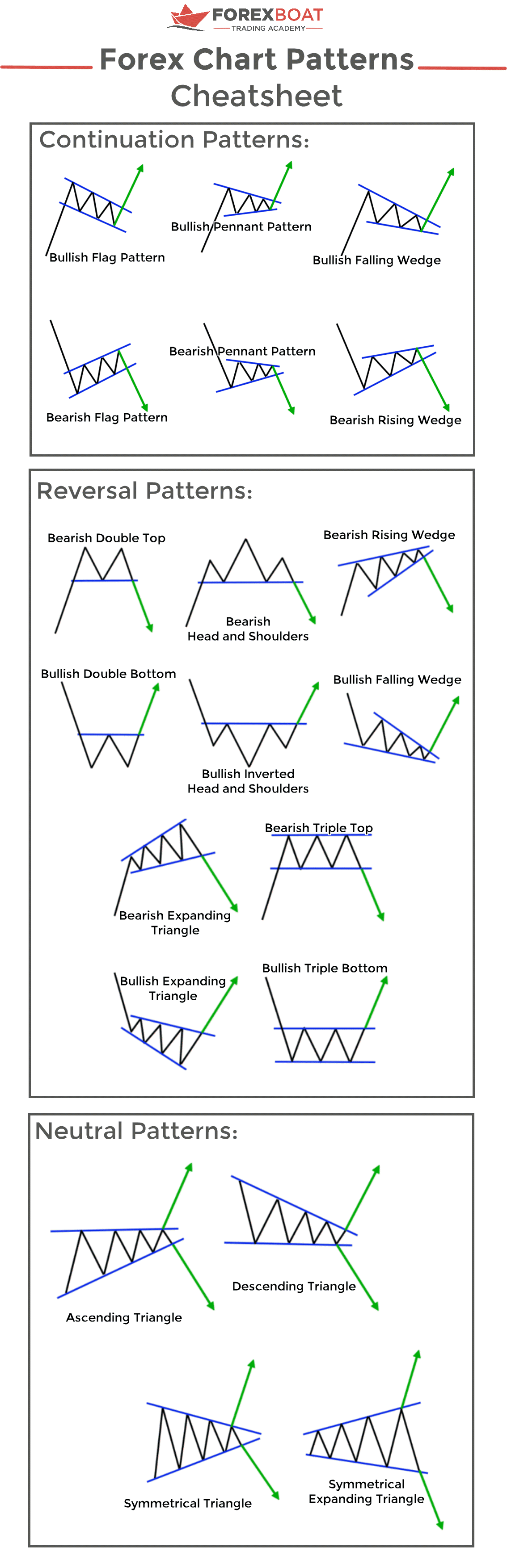

Forex patterns are recurring price formations that emerge on currency charts. These patterns provide valuable insights into market sentiment, support and resistance levels, and the future direction of price movements. By recognizing and interpreting these patterns, traders can gain a significant advantage in the fast-paced world of currency trading.

1. The Head and Shoulders Pattern: A Classic Reversal Indicator

The head and shoulders pattern is a classic technical analysis tool that signals a potential trend reversal. It consists of three distinct price peaks, with the middle peak forming the “head” and the two outer peaks forming the “shoulders.” The pattern is confirmed when the neckline, the line connecting the troughs below the peaks, is broken. This breakout indicates a potential reversal of the prevailing trend.

2. The Double Top Pattern: Identifying Resistance Levels

The double top pattern is a bearish pattern that indicates a potential decline in prices. It features two consecutive peaks at approximately the same level, separated by a trough. A breakout below the trough line confirms the reversal and suggests that the trend may be turning bearish. This pattern often warns of a potential sell-off, signaling traders to adjust their positions accordingly.

Image: www.pinterest.com

3. The Triple Bottom Pattern: Spotting Support Levels

The triple bottom pattern is a bullish pattern that signals a potential rise in prices. It consists of three consecutive troughs at approximately the same level, separated by two peaks. A breakout above the resistance line (the line connecting the peaks) confirms the reversal and indicates that the trend may be turning bullish. This pattern is often used as a buy signal, prompting traders to enter long positions.

4. The Wedge Pattern: Predicting Breakouts and Trends

The wedge pattern is a consolidation pattern that indicates a potential breakout in either direction. It is characterized by two converging trendlines, connecting either highs (falling wedge) or lows (rising wedge). A breakout above the upper trendline for a falling wedge or below the lower trendline for a rising wedge signals a potential trend reversal. This pattern can provide traders with an opportunity to identify potential breakout points and anticipate future market movements.

5. The Channel Pattern: Forecasting Trend Continuations

The channel pattern is a trend continuation pattern that helps identify the direction of a prevailing trend. It is formed by two parallel trendlines, connecting either highs (upward channel) or lows (downward channel). The price action tends to move within the channel, bouncing off the trendlines. A breakout above the upper trendline in an upward channel or below the lower trendline in a downward channel indicates a potential continuation of the trend. This pattern allows traders to assess the strength of the trend and determine potential entry or exit points.

5 Type Of Forex Pattern

Conclusion: Harnessing Forex Patterns for Trading Success

Mastering the art of recognizing and interpreting forex patterns is an invaluable skill for any trader striving to navigate the volatile currency markets. These patterns provide actionable insights into market sentiment, support and resistance levels, and the future direction of price movements. By incorporating these five fundamental patterns into your trading strategies, you empower yourself to make informed decisions, identify potential trading opportunities, and maximize your chances of success. Remember, knowledge is power, and in the realm of forex trading, understanding patterns is the key to unlocking profitability.